Refinancing risk for most EMEA non-bank financial institutions (NBFIs) amid rising interest rates is modest in 2023 due to limited debt maturities, generally sound liquidity and often cash-generative business models, Fitch Ratings says. However, debt maturities in 2024 and beyond are larger and an inability to refinance upcoming maturities at reasonable terms would weigh on Fitch’s assessment of funding and liquidity profiles over a longer period.

Fitch has analysed the refinancing risk for 53 publicly rated EMEA NBFI issuers with aggregate debt maturities of EUR38 billion in 2023 (including deposits and lease liabilities). Of these issuers, 24 face maturities in 2023 of more than a fifth of their outstanding gross debt. In most cases, available liquidity (unencumbered cash and revolving credit facility (RCF) draw-down capacity) covers the bulk of the 2023 maturities.

Please click on the chart to view a larger version

Many of the issuers made use of supportive funding markets in 2020 and 2021 to refinance near- to medium-term maturities and free up RCF drawdown capacity by issuing medium- to long-term debt. Bond maturities in 2023 are therefore generally limited and residual refinancing risk in some cases is partly offset by increased cash balances from issuance proceeds that have not yet been fully deployed. Committed credit lines represented an average of 31% of total liquidity available.

The vast majority (44) of the issuers’ ratings have Stable Outlook (there are also three on Positive, five Negative, one Rating Watch Negative). Most of the companies have sufficient ability to absorb or pass on increased interest expenses, but further funding market dislocations could reduce rating headroom, and higher interest rates will weigh on growth and profitability, which could put pressure on lower-rated issuers’ business model stability.

Materially higher refinancing rates will put pressure on issuers’ business models, particularly where they have not been tested through a full interest-rate cycle or issuers lack scale, limiting operating leverage. A considerable number of EMEA NBFI issuers have short operating histories, having been established or gained scale during the low-interest-rate environment since 2008. This includes a large number of debt purchasers but also equipment rental firms and smaller fleet lessors.

Assuming a doubling of interest expenses (relative to the most recent annualised reporting period) would lead seven of the issuers to report interest coverage ratios of less than 1x, highlighting their sensitivity to rising rates and further inflationary cost pressures.

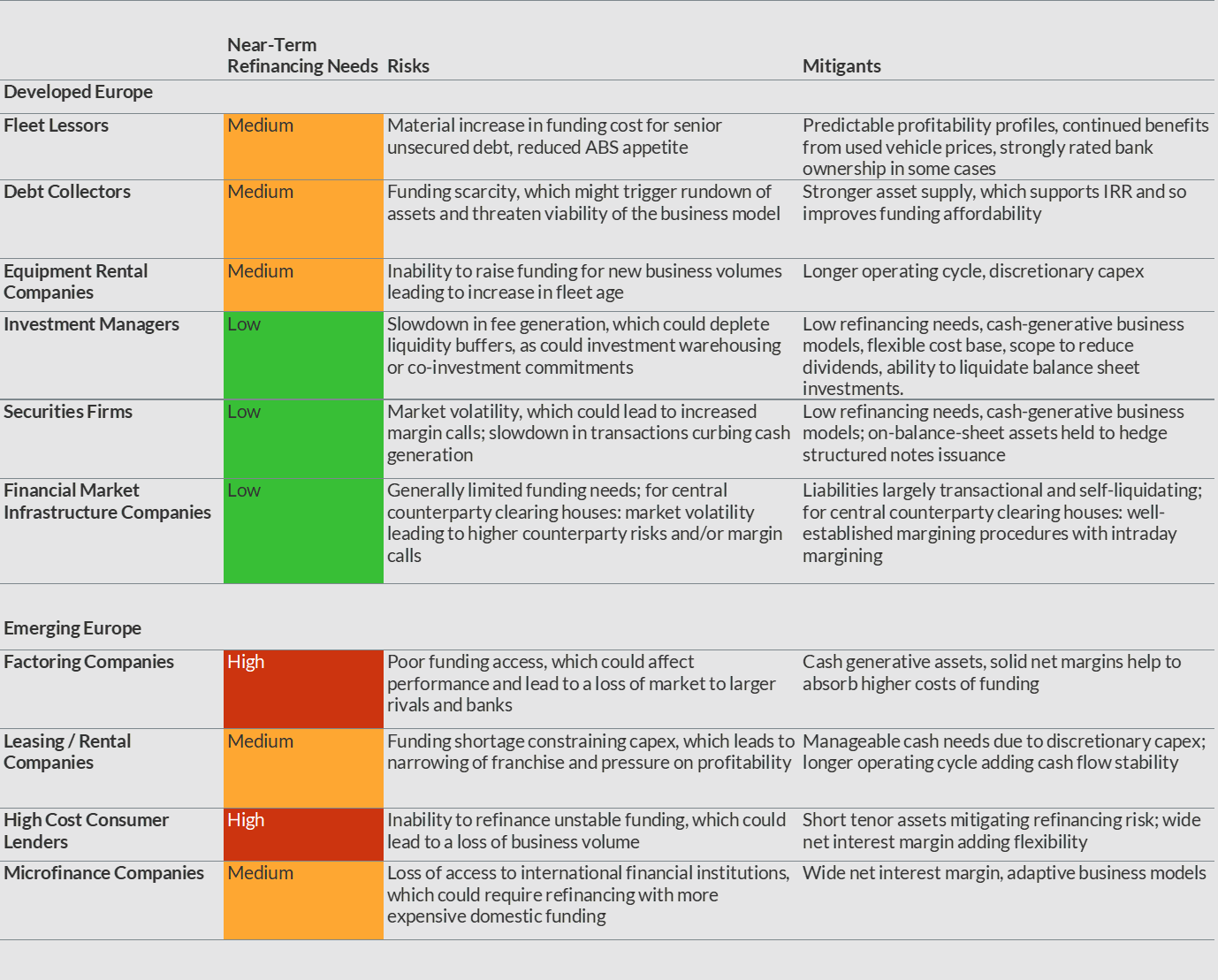

Finance and leasing companies in emerging EMEA markets are particularly sensitive to further capital market dislocations. They also face increasingly volatile operating environments. In developed European markets, capital market dislocations would be most disruptive for debt purchasers and, to a lesser extent, finance and leasing companies. In general, finance and leasing companies are more sensitive to funding availability as their needs for longer-term corporate debt tend to be higher than for other NBFI sub-sectors, such as securities firms and investment managers.