After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: September 01, 2014

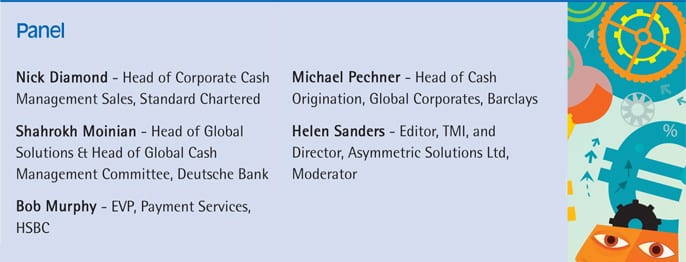

On 30th June 2014, TMI was pleased to welcome four senior transaction banking executives from major international banks to a roundtable to discuss the future of transaction banking. The roundtable was held in association with Fundtech, with the intention that this will be the first of a regular series of roundtable discussions on the changing face of transaction banking. We would like to thank Fundtech for their support, and Barclays for hosting the event.

Helen Sanders, TMI

What changes to customer priorities have you seen over recent years?

Nick Diamond, Standard Chartered  While globalisation remains a theme, its implications have evolved. Many global corporates have already met some key objectives, such as setting up regional treasury centres and shared service centres in Asia and Europe, standardising their various entities on ERPs and implementing treasury management platforms. Now when we talk to clients about globalisation, the focus is typically on the more challenging steps: for example, clients are looking to leverage the centres of excellence they have built in Europe or Asia and expand their focus to other regions. For example, where should you set up a regional treasury centre for Africa, and how would you go about it? While it is not the same as doing so in Europe, what can you leverage from past experiences in Europe and Asia? Consequently, I think globalisation means something very different now than it did five or ten years ago.

While globalisation remains a theme, its implications have evolved. Many global corporates have already met some key objectives, such as setting up regional treasury centres and shared service centres in Asia and Europe, standardising their various entities on ERPs and implementing treasury management platforms. Now when we talk to clients about globalisation, the focus is typically on the more challenging steps: for example, clients are looking to leverage the centres of excellence they have built in Europe or Asia and expand their focus to other regions. For example, where should you set up a regional treasury centre for Africa, and how would you go about it? While it is not the same as doing so in Europe, what can you leverage from past experiences in Europe and Asia? Consequently, I think globalisation means something very different now than it did five or ten years ago.

Michael Pechner, Barclays

I agree, but there are also different perceptions of globalisation. While globalisation at one point meant expansion from one developed market to another, then developed to emerging markets, we are now seeing growing trade flows between emerging markets: for instance, we are experiencing significantly increased volumes to and from Africa. Global multinationals are following global trade patterns as they evolve, which will also have an impact on their transaction banking and liquidity requirements. Ultimately, our clients are looking to improve the way in which they achieve their objectives by making the most of improved information and data streams.

Shahrokh Moinian, Deutsche Bank As you say, one of the trends we are seeing is that many companies are now moving to the next level of their globalisation strategy, but this is coming at a time when the macro-economic environment is changing. One of the main challenges of this scenario is there are things that you cannot do in some emerging countries that you can do in more developed markets, resulting in the need for new solutions and strategies. Another important trend is the impact of technology innovation. Companies are now able to carry out in–house many of the functions that, historically, their banks would have executed on their behalf. Globalisation and digitisation are among the key reasons why treasurers’ objectives and measures of success are changing. For example, some companies establish working capital targets at a senior management level, so cash management, including payables and receivables, is a priority. However, it is not only operational efficiency that is important but also working capital efficiency through improvements in the management of payables, receivables and inventory.

As you say, one of the trends we are seeing is that many companies are now moving to the next level of their globalisation strategy, but this is coming at a time when the macro-economic environment is changing. One of the main challenges of this scenario is there are things that you cannot do in some emerging countries that you can do in more developed markets, resulting in the need for new solutions and strategies. Another important trend is the impact of technology innovation. Companies are now able to carry out in–house many of the functions that, historically, their banks would have executed on their behalf. Globalisation and digitisation are among the key reasons why treasurers’ objectives and measures of success are changing. For example, some companies establish working capital targets at a senior management level, so cash management, including payables and receivables, is a priority. However, it is not only operational efficiency that is important but also working capital efficiency through improvements in the management of payables, receivables and inventory.

