Corporations in the U.S. added $1.01 trillion or 35.9% to their cash holdings in 2020 according to The Carfang Group analysis of Federal Reserve data released today. For the fourth quarter, cash is virtually unchanged, down only $6B or 0.2% and now stands at $3.82T.

According to Anthony J. Carfang, Managing Director at The Carfang Group, “Corporate cash stabilised at historically high levels during the second half of 2020. Following a tumultuous first half in which the Covid pandemic shut down global economies and central banks massively intervened, corporate cash soared.”

The Fed’s balance sheet assets grew from $4.1T to $7.4T during 2020 , a spectacular 79% jump. It continued increasing by $307B during the fourth quarter. Bank reserves, which grew from $1.6T to $3.0T in the first half, continued to grow and ended the year at $3.1T.

Measures of the U.S. money supply also grew at historic rates. M1 grew by 65% for the year. Its increase is accelerating as it grew by 22% in the fourth quarter alone. M2 grew a more modest, but still historic, 25% for the year and 4% during the fourth quarter.

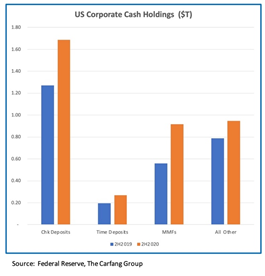

Corporate treasurers substantially increased their cash holdings during 2020. Latest data suggests these increases may have stabilised, albeit at levels never before seen. All major cash categories increased significantly this past year. Cash + checkable deposits grew by $418B, time deposits by $74B and money funds grew by $358B.

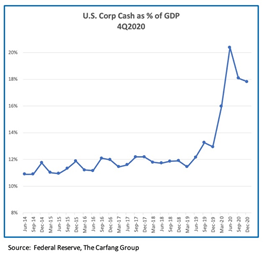

Corporate cash holdings were 17.8% of US GDP, 3X the level of the early 1990s. During the second quarter cash levels soared, exceeding 20% of GDP. The third quarter GDP rebound, combined with the drop in corporate cash, brought the ratio down to 18.1%. It now rests at 17.8%. There had been a three-decade long upward trend in this ratio, but the current leap is well above that trendline. As this is unprecedented, the macroeconomic effects remain to be seen.

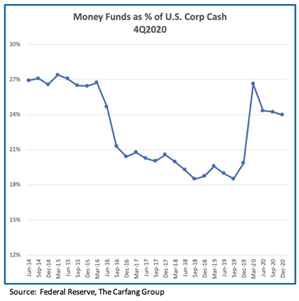

Corporate holdings of checkable deposits + currency grew 33% in 2020 and time deposits grew by 38%. However, corporate holdings of money market funds jumped by 64%.

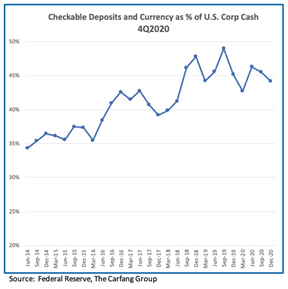

Checkable deposits and currency remained at 44% of corporate cash, after increasing from 35% following the SEC’s tighter rules on money market funds implemented in 2016.

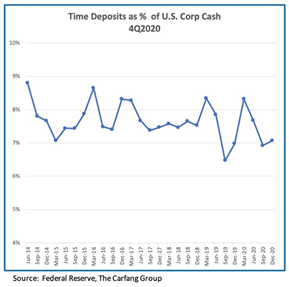

Time deposits now account for 7.1% of corporate cash, dipping toward the lower end of its recent historical range. This is likely due to the low rates resulting from the pandemic-related aggressive Federal Reserve monetary policies.

Money funds, at 24% corporate cash, pulled back slightly during the quarter, but still remain near their highest level since mid-2016 when the SEC instituted new regulations. That’s still less than half the 59% level of December 2008.

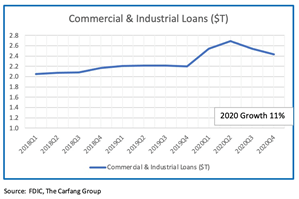

Finally, we take a look at Commercial & Industrial Loans, an important source of corporate liquidity. Many companies were actively drawing down credit lines to further build their liquidity buffers during 2020. C&I loans grew by $233B to $2.4T during the year, up 11 %, after peaking at $2.7T at midyear.

The Carfang Group advises our clients on the strategic and regulatory issues surrounding Treasury Management, Payments, Liquidity and Transaction Banking. We oversee the deepest and broadest LinkedIn groups on key Treasury, Banking, Liquidity, Payments and Regulatory topics via our Idea Exchange and Career Network. Visit https://www.thecarfanggroup.com/idea-exchange.