Deutsche Bank today announced its partnership with FinLync, a global fintech company offering products that are transforming corporate finance and treasury offices. FinLync’s pre-built API integrations and SAP-embedded treasury applications will enable corporate treasury and finance teams to connect to Deutsche Bank’s API offerings rapidly and easily.

FinLync’s technology directly embeds up-to-the-moment bank data into any enterprise resource planning (ERP) platform or treasury management system (TMS), enabling plug-and-play access to Deutsche Bank’s comprehensive suite of innovative APIs. Other benefits include more-precise cash forecasts and improved working capital efficiency through:

- 1-click global cash position that can be refreshed as frequently as desired;

- Real-time payment tracking from initiation to receipt;

- Beneficiary account pre-validation;

- Accelerated automated reconciliation.

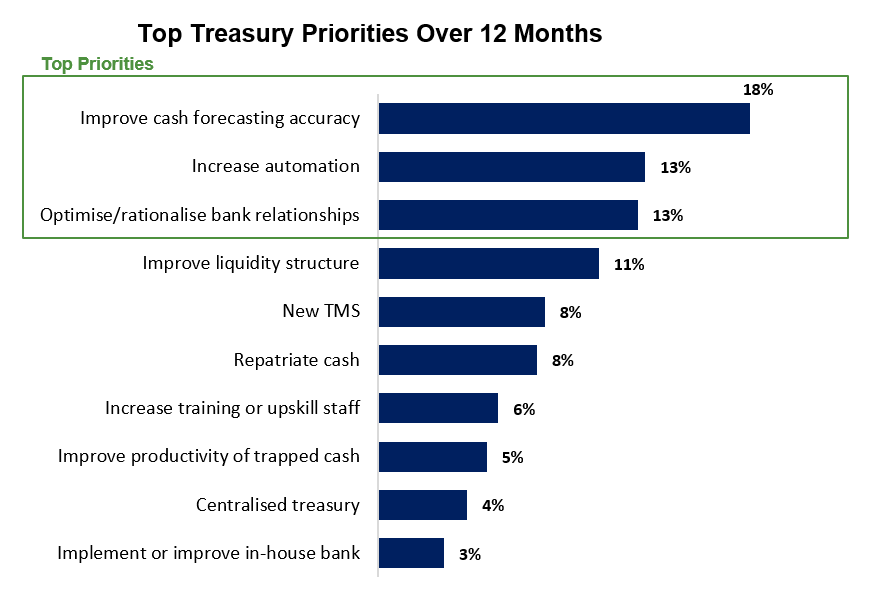

A recent survey by the Association of Corporate Treasurers in partnership with Deutsche Bank shows that API-enabled benefits such as “improve cash forecasting accuracy” and “increase automation” rank as top priorities among treasurers (see figure 1 below). However, ambitions are often yet to be transformed into reality as many corporates worry about the complexity of API integration across multiple banks, regions, and entities. The new partnership addresses this concern and will provide simple, fast, multi-bank connectivity.

“Our integration with FinLync makes it much easier for corporates to adopt our banking APIs and shortcut the road to automated, real-time treasury,” says Kerstin Montiegel, Global Head Client Connectivity / Digital Client Access Channels at Deutsche Bank. “FinLync’s pre-built API integrations and SAP-native applications significantly reduce the complexity of building and maintaining individual API integrations with SAP and other ERPs for our clients.”

Phillip Klein, co-founder and CEO of FinLync, said: “We are excited to join forces with Deutsche Bank’s renowned Corporate API Program. We will support its clients by making bank API connectivity a simple plug-and-play experience, enabling corporates to manage liquidity in real-time and ultimately supporting faster, more-informed decision-making”. He added: “Corporate finance teams have long sought the ability to access all their available bank data and deliver it directly into their existing systems. We are delighted to partner with Deutsche Bank, a global leader in API-based corporate banking, to make this a reality.”

The partnership demonstrates Deutsche Bank’s commitment to developing bank APIs that foster efficient and strategic actions, as well as FinLync’s position as the global market leader in multi-bank Application Programming Interface (API) connectivity and ERP-native apps. Both parties plan to co-innovate and broaden the range of pre-integrated Deutsche Bank APIs to additional use cases, including eBAM and expanding the applications of beneficiary account validation.

For more information, visit: https://www.deutsche-bank.de/pk/lp/db-api/finlync.html