Pechner The difference I see is not necessarily treasurers’ objectives, but how they go about achieving them. Going back to the issue of trade flows, treasurers are looking to their banks to emulate the solutions they already have in place in developed markets as they expand their presence in emerging markets. Going back to the point Shahrokh mentioned, it is not always as easy to do things in emerging markets as in more established economies. Furthermore, it is not enough to consider regions such as Africa as homogenous: there is enormous diversity across countries. Therefore, how treasurers – and we their banks – go about achieving these objectives can pose enormous challenges.

The difference I see is not necessarily treasurers’ objectives, but how they go about achieving them. Going back to the issue of trade flows, treasurers are looking to their banks to emulate the solutions they already have in place in developed markets as they expand their presence in emerging markets. Going back to the point Shahrokh mentioned, it is not always as easy to do things in emerging markets as in more established economies. Furthermore, it is not enough to consider regions such as Africa as homogenous: there is enormous diversity across countries. Therefore, how treasurers – and we their banks – go about achieving these objectives can pose enormous challenges.

Diamond

I think that’s an interesting point. You’re right, clients need a far greater depth of support than in the past. Ten years ago, a corporate would look for a global banking partner or one for an entire region, despite having to compromise on coverage in some countries. This is no longer the case. For example, they may work with three of their global partners in one region to leverage the best coverage and solutions in each individual country, and then build a liquidity structure on top.

Sanders

Presumably, as Shakrokh mentioned, technology is one of the drivers of change in companies’ buying patterns, particularly with multi-bank connectivity such as SWIFT. Corporates no longer need to compromise on services and coverage as they should be able to work with multiple banks without fragmenting processes and data.[[[PAGE]]]

Moinian

Technology is undoubtedly an enabler, but the issues driving relationships are primarily lending and counterparty risk management. Corporates rely on multiple banks for financing, and therefore need to divide up their cash management activities to reward these banks. In addition, ever since the crisis, counterparty risk has continued to be a significant factor since the crisis.

Bob Murphy, HSBC

I think one of the most interesting trends related to globalisation is that global trade is not just an issue for large corporations, but it affects smaller companies too. Technology fuels e-commerce which is giving companies of all sizes the confidence to sell in markets globally and therefore need to be paid, where of course the banks have an important role. A growing challenge for banks, therefore, is how to support these smaller businesses in markets around the world.

Sanders

I think this is a very interesting point. As you say, technology is reducing the cost of entry into some markets for some smaller players and therefore banks need to find ways to support them. At the same time, however, the cost of regulatory compliance, KYC and sanctions screening is going up for banks, so there is a balance between lower costs to access a market on one hand, and the increasing costs of doing business internationally on the other.

Murphy

Absolutely. The cost of doing business for banks offering payments and cash management services continues to go up, not least due to the need to comply with regulations and respond to market, technology and standards changes. These issues require banks to invest significant amounts of capital year-on-year and that needs to be recovered. Although there are challenges, we as banks need to find smart ways of overcoming this dilemma to deliver value to clients, deepen relationships and ensure profitability in the relevant business line. This is not a new issue. When both the euro was introduced and SEPA came along, there was a view that many banks would outsource to the bigger players, but it didn’t happen in practice. The question is, when does the break point come for banks that lack economies of scale when they can no longer justify the year-on-year investment in technology and regulatory compliance, and therefore need to outsource?

Moinian

I agree. As corporate demands become more sophisticated and geographically diverse, banks’ and delivery costs are increasing. On top of these issues is the challenge of Basel III. As the cost of lending increases, the need to generate a return from a client relationship remains as important as ever. In this context, I see banks focusing on developing deeper relationships with fewer clients. This creates additional challenges for smaller companies who may be squeezed out of the credit market. Either supplier financing becomes the norm, on the basis that it will be the only option, or Europe and other regions become like the US, with more disintermediation and more capital markets related funding than bank lending. However, it is impossible to tell at this stage.

