PUBLISHED … NOVEMBER 2021

This article was originally published by McKinsey & Company, please click here to view the article on their site

Cash and liquidity have long been considered key indicators of corporate financial health, and the pandemic has confirmed the continued relevance of this fundamental metric. During the crisis, “cash excellence” proved crucial in enabling continued operations for enterprises still early in their development; and as a business matures, it becomes a key lever for releasing capital to invest in growth. Recently, liquidity metrics have received as much focus as more widely publicised measures like operating margins and EBIT.

About the authors

This article was a collaborative effort by Alessio Botta, Reet Chaudhuri, Nunzio Digiacomo, Matteo Mantoan, and Nikki Shah, representing views from McKinsey’s Global Payments Practice.

Meanwhile, underlying trends in digitisation and increased investor scrutiny are setting new standards for corporate treasury professionals. Cash forecasting is regularly cited among the most inefficient processes by small and large organisations alike. CFOs and CEOs are seeking partners to help them navigate the shift from reporting to predicting. Solution providers (whether banks or software and fintech firms) able to solve this problem will be well positioned to reinforce or extend commercial relationships.

Historically, bank-provided treasury platforms have focused on core transaction execution central to their corporate relationships. The advent of software as a service and API connectivity has made robust, multifunctional workstations far more feasible; in response, software firms and other third-party providers have grasped this opportunity to create solutions that are gaining ground with corporate clients of all sizes across an array of sectors.

Banks recognise the importance of being close to decisions around core underlying payments, investment, and financing flows that their corporate customers are making. Liquidity management tools—including treasury management, cash forecasting, supply-chain finance (SCF)—are increasingly being embedded into the new generation of corporate global transaction banking (GTB) portals. For fintechs and software players with a focus on customer acquisition and retention, banks are increasingly viewed as an important route to market and therefore potential partners. For their part, banks are clearly motivated to provide broad-based state-of-the-art support for commercial banking functions that generate over $550 billion in annual revenue, according to McKinsey’s Global Payments Map.

Banks face several strategic decisions on this front. They must first determine their desired role in this evolving ecosystem: integrators and orchestrators of a full suite of services, background service providers, or developers of proprietary front ends built in-house. Factors such as geographic footprint, client sector focus, and investment appetite will inform the best path for a given bank.

Although the classic build-buy-partner decision remains relevant, recent years have seen a decided tilt toward the partnership model within the treasury space. Banks and third-party solutions usually offer different functionality and strengths, with all groups increasingly realising they can exist in harmony. With speed to market a unifying objective, bank distribution paired with software-firm agility has proven to be a potent combination, whether for the white labeling of third-party technology or in scenarios where banks serve as a channel for branded providers of these services.

In this article we’ll explore the evolving needs of corporate treasury functions, and the complex and fragmented provider landscape that has developed to address them. Based on direct input from practitioners we’ll also detail the factors that should inform each bank’s decision on how to proceed in the space, and offer examples of the components of successful bank-provider partnerships.

Evolving needs of the treasurer

Forward-thinking CFOs and treasurers have begun to fundamentally rethink the treasury function, shifting its role from custodian of historical cash activities to encompass a more strategic and expansive approach of “owning” the full suite of enterprise liquidity. In support of this mandate, treasurers are looking for technology platforms offering predictive liquidity and cash-flow modeling. Specifically, they need robust forecast capabilities that incorporate cross-border positions and exposure to various currencies.

McKinsey recently conducted focus groups with CFOs and treasurers of large corporate and mid-cap European firms. These conversations revealed significant pain points in cash forecasting and currency risk, invoice processing, and payment reconciliation. Cash forecasting is considered the least efficient financial workflow by both small and large organisations—in some cases requiring more than a week to gather and compile forecasting data from a variety of formats, causing further strain.

“What most interests me is the possibility to manage my working-capital operations without manual loading of data, specifically for invoice discounting and factoring, and to have the possibility, not only to have a reporting instrument, but also a predictive tool for operations,” was a representative example of such feedback. Another treasurer offered: “We are building a new digital platform, consolidating lots of data into an integrated system, to help us unlock the potential daily processes, improve transparency and access to real-time information, and enhance security standards.”

