by Martin Schlageter, Head of Treasury Operations, Roche

Over the past decade, Roche has developed a world-class global treasury organisation, a process that has been distinguished by the close collaboration between treasury and IT to become a key service provider to the business. Since 2007 when Roche first featured its SAP implementation in TMI, treasury and IT have gone on to optimise many of its treasury processes. Most recently, Marco Brähler described Roche’s automated SAP and SWIFT-based confirmation exchange and matching solution. In this edition, we are delighted to welcome Martin Schlageter who describes how Roche’s treasury has continued to leverage its centralised platform to centralise and optimise processes, and enhance the value it offers to the group.

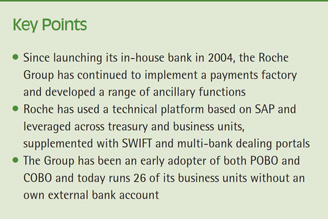

Corporate treasury is often not well understood by the wider business – and vice versa - so as a result, treasury often becomes disconnected with the needs of the organisation which in turn limits its value. Since we first launched our in-house bank in 2004, which has been a major collaboration between treasury and IT, we have transformed our role and recognition within the Roche group. Initially, our focus was to centralise treasury activities across the group, which then extended to implementing our payments factory and subsequently, to develop our capabilities in a range of ancillary functions. By doing so, we are now firmly positioned as a value-added business partner to entities across the group, with close co-operation to facilitate growth and manage risk.

The basis of our success

Critical to our success in achieving this has been the use of a common technical platform, based on SAP, which we leverage consistently across treasury and our business units, supplemented with specialist capabilities such as SWIFT and multi-bank dealing portals as required. While vendors frequently offer a ‘seamless’ integration experience, using a common platform has enabled us to achieve a far higher level of integration, automation and consistency in the way that we share data across the business than many others. As a result, we have become a centre of excellence for treasury, accounts payable, accounts receivable, bank relationship management etc. We now connect 211 participants across 51 countries and 44 currencies into our cash pools, and settle 2.6 million intercompany invoices totalling CHF 112bn each year. As we all speak the same IT language, have visibility over the same information and share a common understanding of the way that data is presented, we are able to build trusted relationships more easily and establish our reputation for service excellence.

A pioneer of cash management efficiency

One of the unique facets of our treasury function has been the early adoption of both ‘payments on behalf of’ (POBO) and ‘collections on behalf of’ (COBO). While many companies have been successful in centralising payments, including POBO, many others have found centralising collections, and establishing COBO more challenging. There are various reasons for this: some commercial, as sales teams may be uncomfortable with introducing an additional party into customer relationships, while others are more technical, such as the use of multiple collection instruments, formats and systems. Roche’s integrated, cohesive systems environment, and close partnership with the business, have been key factors in successfully implementing both POBO and COBO. [[[PAGE]]]

We introduced COBO on a limited scale around six or seven years ago, specifically for foreign currency collections, to cater for situations where business units did not hold bank accounts in the relevant currency. Initially, we did not extend the programme beyond this: it lacked a strong business case, and we were concerned that it would add complexity without reducing costs. Since then, however, by centralising payments more fully on a POBO basis, we reduced the need for local accounts: this in turn made the value proposition for COBO more compelling as we would be in a position to eliminate local accounts completely. We completed pilot projects in three countries including both supplier payments and customer collections, but also payroll, taxes, guarantees etc. Based on the success of these projects, we were able to expand the programme more widely.

The success of a COBO project is largely based on the quality and timeliness of the service that treasury can provide to business units. For example, collection advices need to be alerted immediately to business units without delay, to provide full visibility and confidence over the process and to enable them to free up credit lines. To achieve this, we needed to reshape our processes and also work with our banks to access statement information more quickly. As part of our collections centralisation programme, we also implemented virtual accounts in order to streamline and accelerate the reconciliation process. Initially, we rolled this out in the Eurozone with one bank, but have since expanded more widely. In addition, we are now piloting virtual accounts in Hong Kong with a view to rolling out across Asia. Twenty-six of our business units now have no external bank accounts.

Extending our value

Payments and collections are not the only area in which we are enhancing automation and efficiency: foreign exchange (FX) is also a key area of focus, for example. Our treasury policy is to hedge our FX risk (booked transaction exposures) on a daily basis to reduce volatility in our financial statements, for which we have also developed a global process leveraging our SAP-based in-house banking platform. We fix a daily rate for each currency which is then used for all accounting postings, and all internal invoices are settled at that rate. This provides business units with a guaranteed rate and transfers FX risk to group treasury, which equates to an exposure of around CHF 4.5bn across 47 currencies, mainly as a result of intercompany flows.

We transact around 120,000 FX deals each year, both internally and externally. We conduct around 98% of external deals centrally, of which 96% take place through multi-bank dealing portals with straight-through processing to our central treasury infrastructure. Three currencies, the Bosnian convertible marka (BAM), Pakistani rupee (PKR) and Venezuelan bolivar (VEF) are excluded from our central hedging process at present, but with a central framework in place, we will be in a position to incorporate these currencies into our global process in the future.

Leveraging new opportunities

As the liberalisation of RMB has progressed, we have also been able to standardise the way we manage our RMB risk. We opened an offshore RMB account quite early, and connected this into a Netherlands-based cash pool. We aimed to minimise the number of RMB accounts that we hold, and the number of payments from different entities being paid into China which we have achieved by centralising cross-border RMB payments through a Hong Kong-based RMB account. We are also proactive in engaging with banks and regulators to explore new opportunities as regulatory conditions evolve. For example, in 2014, we were invited to be a pilot to include both on- and offshore RMB in a cross-border cash pool. This has been a great opportunity to manage liquidity more efficiently, and we are now able to manage RMB in a similar way to other currencies. The regulatory environment in China remains more complex than other countries: for example, certain types of flow cannot be taken out of the domestic banking system, but this complexity is easing.

Innovation to drive success

One of the reasons that many treasurers choose not to embark on projects to centralise or optimise cash and treasury management activities is that they cannot implement projects across 100% of their business. There will always be exceptions, whether as a result of external regulation or internal culture or business organisation, but these exceptions should not be a reason to shelve the project altogether, as the benefits can be considerable, and often unexpected. As regulations change and the value proposition of centralisation and optimisation becomes clearer, the scope of the project can then be extended to the relevant currencies, countries or business units in due course. What is key, however, is to have a single, robust platform that facilitates transparent, efficient and consistent processes and promotes trust and collaboration both within and beyond the group.