With carbon markets gaining more prominence in corporate sustainability strategies, we take a closer look at how carbon credit prices are calculated and key factors that companies should consider when purchasing carbon credits for offsetting their residual emissions.

With 2050 fast approaching, there is growing awareness that putting a price on carbon will play an important role in achieving net-zero emissions. At the core of carbon pricing is the concept of capturing the costs of externalities arising from the emission of greenhouse gases (GHGs). In doing so, carbon pricing changes corporate and public sector decision-making by steering producers and consumers towards low-carbon production processes, while also stimulating innovation to bring down the cost of emission abatement measures.

In this article, we look at how the price of carbon is determined and discuss key factors that should be considered by any company looking to leverage carbon markets as part of a wider sustainability strategy.

Which instruments and markets help to put a price on carbon?

Carbon pricing is influenced by a number of different instruments, markets, and factors. Some of the key instruments that influence the price of carbon include:

- A carbon tax, which puts a direct price on GHG emissions with emitters having to pay for every ton of carbon they emit. In theory, higher prices steer businesses and individuals toward less carbon-intensive activities. A carbon tax is different from an emissions trading system (ETS), for example, the EU ETS; the emission reduction outcome of a carbon tax is not predefined, but the price of carbon is (determined by the government administering the tax).

- Internal carbon pricing, where companies and other entities assign their own internal price to carbon use to factor this into their investment decisions. Click here to learn more about how corporate pioneers such as British Land and Microsoft are using internal carbon pricing to decarbonise and increase competitiveness.

- A carbon credit system, also known as a cap-and-trade system, sets a limit on total direct GHG emissions from specific sectors, while also creating a market where the rights to emit (allowances) are traded. Firms that cut their pollution faster can sell allowances to companies that pollute more, financially rewarding those moving more quickly towards low-carbon production. The EU carbon credit system, the EU ETS) , was the world’s first major carbon market and remains the biggest. It has shown that putting a price on carbon and trading can work: in 2030, emissions from sectors covered by the EU ETS are forecast to fall by 43% from 2005 levels [1].

- Crediting mechanisms, in which emissions reductions from specific projects are assigned credits that can be sold to businesses and corporates to assist in their offsetting needs as part of their overall climate strategy.

How do carbon markets influence the price of carbon credits?

Quantifying emissions is relatively straightforward, but the pricing of carbon credits remains elusive, mostly because of the wide variety of credits in the market and the number of factors influencing the price.

The nature of the underlying project is one of the main factors affecting the price of carbon credits, and projects are grouped into two large categories or baskets:

- Avoidance projects, which avoid emitting GHGs completely, reducing the volume of GHGs emitted into the atmosphere. These include off-grid renewable energy initiatives , projects to prevent deforestation and farming emission reduction schemes , and the development of energy-efficient buildings.

- Removal projects, which remove GHGs directly from the atmosphere. These include nature-based projects (for instance, using trees or soil to remove and capture carbon) and tech-based projects (such as human-made carbon capture and sequestration).

A carbon credit represents the verified removal, or avoidance/reduction of one tonne of carbon dioxide from the atmosphere. A purchased carbon credit may be ‘retired’ by the owner to offset one tonne of carbon dioxide emissions.

Removal credits tend to trade at a premium to avoidance credits, not just because of the higher level of investment required by the underlying project but because of the high demand for this type of credits. They are also believed to be a more powerful tool in the fight against climate change.

Beyond the type of the underlying project, the price of a carbon credit is also influenced by:

- The volume of credits traded at a time: Typically, the higher the volume, the lower the price. Larger firms can often benefit from economies of scale by purchasing more credits at one time.

- The location of the underlying project: Inhospitable geography, lack of access to critical infrastructure or resources, or risk due to war and conflict mean some regions and countries inevitably struggle to develop projects without incurring higher costs.

- The project’s ‘vintage’ – when the emission reduction took place: Usually, the older the vintage, the cheaper the price. This is, however, somewhat controversial. Gold Standard, a body that certifies carbon credits, maintains that as long as a project meets the criteria for a reputable standard it shouldn’t matter when the emission reduction took place (in fact, one could argue that emissions avoided five years ago are more valuable than the same reduction made today).

- Project quality: Typically, the greater the environmental (and in many cases, developmental) benefits produced by underlying projects, the higher the price.

- Pricing and data transparency: Like any market, price and data transparency can go a long way towards influencing what companies will pay for credits. In the long run, greater transparency usually translates into lower prices. Nascent but fast-growing platforms such as Project Carbon are helping to improve transparency and communication by connecting buyers and sellers on voluntary carbon markets.