Overall, treasurers of large corporates highlighted five primary needs:

- Timely visibility into all global transactions

- Eliminating time-consuming and error-prone manual payment-generation workflows

- Reducing exposure to nonstandardised bank documentation and other compliance issues causing significant delays or confusion

- Protecting against fraud

- Keeping pace with industry changes to formats and technologies, particularly in the payment process

These interviews further revealed that large enterprises prioritise seamless integration with enterprise resource planning (ERP) systems and the ability to make swift decisions (for instance, access to financing, short-term investments) based on underlying cash positions. CFOs and treasurers of these businesses are exploring SCF programs—involving numerous internal and external stakeholders—for an efficient and sustainable approach to circumventing supply-chain failures resulting from financial disruption. Their priorities in structuring a comprehensive SCF program include:

- Internal systems integration. The typical organisation supports several ERP systems across multiple entities, necessitating integration among platforms to allow treasury management systems (TMS) to work properly. A successful supply-chain finance program requires full integration among all data sources and reporting software, enabling the treasurer and other end users to make decisions based on real-time data and analytics.

- Establishing multi-funder models. Price is no longer the sole criterion for evaluating liquidity financing alternatives; ease of satisfying know your customer (KYC) requirements, credit capacity, and platform design play increasingly crucial roles for treasurers of large corporates. Despite their typically higher nominal price, bank-independent technology solutions are becoming the preferred model given their added flexibility, ability to support a multi-funder model, and often more rapid incorporation of new features addressing evolving treasury priorities.

- Setting clear goals and objectives. Successful programs require the clear identification of targets and KPIs to create a framework for execution. With various stakeholders involved (treasury, procurement, IT, legal, accounting) the absence of common and measurable objectives can lead to cross-functional misalignment. One treasurer suggested essential elements of a successful program include a negotiation strategy for payment-term extensions, as well as a segmented messaging strategy for various suppliers. The latter point is particularly instructive: within large SCF programs, it is important to coordinate the information coded within a payment transaction based on the platforms employed by each party.

The situation in the small and medium-size enterprise (SME) space is quite different. Particularly at the smaller end of the spectrum, proprietors are less inclined to look to third-party providers for financing and treasury-management solutions, relying instead on bank offerings. Keeping pace with daily operational realities leaves little bandwidth for digitisation efforts—in fact, larger B2B buyers are often the drivers behind modernisation of smaller supplier partners. Nonetheless, relations between SMEs and their banks are often complicated, with lending terms frequently incompatible with client needs even when products are available. As a result, owners often elect to finance with personal funds or forgo debt altogether. McKinsey’s research identified the greatest SME need to be access to liquidity, access to broader B2B markets (with cross-border funding posing particular challenges), and transaction complexity. While the threat of bank disintermediation is not as imminent for the SME market, the emergence of a compelling third-party proposition certainly poses future risk.

The liquidity management ecosystem: Solutions addressing these needs

In response to these priorities, corporate software solutions are evolving to foster cash-excellence capabilities throughout the organisation. These solutions span the full scope of CFO responsibilities and offer different functionality, each contributing to improved cash and liquidity visibility and positioning. In recent years, a number of solutions have sought to address the evolving needs of businesses’ cash and liquidity management—including ERP providers, banks, and third-party software including treasury management systems—and a wider set of players across the liquidity management space. McKinsey estimates annual global corporate spending to be $3.5 billion annually on software addressing the needs outlined in this article.

