Bank of America today announced that it has enhanced its accounts receivables matching solution Bank of America Intelligent Receivables with additional reporting and new forecasting capabilities, providing clients with insights based on historical trends and their customers’ behaviors. The bank also announced that it has completed the global roll out of Intelligent Receivables with the product’s launch in Brazil.

Intelligent Receivables uses AI and advanced data capture technology to bring together payment information and associated remittance detail from various payment channels, whether electronic or paper based. With its ability to grab data from multiple sources (including emails and attachments), Intelligent Receivables will seek to match payments to outstanding invoices and thereby help to meaningfully reduce the costs normally associated with manual processing while speeding up the posting of revenue.

“The new capabilities are a natural extension of a tool that constantly interacts with data,” said Liba Saiovici, head of Global Receivables in Global Transaction Services (GTS) at Bank of America. “The new dashboards give clients a more comprehensive view into their total collections and outstanding receivables from which they can dig further to better understand their customer’s behavior around timeliness and preferred mode(s) of payment.”

Around the world, Intelligent Receivables is increasingly being used by large and medium sized companies in nearly all industries. Bank of America has made continual improvements to the tool since it was launched in 2017, and last year added new language processing capabilities, including Simplified Chinese, Traditional Chinese, Korean and Thai. Portuguese is also available to support clients in Brazil.

As an indicator of client engagement, Intelligent Receivables last year processed ~43 million invoices, a ~50% increase from the year earlier. “The growth in adoption of Intelligent Receivables is a testament to the tool’s impact on a company’s bottom line,” said Fernando Iraola, co-head of Global Corporate Sales GTS and head of Latin America GTS at Bank of America. “We’re confident that clients will see even greater value from using the tool with its new reporting and receivables forecasting capabilities.”

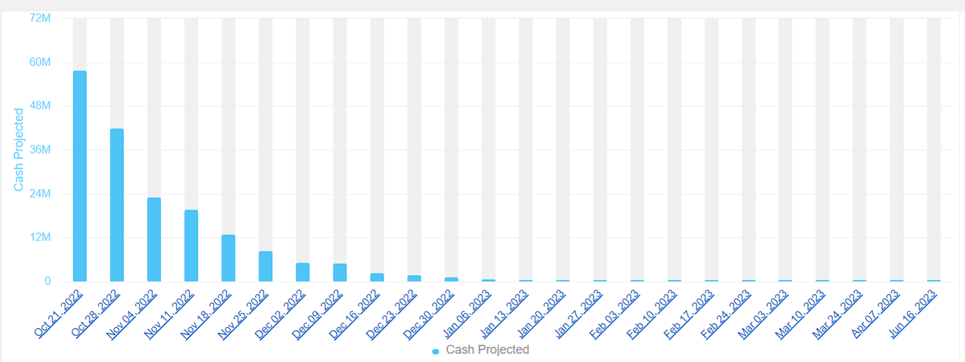

A report from Receivables Forecasting uses historical cash realisation patterns to project future receivables