- Dennis Gannon

- Vice President Analyst, Gartner

Balancing Today’s Costs with Tomorrow’s Growth

The findings of a recent survey by US research and advisory firm Gartner reveal valuable actionable insights, helping treasury leaders support their CFOs in navigating the tricky path between funding improvements and developing the business while managing costs and mitigating risk.

CFOs are entering 2026 at a pivotal moment. As guardians of financial health and strategic enablers of growth, finance leaders face mounting pressure to optimise costs while investing in future opportunities.

According to Gartner’s survey of more than 200 CFOs in August 2025, the tension between short-term cost-cutting and long-term growth investment is sharper than ever. Only 36% of CFOs surveyed express confidence in their ability to drive enterprise AI impact, highlighting a critical gap as technology reshapes the finance function.

For treasurers reporting into the CFO, these findings offer both a challenge and a roadmap

Identifying primary issues

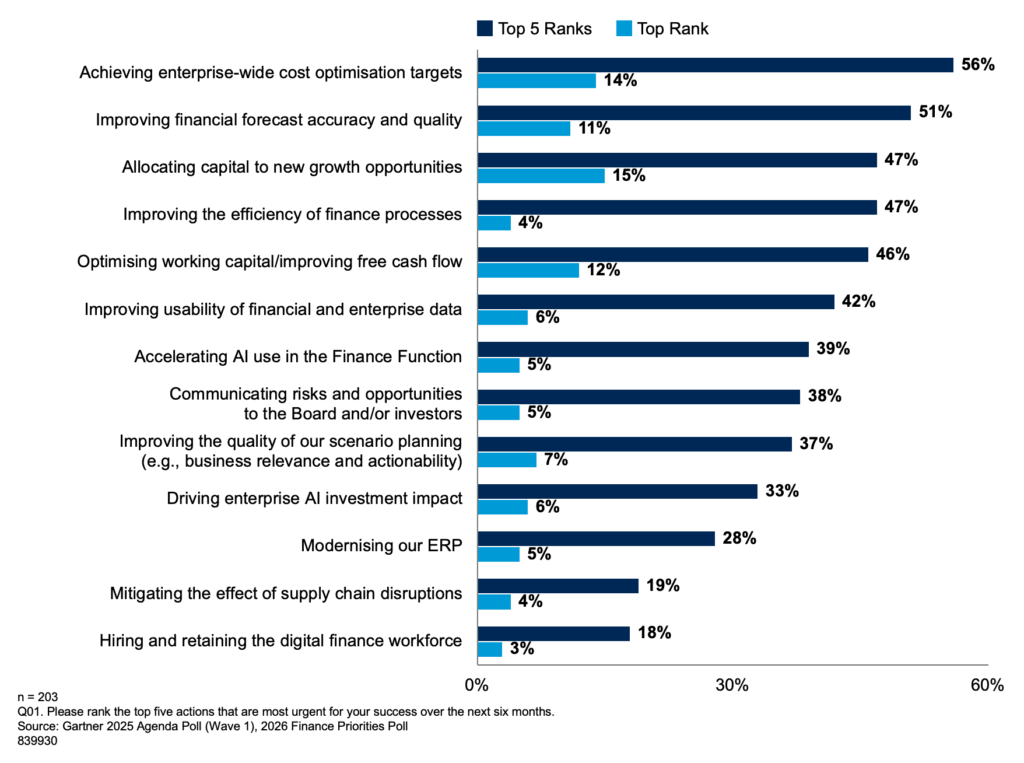

Top priorities for CFOs as they prepare for the year ahead reflect a dual mandate of managing cost and growth. A significant 56% of CFOs surveyed rank achieving enterprise-wide cost optimisation targets in their top five priorities (see fig. 1). At the same time, it’s important to note that 51% cite improving financial forecast accuracy and quality as a prime concern, which impacts optimisation results. Although less than half of CFOs list capital allocation for growth in their top five, more identify funding growth opportunities as their number one priority than any other item.

Figure 1: Most urgent CFO actions/questions for success over the next six months

This bifurcation signals a divide between those focused on efficiency and those prioritising expansion. For treasurers, understanding where their organisation falls on this spectrum is essential for aligning strategies and recommendations.

