by Steven Lenaerts, Head of Product Management Global Channels, BNP Paribas

As consumers, we are all becoming more comfortable with the use of mobile devices for personal banking. Increasingly, we expect a similar level of convenience for corporate banking, so it is inevitable that mobile devices will play a growing role in connecting users and providers of payment and banking services. Banks are responding by developing mobile channels that create added value by extending business processes, integrating with existing systems and maintaining a high level of security.

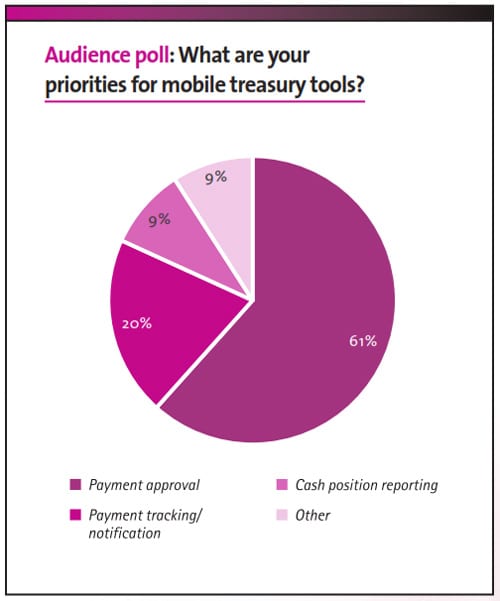

There are a number of complexities in developing mobile channels for corporate rather than retail banking, not least that corporations operate internationally, so mobile banking solutions need to support the regulatory differences across locations. There are also technical considerations to address such as differences between operating systems, screen sizes etc. but these are all surmountable. More important is to ensure that users have access to the mobile capabilities they require. Users are currently looking for mobile access to facilitate decision-making for relatively simple but critical tasks such as payment approval and tracking sensitive payments, etc. Conversely, they tend to prefer to conduct more involved and complex tasks, such as analysing data through dashboards, via online banking platforms.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version