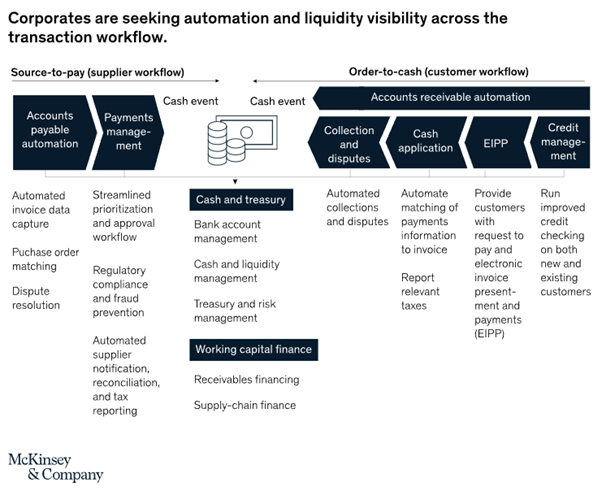

The scope of these offerings includes (Exhibit 1):

- Next-generation approaches to cash and treasury management. Extending beyond basic visibility and forecasting, these generate more accurate multicurrency forecasts, streamline workflows, and enable more robust hedging, financing, and investment decisions.

- Order-to-cash/receivables solutions. These streamline the accounts-receivable process, reducing days sales outstanding, increase collection rates, and further enhance visibility and accuracy of cash forecasts.

- Source-to-pay solutions. By simplifying accounts-payable and payments workflows, they generate benefits including reduced fraud losses, payments prioritisation for identified suppliers, and increased visibility and accuracy of cash forecasting.

- Integrated working-capital finance, trading, and investment activities. This suite provides treasurers and CFOs with a wider range of options than previously available, including supply-chain finance, receivables financing, and short-term investment products.

Players and approaches differ by geography: for instance, the US market is driven primarily by third-party software vendors, whereas in Asia the solutions tend to be bank-led. Cloud-based solutions have made these capabilities more accessible to SMEs—even those without a formal treasury department—thereby significantly widening the potential addressable market.

Key success factors for banks partnering with fintechs on offerings

Banks, which have historically not focused on the cash-management software space, increasingly realise that providing at least a portion of this functionality and embedding themselves more fully into the corporate workflow reduces the risk of disintermediation from the underlying payments, investment, and financing flows of corporate customers. Accordingly, corporate liquidity-management tools—including treasury management, cash forecasting, and SCF—are increasingly embedded into the next generation of corporate GTB portals.

Asia–Pacific focus

While the Asia–Pacific payments sector has benefited from extensive fintech activity focused on digitizing small merchants and enhancing overall business efficiency, there has been relatively lighter emphasis on modernizing treasury solutions for large corporates. Such opportunities are limited in part by divergence in infrastructure and regulatory standards across countries (currency convertibility, real-time payment rails, and market access, for example) making it challenging for banks or software providers to create solutions capable of delivering sufficient scale and value for multinational clients operating across the region.

Some banks in the region have taken the initiative to develop bespoke solutions addressing specific client needs, however—for example:

- Singaporean multinational bank DBS implemented a fully automated real-time payment system for drivers at ride-hailing firm Gojek. This created a differentiating feature recognized by the client as a recruiting advantage. Rather than waiting until the end of the week for payment (as with other taxi firms), Gojek’s drivers can now transfer funds to their bank account after each trip.

- ICICI Bank’s STACK offering provides customized digital banking services to companies in over 15 sectors, with the goal of facilitating operations across these clients’ entire ecosystem. The Indian bank also established eight “ecosystem branches” to support and expand the rollout of these capabilities across channel partners, employees, vendors, and other counterparties.

Going forward, large Asia–Pacific corporate entities are likely to enjoy features such as dynamic cash-flow forecasting, source-to-pay solutions, and multi-funder models, similar to their counterparts in more developed markets. In preparation, banks in the region should stay ahead of the curve by rethinking their treasury-services strategies. This involves determining which client groups to target (as not all capabilities will resonate equally across sectors), which features are likely to gain the most initial traction with that segment, and whether these solutions are best developed in-house or via partnership with a fintech firm.

