Divide and Rule

We explore cash segmentation drivers, options and outcomes for money market investors.

Published: November 03, 2022

Exclusive insight for TMI subscribers! Northern Trust Asset Management share a monthly market commentary for treasurers.

The fallout from September’s UK “mini budget” led to the resignation of Chancellor Kwasi Kwarteng and then Prime Minister Liz Truss. Jeremy Hunt replaced Kwarteng as Chancellor and reversed most of the fiscal loosening his predecessor had announced. Former Chancellor Rishi Sunak was named the new PM, with Hunt retained as Chancellor in Sunak’s Cabinet reshuffle. The Bank of England (BoE) launched a Temporary Expanded Collateral Repo Facility to ease liquidity pressures facing liability-driven investment (LDI) funds. To further quell market volatility, the bank expanded its purchases to include inflation-linked gilts in its mandate. The UK’s CPI print of 10.1% saw a significant increase in food and raw materials. Throughout October, the UK’s end-of-year implied interest rate fell from 4.63% to 3.57%.

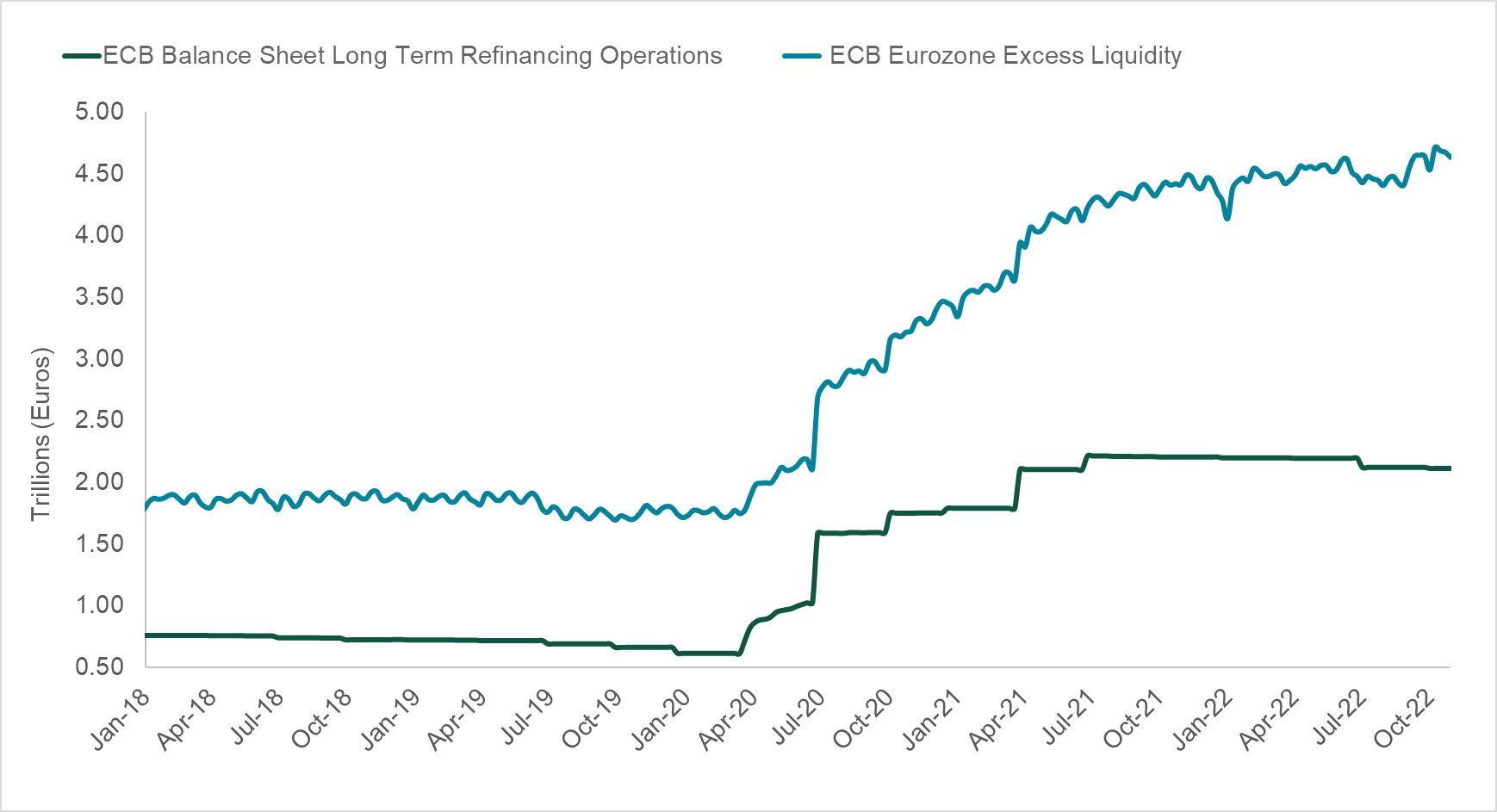

The European Central Bank (ECB) raised rates by 75 bps, taking the deposit rate to 1.5%. The meeting was perceived as dovish, with President Christine Lagarde highlighting that “the Governing Council has made substantial progress in withdrawing monetary policy accommodation”. As anticipated, the ECB tweaked the terms of its targeted longer-term refinancing operations (TLTRO) loans, adjusting the interest rates of TLTRO III to the average key rate from 23rd November onwards, with three additional voluntary repayment dates. This move aims to reduce excess liquidity in the system (see Chart of the Month) and free up collateral. Pandemic emergency purchase programme investments will continue until 2024, while the asset purchasing programme will continue as long as required. Inflation remains high — 9.9% in the euro area — driven by energy (up 40.7%) and food (up 11.8%).

Federal Reserve members remained adamant that they would do everything required to bring down inflation. However, the Wall Street Journal reported that the Fed would likely begin to consider easing back on the magnitude of hikes while maintaining their aggressive posture. The expectation is that the Fed will still raise rates by 75 bps in November, but the expectation for December has trended closer to 50 bps rather than 75 bps. The Consumer Price Index showed headline inflation growth beat expectations for September (0.4%) and annually (8.3%). More troubling was the core component, which was up 0.6% on the month and 6.6% annually, the firmest reading since 1982. Rises in non-farm (263,000) and private payrolls (288,000) beat expectations, while the unemployment rate dropped to a cycle-low 3.5%.

