Exclusive insight for TMI subscribers! Northern Trust Asset Management share a monthly market commentary for treasurers.

Eurozone Market Update

The European Central Bank (ECB) kept key interest rates unchanged in March, as widely expected by the markets. Greater focus was on the new staff macroeconomic projections, which indicated a softer path for headline and core inflation and near-term growth prospects. The Governing Council noted that most measures of inflation have declined further but stressed that domestic price pressures remain high. This is in part due to strong wage growth, which is a critical data point for the ECB’s rate decisions (see Chart of the Month). President Christine Lagarde stressed the ECB’s data-dependent approach, stating that they will know a little more in April and a lot more in June. This can be seen as a continuation of her guiding market participants towards a June cut, which aligns with our base case for the ECB.

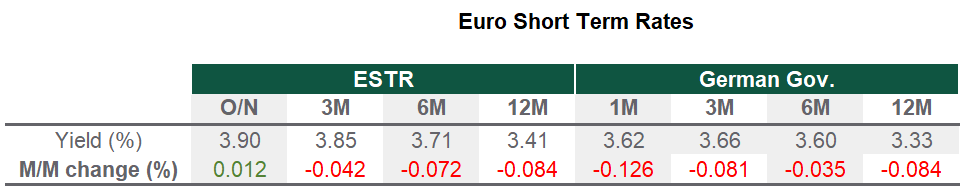

Source: Bloomberg, data as of 28 March 2024

UK Market Update

The Bank of England (BoE) maintained the bank rate at 5.25% in March, with only one dissenting voice preferring a cut. This was the first time since September 2021 that nobody voted for a rate hike. Markets reacted strongly to the change of sentiment, fully pricing in three 25 basis points (bps) base reductions for the year. August remains the most likely month for the first cut, but pricing for June reflects a greater than 50% chance of a reduction ahead of the Summer. Governor Andrew Bailey signalled that the bank was “not yet at the point where we can cut interest rates, but things are moving in the right direction.” UK Consumer Price Index (CPI) inflation fell to 3.4% in February from 4% in January, while core inflation fell to a two-year low of 4.5% from 5.1%. Services CPI, a key metric for the BoE, eased to 6.1% from 6.5%, which aligns with the BoE’s latest inflation projections.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version