While risk is being pushed down the chain, it will still sit on the larger transaction banks’ books in some shape or form

Pechner

I fully agree with you. I think that banks will likely look to consider the profitability of their client relationships across the whole breadth of those relationships. In the end, while risk is being pushed down the chain, it will still sit on the larger transaction banks’ books in some shape or form, whether as an operational account or in the correspondent bank space.

Diamond

In this environment, transaction banking suddenly becomes more important than ever both for the bank and for clients. Firstly, because of the alternative choices of funding you can offer a client: for example trade lending; secondly, how you help clients manage their liquidity. Depth of customer relationships is key, and banks will expect, rather than hope, to have a transactional banking relationship with the organisations to which they offer their balance sheet. From the perspective of a bank’s transaction banking business, Basel III will therefore be particularly interesting, not least because we will have a key role to play in supporting clients in this new environment.

Sanders

Are we likely to see banks reducing the number of countries in which they support their clients, but deepening the relationship within that group of companies, rather than seeking global coverage?

Pechner

It’s interesting. Based on the issues we have discussed, such as the opportunities opened up by technology, the importance of share of wallet, etc., corporations are in a better position now than ever before to select banks according to their strengths in each market, and therefore achieve a ‘best of breed’ banking panel. This does not yet seem to be reflected in many companies’ buying behaviour, and many still effectively say, ‘This is our regional requirement and we would expect it to be carried out by a single bank.’

Sanders

Do you think this may be because purchasing departments are writing the RFPs rather than the treasurer, who probably has a greater awareness of the nuances of banks’ services and the importance of the relationship?

Diamond

Yes, I think this is part of it; also, many companies feel they ought to send the RFP to all their relationship banks. For example, at Standard Chartered Bank where we have a clear geographic focus, we still receive RFPs where we are asked to do everything. As banks, however, we probably need to be smarter in our responses and tender only for the countries or activities where we can best add value.

Moinian

I think that even though a corporate is asking for everything, it is unlikely in practice to offer its whole business to one bank globally or even one bank per region. Treasurers are very aware of the balance between lending and operational efficiency, but they can address the issue of efficiency through standardised and multi-bank connectivity.

Diamond

On exactly this point, we are finding more companies getting their banks together and stipulating their connectivity needs. Banks can then decide whether to tender for business on this basis or not, so treasurers achieve the efficiency they are looking for and can therefore make decisions based on other factors.

Sanders

Does that approach work for the banks as well?[[[PAGE]]]

Pechner

I think so, and we have definitely seen successful examples of this collaboration in the past. Ultimately, working together helps the whole market shift towards standardisation, which in my opinion is a good thing.

Sanders

We’ve discussed what banks are looking for from a partnership with their clients, but what are corporates looking for?

Moinian

Our clients tell us that they do not want their banks to push products in particular segments, such as cash, trade or FX. Instead, they are looking for us to deliver holistic solutions to their treasury challenges, irrespective of which part of the bank delivers each element of the solution. This could require a bank to provide an advisory service, co-ordinate different business functions or create an entirely new solution, according to its capabilities and its organisation. If you talk to a treasurer about payments or collections in a region, the reality is they are unlikely to see much additional value compared with an incumbent bank. The differentiation, however, can be achieved in dialogue around improving key metrics such as working capital.

Pechner

I agree. Our clients tell us that it’s not just about lending, although clearly this is important. Even if a bank appears to provide a largely commoditised product, treasurers want to know how it will be delivered, the assurance that it will be done well. The challenge then is to offer, and demonstrate the benefit of, additional value-added services.

Murphy

Absolutely. I think corporates wrestle with new technology and market practice, such as 24/7 payments, which implies near real-time provision of information, just as much as banks. If a bank can offer solutions to accelerate reconciliation, support faster decision making and provide visibility over cash flow so they can adjust their finance needs more responsively, a commoditised service of moving money from A to B can be elevated to a more value-added solution.