Understanding cost optimisation

Cost optimisation remains at the forefront of CFOs’ minds, but both investors and boards are increasingly sceptical of cuts that are not sustainable over the long term. Gartner’s research highlights that successful CFOs foster a cost-conscious culture, placing a premium on transparency and financial acumen across the organisation. They are deliberate in directing resources toward business differentiators – those areas that truly set the business apart – while simultaneously reducing spending on functions that competitors can easily replicate.

For treasurers, this means working closely with business units to identify the underlying drivers of cost and differentiation to uncover opportunities for value creation. It is important to develop reporting that not only tracks cost reductions but also demonstrates the sustainability and strategic rationale behind these decisions. Encouraging a culture of ownership and accountability for cost management throughout the organisation is essential to driving lasting results.

Forecasting and resource allocation techniques

In today’s volatile environment, the ability to forecast with accuracy and reallocate resources swiftly is a significant competitive advantage. CFOs are increasingly called upon to apply advanced analytics and scenario planning to improve the quality of their forecasts. They are also adopting resource allocation techniques that enable them to shift resources quickly away from underperforming projects and toward higher-value opportunities.

Treasurers play a vital role in this process by collaborating with FP&A teams to stress-test forecasts and model a range of potential scenarios. Recommending tools and processes that support dynamic budgeting and rapid reallocation can help the organisation respond more effectively to change. It is equally important for treasury to ensure that its perspective on liquidity and risk is fully integrated into enterprise-wide planning efforts.

The capital activist mindset

A growing subset of CFOs is taking on the role of ‘capital activist’, driving sharper trade-offs and prioritising growth even as cost pressures persist. This approach involves relentless prioritisation around a well-defined portfolio strategy and making tough decisions about where to invest and where to divest.

Treasurers can support this mindset by providing robust analysis of risk, return, and strategic fit to inform capital allocation decisions. Facilitating cross-functional discussions helps ensure that finance, operations, and strategy are aligned. As market conditions evolve, monitoring the impact of investment decisions and adjusting recommendations accordingly is crucial to maintaining momentum.

AI and digital transformation

Despite significant investments in AI and digital transformation, only a minority of CFOs feel confident in their ability to drive meaningful enterprise AI impact. Confidence is similarly low when it comes to accelerating the use of AI within finance and in hiring and retaining digital talent. Gartner recommends a dual-path approach: businesses should leverage embedded AI in vendor software for immediate gains, while simultaneously building the culture, governance, and skills necessary for long-term value creation with the technology.

For treasurers, this means identifying quick wins where AI can automate routine processes, such as cash forecasting or risk analysis, to deliver immediate efficiency gains. It is important to advocate for upskilling and reskilling initiatives within the treasury team to build digital capabilities.

Additionally, participating in governance discussions ensures that AI adoption aligns with risk management and compliance requirements.

Closing the digital skills gap

The urgency of digitisation is clear, but progress requires more than technology investments alone. CFOs must set clear targets and action plans to close the digital talent gap, link transformation goals to digital talent ambitions, and promote agile, modern management practices that attract and retain top talent.

Treasurers should begin by assessing the current digital skills within their teams and identifying any gaps. Partnering with HR and finance leadership to define talent development priorities – both in the finance function and the wider organization – is critical, as is fostering a culture of continuous learning and innovation. These steps will help ensure that treasury is well positioned to support the broader finance and organisational transformation.

Navigating strategic tensions

Budget and resource constraints remain the most cited obstacles to achieving top priorities. The ongoing tension between cost optimisation and growth investment will require sharper trade-offs and more disciplined portfolio management.

Treasurers can add value by providing clear, data-driven insights into the trade-offs associated with different funding decisions. Helping the CFO articulate the rationale for resource allocation choices to the board and executive team is essential, as is monitoring the external environment for emerging risks and opportunities that may require a shift in strategy. Through these actions, treasurers can help the organisation navigate uncertainty and position itself for long-term success.

Turning insight into action

The road to 2026 is fraught with complexity, but also opportunity. For treasurers, the imperative is clear:

- Identify and align closely with your CFO’s priorities and the organisation’s strategic direction.

- Champion a balanced approach that optimises costs without sacrificing the best opportunities for future growth.

- Embrace digital transformation, not just as a technology initiative, but as a catalyst for cultural and talent evolution.

- Be proactive in identifying risks, surfacing opportunities, and supporting data-driven decision-making.

By taking these actions, treasury leaders can help their businesses not just weather uncertainty but emerge stronger, more agile, and better positioned for long-term success.