- Daniel Farrell

- Head of International Fixed Income, Northern Trust Asset Management

Exclusive insight for TMI subscribers! Northern Trust Asset Management share a monthly market commentary for treasurers.

Eurozone Market Update

Despite the recent market turbulence caused by Silicon Valley Bank (SVB) and Credit Suisse (CS), the ECB stuck to its forward guidance by raising all interest rates by 50 bps, taking the deposit rate up to 3%. While driven by elevated inflation, the decision was not unanimous, with three to four members advocating for a wait-and-see approach. There was a doveish change of tone on forward guidance, with the governing council stating: “The elevated level of uncertainty reinforces the importance of a data-dependent approach to policy rate decisions”. The ECB also underlined that rate rises are focused on combatting inflation and that many other tools exist in its extensive liquidity facilities to tackle any market fallout from the recent banking turmoil.

UK Market Update

In line with market expectations, the BoE hiked 25 bps in March after UK inflation (10.4% headline, 6.2% core) came in higher than expected. The rise took the base rate to 4.25%. The voting pattern was interesting, given the divergence of views expected following the US regional bank woes and the takeover of CS. The vote split – 7 for a 25 bps hike and 2 for no change – was perceived as hawkish. However, it should be noted that Catherine Mann, a member of the BoE’s Monetary Policy Committee (MPC) and previously an advocate for 50 bps hikes, voted for a 25 bps hike, providing further evidence that the MPC is moving towards a pause. The vote split and statement suggest that future BoE rate decisions will be data-dependent.

US Market Update

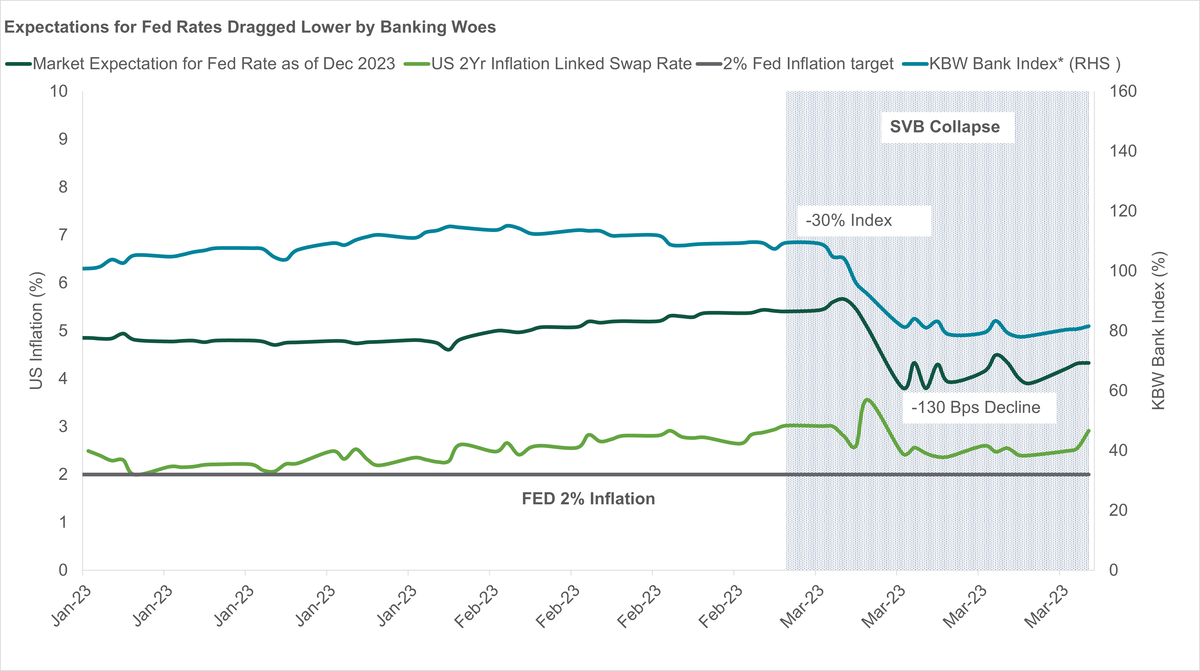

Following a tumultuous fortnight in global banking markets (see Chart of the Month), the Federal Reserve’s FOMC raised interest rates by 25 bps in March. The FOMC’s policy statement noted that recent concerns about the banking sector were “likely to result in tighter credit conditions … and to weigh on activity, hiring, and inflation.” Fed Chair Powell remarked that, if persistent, such tightening of credit conditions could, in effect, reduce the need for policy rates to rise much further. At this meeting, policymakers unanimously approved the increase because economic activity and inflation data had surprised to the upside. While futures markets have multiple 25 bps rate cuts priced in for this year, Powell noted that no policymaker saw a cut this year as appropriate.

Looking Ahead

The banking sector turmoil has muddied the monetary policy outlook. The subsequent tighter financial conditions have introduced uncertainty over the path of policy rates for the rest of the year. For example, the market believes the FOMC will soon start cutting rates. However, we are not convinced. To us, the future path of monetary policy remains highly dependent on incoming data. Barring a further tightening of credit conditions, we don’t think the FOMC is quite done raising rates yet, and rate cuts remain unlikely this year. In the UK, we expect a final 25 bps hike by the BoE in May, followed by a prolonged pause, although this is not a done deal. However, we strongly disagree with the market view that the BoE will begin a rate-cutting cycle as early as September 2023. Ultimately, we are exercising caution in all regions and maintaining a duration-neutral stance until greater clarity on the inflation path and banking system stability is confirmed.

Chart of the Month: March's US banking turmoil had a clear impact on the market's rate expectations

Source: Bloomberg. As of 31/03/2023

For Europe and Asia-Pacific markets, this information is directed to institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of Northern Trust and are subject to change without notice.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

Forward-looking statements and assumptions are Northern Trust’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

The Northern Trust Company of Hong Kong Limited (TNTCHK) is regulated by the Hong Kong Securities and Futures Commission. In Australia, TNTCHK is exempt from the requirement to hold an Australian Financial Services Licence under the Corporations Act. TNTCHK is authorized and regulated by the SFC under Hong Kong laws, which differ from Australian laws. In Singapore, The Northern Trust Company of Hong Kong Limited (TNTCHK), Northern Trust Global Investments Limited (NTGIL), and Northern Trust Investments, Inc. are exempt from the requirement to hold a Financial Adviser’s Licence under the Financial Advisers Act and a Capital Markets Services Licence under the Securities and Futures Act with respect to the provision of certain financial advisory services and fund management activities.

Northern Trust Asset Management (NTAM) is composed of Northern Trust Investments, Inc. (NTI), Northern Trust Global Investments Limited (NTGIL), Northern Trust Fund Managers (Ireland) Limited (NTFMIL), Northern Trust Global Investments Japan, K.K. (NTKK), NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd and investment personnel of The Northern Trust Company of Hong Kong Limited (TNTCHK) and The Northern Trust Company (TNTC). ).© 2023 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.