I think corporates’ key requirement is high-quality relationship management

Diamond

I think corporates’ key requirement is high-quality relationship management. They want their banks to spend time understanding their business and their challenges, and then think carefully about what solutions meet these needs. It sounds very simple, and in theory it should be, but historically, due to the way in which banks have been structured, we have been less good at delivering on this than we should have been. One challenge is that there is typically a number of buyers within a client organisation, who may not have a natural working relationship or share common metrics.

Sanders

As this often means working with different buyers or influencers in a variety of markets, given the globalisation trend we discussed earlier, how do banks structure their organisation to meet less centralised buying behaviour?

Diamond

Absolutely, we need to be flexible in the way that we manage client relationships across products and geographies. For example, I might be speaking to a regional treasurer in Ireland of a US-headquartered client who is responsible for Middle East and Africa. This doesn’t fit into a typical client relationship model, so we need to be adaptable.

Moinian

It’s all about knowing your client. You may have the best solutions for an organisation, but they cannot be used unless you’re having discussions with the right people and potentially bringing them together to add value beyond individual departments. I would then emphasise lending as the second thing, and the third is the ability to deliver on what you promise.

Sanders

Given that treasurers have a wide and growing range of responsibilities, how do banks avoid fragmenting their client relationship given that different people may be responsible for delivering elements of a bank’s service to them?

Moinian

Banks need to structure their organisation, and the teams within it, to offer the flexibility that clients need today. At Deutsche Bank, for example, the Trade Finance and Cash Management Global Solutions team brings together people from different product areas and spends time listening to clients and devising the appropriate solutions, rather than merely pitching products. Another organisational change is the development of our market advocacy regulatory teams. Among the many responsibilities they have is to represent the interests of our clients with the regulators, and then explain the implications of new regulations to our clients.

Diamond

From a coverage perspective, financial markets and transaction banking teams are now structured in quite a similar way. If you then layer in our relationship management teams, you end up with a multidimensional coverage model that supports a more transparent, but deeper model for our clients, with one key point of contact for customers across cash, trade, financial markets and coverage.

Regulatory developments are not just creating challenges - they are also creating opportunities too

Moinian

Regulatory changes will also drive greater transparency and dialogue in client relationships. While there is a tendency to focus on some of the more prohibitive regulatory challenges, such as compliance issues and Basel III, there are also regulatory developments that are creating opportunities. SEPA is one, and RMB liberalisation is another, both of which bring positive implications for corporates. Although opportunities for cross-border RMB are developing rapidly, many corporates still have not fully realised and leveraged these opportunities, and banks need to help them more with this.

Diamond

This is a very good example of how I see two-way client relationships developing. If a bank helps a client with the specific task of maximising its RMB liquidity opportunities, for example, which is very complex, then that bank would also expect to develop a broader liquidity partnership too: clients – and their banks – will not simply be able to cherry-pick.

Sanders

As we have said, technology is key to banks’ delivery of services, particularly in new markets, so that more focus can be given to relationships rather than service delivery. What technology needs are emerging amongst your clients, and how are you responding?[[[PAGE]]]

Pechner

A priority for many banks is to enhance the quality of the user experience. Everyone expects the ease and convenience of their smartphones, but it is important not to forget the complexity of the processes underlying that single click or swipe. A payment still needs to go through a clearing system and may take three days, depending on the region, irrespective of the speed with which it can be transmitted by a user. A priority, and a differentiator, is security. Risk of system shutdown or security breaches are very real, and clients need assurance that this is their banks’ priority, which is ultimately more important than small improvements to the user experience.

Risk of system shutdown or security breaches are very real, and clients need assurance that this is their banks’ priority

Diamond

You’re exactly right. A related challenge is the regulatory focus. On one hand, we are keen to optimise the client experience; on the other, regulators are continuously raising the hurdles. Managing client expectations is therefore a key issue.

Murphy

I agree. We all take our personal experience into the work environment, which then drives our expectations. A challenge for banks is how to engage with clients and support their activities in real-time, but the fundamentals still apply. For example, ID verification remains key: is this the corporation it purports to be? Does the user have the authority to complete this action? Do they have the funds to carry out this transaction? Is it legal? Can I fulfil it?’ These validation processes need to be compressed into seconds or nanoseconds when offering a real-time service to clients which is a real challenge.

