Global Treasury Benchmark Survey 2017

by PwC

PwC’s latest global treasury benchmarking report reveals that the success of the treasury profession is dependent on how well it operates in an increasingly virtual environment. It records the views of over 320 treasurers and chief financial officers (CFOs) from around the world.

The forces changing treasury

Financial technology, such as online tools, enterprise resource planning (ERP) and treasury management systems (TMSs), is finally delivering on promises made over the last ten years. Integration, unbroken audit trails, enhanced security and workflow enable workers to collaborate on processes independent of their physical location, and the declining cost of treasury technology makes this more and more available.

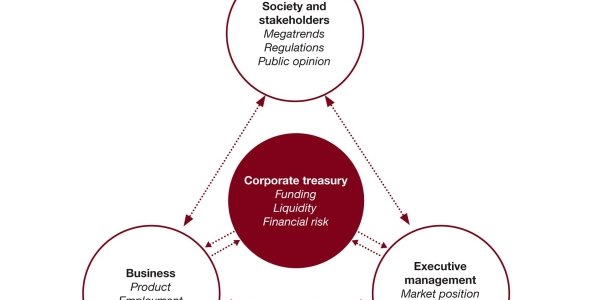

Virtualisation is prevalent in treasury and probably has more impact here than on other business functions. It requires a more collaborative and less hierarchical organisation of processes. CFOs are also urging treasurers to take on wider responsibilities.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version