Both the Fed and BoE meet in early November. We expect both to increase rates by 75 bps, but communication will be vital for any indication of a pivot for future rate hikes at a slower pace. This follows the more dovish shift from the ECB, alongside lower-than-expected rate hikes by both the Reserve Bank of Australia and the Bank of Canada. The UK’s delayed budget on 17th November will see Sunak and Hunt scrambling to plug the gap in public finances caused by surging inflation and soaring interest rates. If successful, this will calm UK markets, likely resulting in the BoE hiking less than the market has priced in. Following the ECB’s TLTRO announcement, we will watch for any early repayments at the first additional voluntary repayment date on 23rd November. Any large repayment may result in modest upward pressure on short-term interest rates.

Latest News & Insights Across Global Liquidity Markets

Northern Trust Asset Management welcomes you to the full Liquidity Link Newsletter, our monthly publication offering timely updates on the UK, Eurozone and US markets - along with the latest:

For Europe and Asia-Pacific markets, this information is directed to institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of Northern Trust and are subject to change without notice.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

Forward-looking statements and assumptions are Northern Trust’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

The Northern Trust Company of Hong Kong Limited (TNTCHK) is regulated by the Hong Kong Securities and Futures Commission. In Australia, TNTCHK is exempt from the requirement to hold an Australian Financial Services Licence under the Corporations Act. TNTCHK is authorized and regulated by the SFC under Hong Kong laws, which differ from Australian laws. In Singapore, The Northern Trust Company of Hong Kong Limited (TNTCHK), Northern Trust Global Investments Limited (NTGIL), and Northern Trust Investments, Inc. are exempt from the requirement to hold a Financial Adviser’s Licence under the Financial Advisers Act and a Capital Markets Services Licence under the Securities and Futures Act with respect to the provision of certain financial advisory services and fund management activities.

Northern Trust Asset Management (NTAM) is composed of Northern Trust Investments, Inc. (NTI), Northern Trust Global Investments Limited (NTGIL), Northern Trust Fund Managers (Ireland) Limited (NTFMIL), Northern Trust Global Investments Japan, K.K. (NTKK), NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Belvedere Advisors LLC, Northern Trust Asset Management Australia Pty Ltd and investment personnel of The Northern Trust Company of Hong Kong Limited (TNTCHK) and The Northern Trust Company (TNTC). ).© 2022 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.