- Daniel Farrell

- Head of International Fixed Income, Northern Trust Asset Management

Northern Trust Asset Management Monthly Market Commentary – Exclusive Insight for TMI Subscribers

Eurozone Market Update

The European Central Bank (ECB) remains more dovish than other major central banks, with expectations that inflation would move below target towards the second half of the year. There is a balanced view that monetary tightening is not required at this stage. Should inflation be higher than expected, we think they will react. Eurostat’s data showed euro area headline inflation up by 0.1% to 5.0% year-on-year in December, while core inflation was stable at 2.6% year-on-year. The dropping out of the base effect linked to Germany’s value-added tax cut, along with easing supply chain constraints, services reopening, and energy prices normalising have all contributed. Unemployment has declined sharply in recent months, down to 7.2%.

UK Market Update

Bank of England (BoE) officials were quiet in the run-up to February’s monetary policy meeting, leaving critical economic data to guide markets. This included the November labour market report, which indicated that employment fell in October and November. The end of the furlough scheme hurt employment less than feared, though it did have an impact. Average wage growth contracted by 1% year-on-year while headline inflation outpaced expectations with a three-decade high of 5.4% growth year-on-year. Services inflation continues to firm, which will be on the BoE’s radar. The gilt market sold off this month due to the higher inflation and increased expectations of rate hikes from central banks in developed markets.

US Market Update

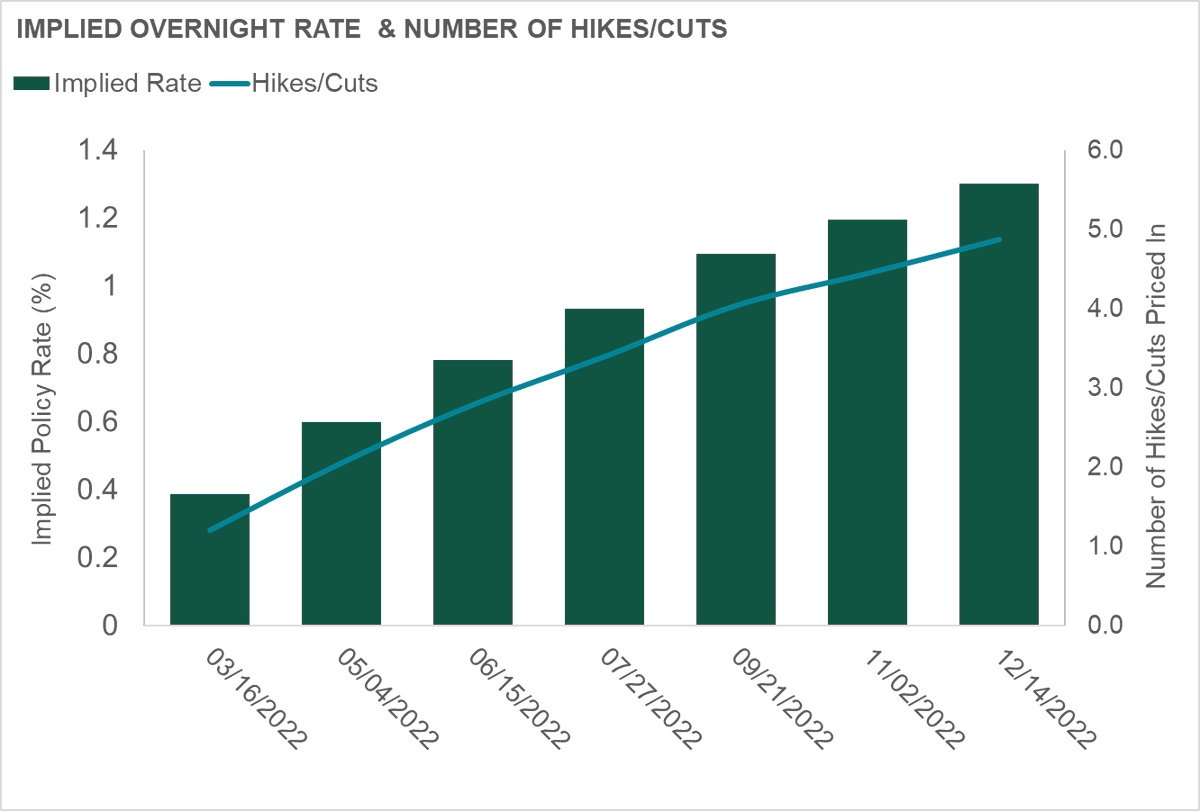

At January’s Federal Open Market Committee (FOMC) meeting, officials left rates unchanged at 0-0.25%. However, both the meeting statement and post-event press conference saw Federal Reserve Chair Jerome Powell continue the hawkish narrative seen since the end of Q4 2021. With unemployment at 3.9% and continued concern about rising inflation, Fed officials signalled “it will soon be appropriate” to raise policy rates. Powell did not rule out the possibility of a 50 bps hike in March or raising rates at every FOMC meeting, depending on data. The market viewed the post-meeting press conference as very hawkish, pushing up yields across the curve. Fed funds futures are now pricing in five rate hikes for 2022 (see Chart of the Month).

Global Outlook

Both the BoE and ECB meet on 3rd February. We expect the BoE to hike rates a further 25 bps, taking the base rate to 0.50%. We also expect quantitative tightening to start once economic data from both inflation and employment is strong enough. However, as the past two meetings have proved, the BoE can be unpredictable. With the focus of the ECB meeting, investors will be looking at whether the bank continues to diverge from the UK and US central banks on their inflation outlook. They also will look for early indications of the appropriate time to tighten policy, something we believe will not commence in 2022. Finally, we will monitor Fed officials’ speeches to see if they are supportive of Powell’s hawkish views or if the market misread the comments.

Chart of the Month: Hawkish Fed Have Investors Asking “How Soon, How Much?”

Sign up to the Liquidity Link Newsletter

Latest News & Insights Across Global Liquidity Markets

Northern Trust Asset Management welcomes you to the full Liquidity Link Newsletter, our monthly publication offering timely updates on the UK, Eurozone and US markets - along with the latest:

For Europe and Asia-Pacific markets, this information is directed to institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of Northern Trust and are subject to change without notice.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

Forward-looking statements and assumptions are Northern Trust’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

The Northern Trust Company of Hong Kong Limited (TNTCHK) is regulated by the Hong Kong Securities and Futures Commission. In Australia, TNTCHK is exempt from the requirement to hold an Australian Financial Services Licence under the Corporations Act. TNTCHK is authorized and regulated by the SFC under Hong Kong laws, which differ from Australian laws. In Singapore, The Northern Trust Company of Hong Kong Limited (TNTCHK), Northern Trust Global Investments Limited (NTGIL), and Northern Trust Investments, Inc. are exempt from the requirement to hold a Financial Adviser’s Licence under the Financial Advisers Act and a Capital Markets Services Licence under the Securities and Futures Act with respect to the provision of certain financial advisory services and fund management activities.

Northern Trust Asset Management (NTAM) is composed of Northern Trust Investments, Inc. (NTI), Northern Trust Global Investments Limited (NTGIL), Northern Trust Fund Managers (Ireland) Limited (NTFMIL), Northern Trust Global Investments Japan, K.K. (NTKK), NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Belvedere Advisors LLC, Northern Trust Asset Management Australia Pty Ltd and investment personnel of The Northern Trust Company of Hong Kong Limited (TNTCHK) and The Northern Trust Company (TNTC). ).© 2022 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.