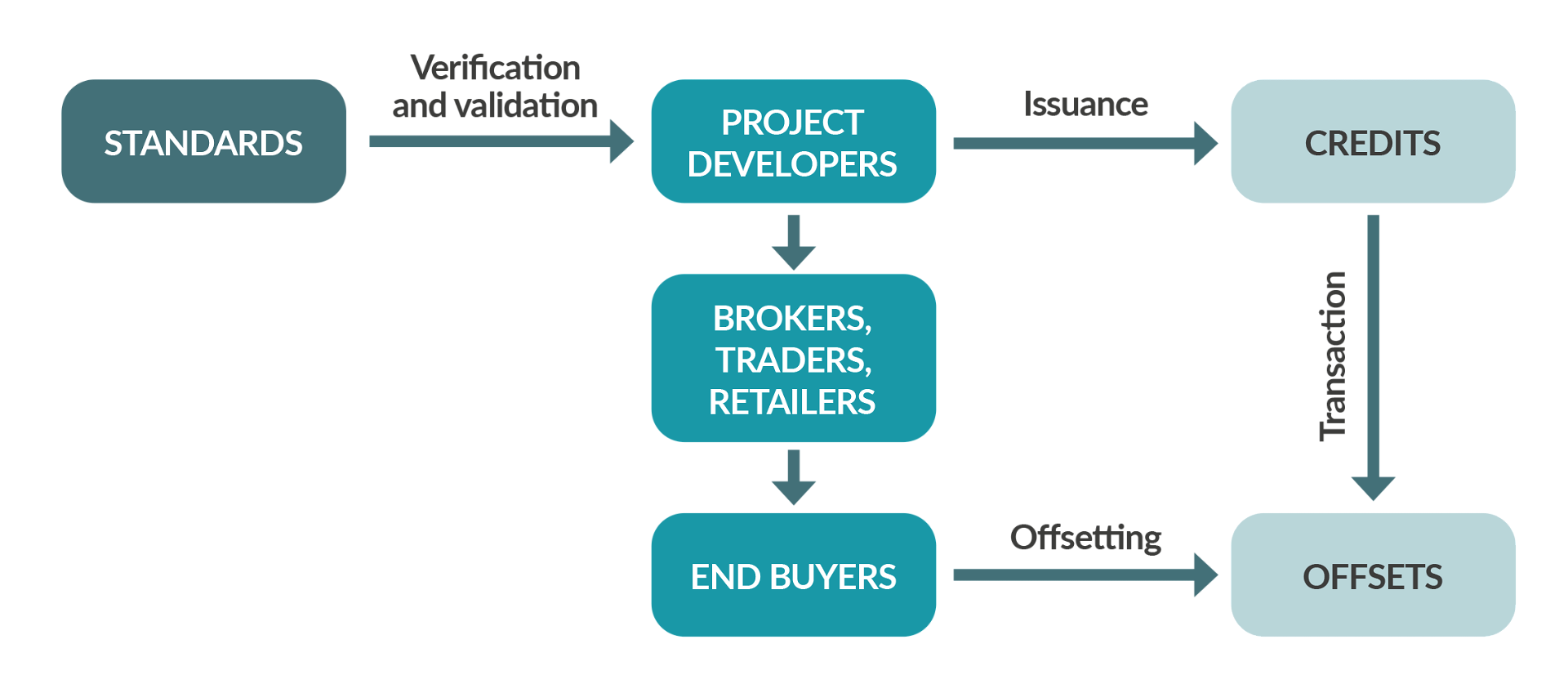

The structure of the voluntary carbon market

Carbon credit prices will rise in the near- and medium-term

Carbon prices are mainly driven by supply and demand in the carbon markets. As such, they cover only a small proportion of the societal costs of emissions. Hence, there is a significant divergence between the price of carbon across different markets and the price that experts say is necessary to reach the temperature goals set by the 2015 Paris Agreement. In their paper The Social Cost of Carbon, Risk, Distribution, Market Failures: An Alternative Approach, Nicholas Stern and Joseph E. Stiglitz argue that the social cost is close to $100 per tonne – this compares with high-quality carbon credits currently priced around the $7-17 per tonne.

Clearly, a gap needs to be bridged. Charging $100/tonne today would cause social and economic upheaval: given the limited range of cost-effective alternative technologies, simply driving up the price of carbon would not immediately reduce emissions. Many businesses wouldn’t be able to afford the price and, facing a lack of alternatives, wouldn’t be able to easily switch (or even stay in business). Nor would they be able to fully decarbonise their operations.

Yet other factors also put upward pressure to prices. Typically, nature-based projects don’t start to deliver credits until year three or four of operation. Tech-based carbon credits tend to start at a high price, which will start moving lower as investments bring efficiencies. But innovation takes time. And with demand on the rise, we can expect the demand/supply imbalance to persist for a while.

But in the long run, platforms that increase the frequency of carbon-credit trading, broaden the types of organisations participating in carbon markets, and enhance market transparency will bring much-needed liquidity and hopefully a stable price.

Follow NatWest’s Carbonomics 101 series to keep informed about the development of the carbon markets and learn about the role they could play in your sustainability strategy. Access forthcoming articles in this series the moment they’re published by following NatWest on social media, and visit the bank’s Carbon Hub for essential tools & insights to help you on your sustainability journey.

[1] https://ci.natwest.com/insights/articles/esg-essentials-for-corporates-the-environmental-angle-6-carbonomics-putting-a-price-on-carbon/#_ftn1