July 2024 20 Min Read

The ABC of CBDCs

TMI examines the emerging CBDC area and its impact on treasury.

July 2024 20 Min Read

TMI examines the emerging CBDC area and its impact on treasury.

May 2024 13 Min Read

TMI calls upon Tony McLaughlin (Citi) to unlock tokenisation’s meaning, purpose, and potential value.

December 2023 6 Min Read

Tokenisation is the process of issuing a digital representation of an asset on a blockchain.

September 2023 30:26

John O’Neill and Zhu Kuang Lee (HSBC) discuss the innovative activity happening around asset tokenisation.

August 2023 9 Min Read

Specialists from NatWest highlight the profound impact CBDCs could have on treasury operations.

July 2023 39:50

Lee McNabb, Oliver Butcher, and David Silver (NatWest) join TMI’s Eleanor Hill for a candid discussion regarding the application of digital assets in a treasury context.

October 2022 14:39

Lee McNabb (NatWest) provides listeners with a valuable overview of the current happenings in the crypto marketplace.

September 2022 32:22

Mark Williamson (HSBC) and Søren Mortensen (IBM) explore how attitudes have changed to CBDCs over the last 12 months.

September 2022 12 Min Read

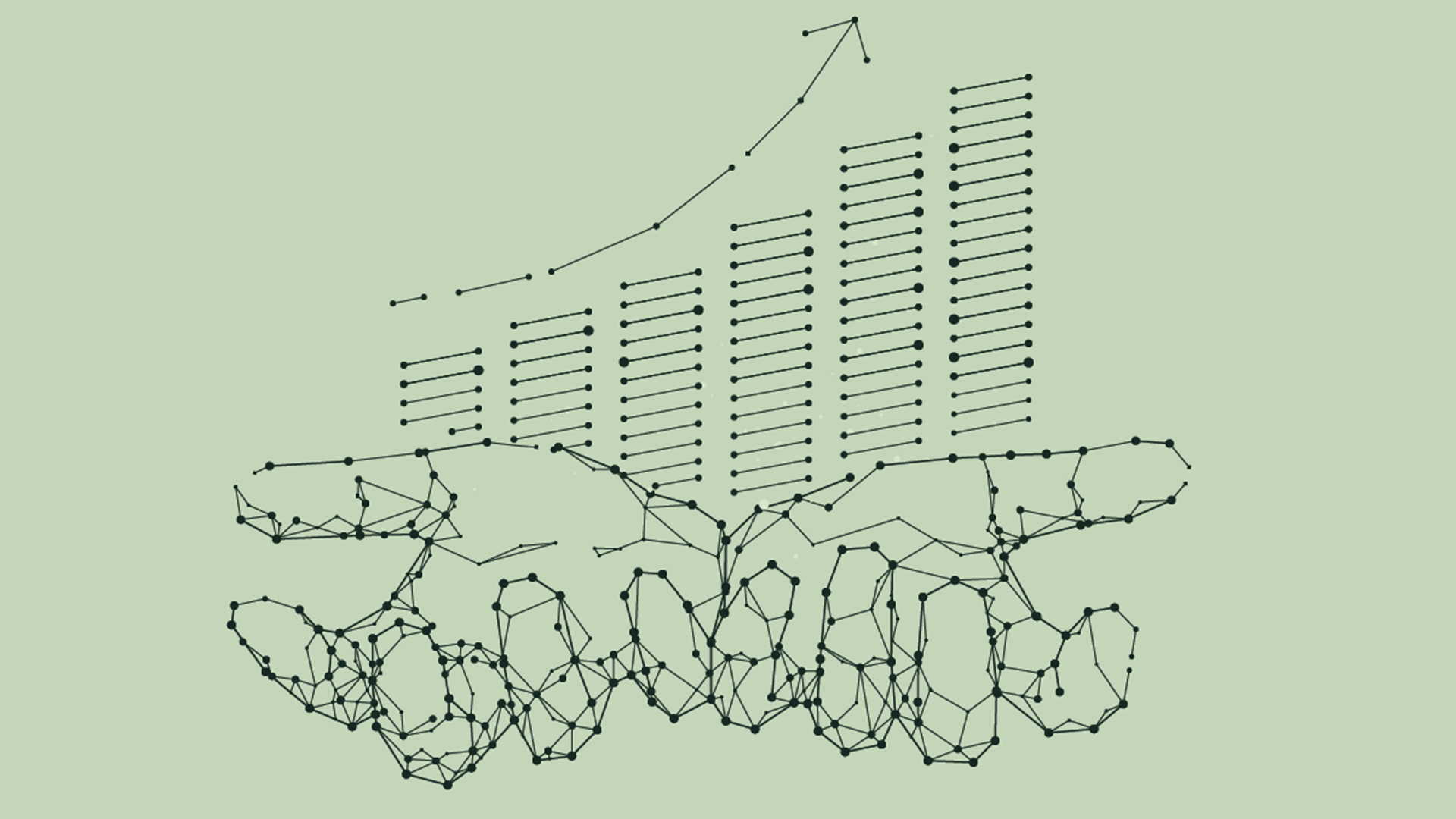

For those who believe crypto assets are too volatile and cannot be used by treasury, it’s worth knowing that they are not all the same.

February 2022 7 Min Read

In the December 2021 Calastone Connect Forum, experts considered how exchange traded funds and tokenised funds could, and potentially should, become part of every treasurer’s asset class armoury for managing liquidity. Ed Lopez, Chief Revenue Officer, Calastone; Patrick...

January 2022 10 Min Read

The world’s first trade finance-based non-fungible token transaction in 2021 highlights the need for treasurers to understand the technology behind tokenisation and the practical implications that it could have for corporate finance.

June 2021 9 Min Read

Corporates have started putting Bitcoin on the balance sheet. Central banks are pursuing their own digital currencies. The rise of cryptocurrencies is happening at a startling pace and will have a variety of impacts. Now is the time for treasurers to educate themselves...