Some banks have developed vertically focused solutions with functionality and integrations designed to meet the unique needs of strategically important customer segments. The rise of open banking, the ongoing search for new banking revenue models, migration of services to the cloud, and client demand for integrated experiences are also informing these strategic decisions. DBS has been particularly active in this arena in Singapore; for instance, using APIs and mobile apps to enable real-time payments to online merchants and delivery-service drivers (see sidebar, “Asia–Pacific focus”).

Banks face the ever-present decision of whether to build, partner, or acquire these capabilities. Recent years have seen a material increase in the partnership model, for white labeling of third-party technology as well as banks acting as a channel or seller for such services. This model enables quicker time to market and faster introduction of new customer functionality. Fintechs and software players with a focus on customer acquisition and retention increasingly view banks as a priority channel and an efficient path to market (Exhibit 2).

Exhibit 2

In McKinsey’s experience, the following key success factors optimise the potential for bank-fintech partnerships to accelerate their time to market as well as commercial impact.

- Document a commercial approach determining both ownership and roles with regard to customer engagement. As an example, while initial contact might be conducted by the fintech alone, subsequent meetings will be handled together since customers—particularly large corporations—are seeking integrated product offerings requiring expertise that extends beyond technology platforms.

- Develop a go-to-market strategy tailored to customer segments. For some segments, fintech tools may be offered as white-label solutions via bank proprietary assets, thereby differentiating the commercial offer from other segments in which the fintech offers its platform as a stand-alone suite backed by a bank acting as a counterparty for execution of payment transactions.

- Identify and agree on an IT implementation and delivery road map to serve as the baseline from which the bank will develop its commercial campaigns.

- Establish a dedicated IT-business governance team with recurring meetings to address commercial challenges as well as technology enhancements, potential change requests, or new deployments.

- Develop internal expert capabilities in the partnership products (likely in product specialist and relationship manager roles) as well as new digital tools the fintech may bring to the table as key assets. When proposing client solutions, these individuals will ask for interactive demo sessions, during which the sales network must possess the capabilities to surf the new platform and manage the end-to-end digital process underlying the new product.

- Identify KPIs by which the overall partnership will be valued and establish the proper time frame for KPI monitoring and assessment.

Partnership benefits

The following examples give some insights into how established partnerships work to enhance the offerings of both parties:

- Société Générale and Kyriba joined forces to offer cloud management solutions to their corporate clients. These services include real-time monitoring of treasury positions, payments automation, multibank connectivity, and ERP payment validation workflow management.

- Citi’s Smart Match product, enabling corporate clients to enhance straight-through-reconciliation rates in cash applications, is powered in part by AI and machine-learning capabilities from HighRadius. The parties formed a strategic partnership in 2018,1 helping Citi and its clients to merge disparate pieces of payment data and reconcile payments received against invoices issued more efficiently.

- DNB’s 2018 strategic channel sales partnership with Kyriba provided the bank with a new set of updated financial management tools to centralise payments, automate workflows, and detect and prevent payments fraud in real time for more than 220,000 corporate clients. These cloud-based services also address the need for stronger compliance and data protection required by evolving government regulation.

Banks are motivated to provide broad-based state-of-the-art support for commercial banking functions that generate over half a trillion dollars globally in annual revenue. They remain in a sound position to determine their role in serving these clients going forward. Although buy and build remain valid alternatives, in most cases a partnership approach enables banks to introduce new products and functionality more rapidly in an environment in which time to market is critical.

To successfully manage partnerships with fintechs and capitalise on their opportunity to play a leading role in the redefinition of treasury services, banks need to enhance a variety of internal capabilities ranging from sales management and product evangelism, to robust commercial and IT governance, and effective go-to-market strategies.

Read the next chapter in the report, “Merchant acquiring and the $100 billion opportunity in small business.”

About the Authors

Alessio Botta is a senior partner, Nunzio Digiacomo is a partner, and Matteo Mantoan is a specialist, all in McKinsey’s Milan office. Reet Chaudhuri is an associate partner in the Singapore office, and Nikki Shah is an associate partner in the London office.

This article was originally published by McKinsey & Company, www.mckinsey.com. Copyright (c) 2020 All rights reserved. Reprinted by permission.