Diamond

Do you think we are investing enough in this as a banking community? If you take digital signatures and some of the cloud-based initiatives that TMS and ERP vendors are undertaking, should banks be co-operating more to share the burden more?

Murphy

I think there is still some underlying reticence. There are some examples of banks working together to develop cash management and card solutions, but on the whole, banks are not good at working together to develop common solutions. With an ever-growing number of new participants in this space, it becomes increasingly difficult to achieve common agreement on standards.

Pechner

Do you think that some of these new entrants, who are not necessarily banks, could cause some disintermediation in the longer term, and are largely leveraging the investment that banks have already put in without having to incur the costs themselves? The reason we all have complex legacy systems is because of all the years we have spent on investment and build.

Sanders

On the other hand, because there is the financing relationship that underpins the corporate relationship, there is perhaps a limit to how far some of those new entrants can go, certainly within the larger corporate community, simply because those drivers of the bank-to-corporate relationship are still there.

Murphy

Perhaps banks have not invested enough in this clientfacing space, which has left room for new players. While their capability may be quite limited, and they do not have the capacity or organisational depth to sustain meaningful relationships, they are there and engaged. A question is: can banks displace them or should we be working with them?

The supply side is growing faster than the demand side, which is an unsustainable situation and could, in turn, encourage more collaboration between banks.

Moinian

The supply side is growing faster than the demand side, which is an unsustainable situation and could, in turn, encourage more collaboration between banks. If you look at the telecoms industry, companies use each other’s networks rather than try to replicate all the time. We have talked for years about consolidation. SEPA was supposed to lead to consolidation, as was the banking crisis, but this has not happened on a large scale. Europe still has many more banks than the US, partly because the market is still more driven by bank lending, and not everyone can take those lending relationships onto their own books. There is no set formula on how many banks there should be, but what is clear is the dynamics and the economics do not work at the required scale.

Murphy

There is a regulatory angle to this, not least in the way that banks interact with regulators. Singapore, for example, is a relatively small market but has embarked upon a series of market changes with the introduction of Immediate Payments and a new bulk payment solution and ring-fenced bank arrangements.

Sanders

Given the banks’ need to invest enormous sums simply on compliance, what do we need to do to reduce the cost of rolling out new innovations and deliver services, particularly when looking internationally?

Pechner

In my opinion, we need to try to find synergies between these regulatory requirements. There is a lot of additional reporting requirements emerging, including intra-day reporting. At the same time, clients are demanding more. We are still looking at two separate ways of delivering on these requirements. Somehow, we need to find and leverage synergies to add value to the client experience.

Murphy

Banks have significantly underinvested in management information, big data and data analytics to understand what our clients are doing and respond in a faster, more effective and efficient way. There is a limit to how far you can reduce the cost of delivering services if these are already electronic. In terms of developing the ability to do other things more efficiently, such as funding compliance, you need more data and a better understanding of a client, their activities and what their trading partners are doing. Only then can the cost of compliance and validation go down, and your ability to introduce valueadded services go up.

Diamond

This is a very interesting point. What is different in this next level of technology innovation is that while web technologies and host-to-host channels were within our comfort zone, the emergence of mobile applications and big data mean that we need to reinvent ourselves and adjust to these fast-moving technologies.

Moinian

The first thing is to understand the demand, and the second is getting the solutions to market in order to meet that demand. As an industry, we need far lighter delivery models, possibly working with technology companies that have that kind of expertise rather than payment service providers.

Pechner

We also need to collaborate more with our retail banks, who already have experience in big data collection and more seamless delivery of simpler products. Mobile payments is one example of this.[[[PAGE]]]

Diamond

Some of these solutions are not difficult, but I agree they need to be linked to client demand. As an example, there are pockets of eInvoicing around the world, but have these solutions met client needs? Additionally, if you look at bank account maintenance, we have all been talking about eBAM for a long time, but mostly what we see currently is BAM without the ‘e’.

Sanders

Do you have any final points you would like to make?

Pechner

I was told that over the past 2,000 or 3,000 years, there have been only three major changes in the payments space: coins; then notes and paper; then cards. Are we now at the point when we are experiencing a major digital revolution?

Diamond

We have talked today to some extent on the assumption that the globalisation and digitalisation agenda will be driven from established markets in Europe or The US. However, emerging markets such as in Africa are already taking the leap from cash to mobile without the steps in between. So perhaps the digital banking revolution will be led from emerging markets, not by the developed world.

Moinian

One point I feel very strongly about is that, however we reach the next level of digitisation, there is a need to take a more holistic view in our interaction with our corporate clients - across cash, trade finance and funding of their suppliers. This is critical not only to our relationships and solutions, but also to the technology that we provide. Otherwise, we will spend money on technology that does not further our relationships or solve client challenges.

While real-time payments now exist in the UK with similar initiatives in 10 or 12 countries around the world, will we see a SEPA faster payment solution or do we need an alternative approach?

Sanders

How would you define that digital revolution?

Murphy

We have talked about e-commerce and mobile payments and doing more in real-time. The question is whether banks and traditional payment infrastructures can support this. Faster payment schemes around the world are already proving quite revolutionary by enabling instant movement of money which support some of the things we are seeing but these are capital and time intensive programmes. While real-time payments now exist in the UK with similar initiatives in 10 or 12 countries around the world, will we see a SEPA faster payment solution or do we need an alternative approach?

Diamond

If we go right back to the beginning, we talked about the fact that access to, and cost of capital, will continue to be challenging for our clients particularly as we move into a growth environment and under new regulatory conditions. Our clients are going to have to use every dollar of cash they have globally to fund themselves as far as possible. To do this, they will need realtime clearing and access to information around the globe. So when we talk about client need, what we are really talking about is access to every dollar of cash they have anywhere in the world, as quickly as possible.

Sanders

It makes you realise that whatever discussions there may be about commoditised business, there is ultimately very little that is commoditised when you talk about global transaction banking. Thank you to all of our panellists, and we look forward to continuing these discussions in the future.

In the wake of the economic crisis, banks have taken new interest in transaction banking, seeing it as one of the few areas for stable and predictable revenue and growth. Customers demand better response, accuracy of information and more agility from their banks and this has driven the need to develop more accurate information delivery, better utilisation of on-line channels, flexible packaging of bank offerings, and to strive for more granular solutions that are better tailored for a particular geography and enterprise type. This major transformation has led to the creation of new payment channels, including online and mobile, as well as the move toward immediate payments, in conjunction with real-time consolidated information delivery. On the corporate front, treasurers are now challenged with striking the delicate balance between managing cash, liquidity and counterparty risk, while maintaining solid bank relationships and credit ratings, managing competitive pressures, and dealing with the complex demands of globalisation. All of this while banks and corporations alike manage new entrants into the market and deal with constantly evolving regulatory requirements.Fundtech is a leading provider of financial technology software solutions to banks and corporations across the entire financial supply chain, including payments, cash management, financial messaging, and payables and receivables automation. Moti Porath, Executive Vice President at Fundtech, explains how customers should make use of innovative technology to solve problems and realise significant competitive advantage.

In this new and complex environment, firms must increasingly seek ways to leverage tactical, short-term fixes into long-term, scalable solutions. Critical to achieving this is to look at a firm’s transaction banking requirements across the entire financial supply chain, rather than just on a per-product, per-geography or per- project basis. As the needs of the business become increasingly more complex, corporations no longer look for particular products, such as cash, trade or FX. Instead, they want holistic solutions to meet a multitude of treasury challenges. Banks – and technology vendors – that realise this and rise above short-term tactical product delivery must provide solutions that help firms to improve critical aspects of treasury management. These include liquidity utilisation, risk management, compliance and working capital. At the same time they must build enabling connectivity technology and service multiple channels.

By adopting a ‘big picture’ customer-centric approach, banks, their corporate customers, and, in turn, their customers will be able to effectively and efficiently manage all types of payments, within and across national borders, from and to any channel, with a high degree of automation and straight-through processing . From coins, to notes, to cards, to digitisation, the strategic path forward will most certainly be enabled by innovations in technology. How smart firms build them and smart firms employ them will definitely identify the winners in the next phase of the payments evolution.