Exclusive insight for TMI subscribers! Northern Trust Asset Management share a monthly market commentary for treasurers.

Eurozone Market Update

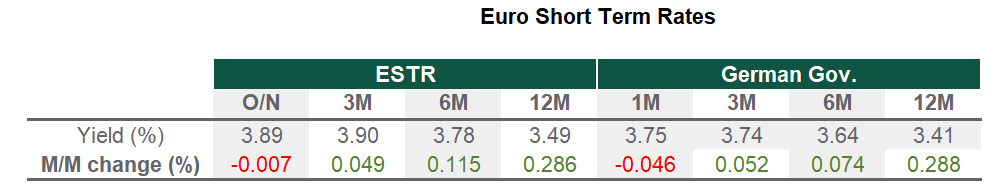

With no monetary policy meetings from our three central banks in February, we paid close attention to the economic data that might impact rate decisions at their March meetings. Flash figures show annual eurozone headline inflation came in at 2.6% in February, down from 2.8%, while core inflation of 3.1% was the lowest since March 2022. Services inflation also eased to 3.9% from 4%. The hawks and doves in the European Central Bank (ECB) have expressed confidence in the disinflationary trend but want further evidence of its continuation before embarking on an easing cycle. Wage growth data for the fourth quarter of 2023 showed negotiated wages slowed to 4.46% from 4.69%. The ECB’s chief economist, Philip Lane, commented that 3% wage growth would be consistent with the 2% inflation target, indicating that the ECB is likely to keep rates steady to meet that target. The amount of easing expected by June fell 4.2 bps to 25.52 bps, signalling the first full cut in June, with 75 bps of cuts priced in for the year (see Chart of the Month).

Source: Bloomberg, data as of 29 February 2024

UK Market Update

UK annual headline inflation in January (4.0%) was lower than market consensus estimates and the Bank of England’s (BoE) expectations (4.1% each). Core inflation remained steady at 5.1%. Services inflation ticked up from 6.4% to 6.5% in January but was again lower than anticipated by the market (6.8%) and BoE (6.6%). In a speech, Dave Ramsden, a BoE deputy governor, noted that “key indicators of inflation persistence remain elevated”, and more evidence is required on “how entrenched this persistence will be” when considering how long to leave rates at their peak. This echoed comments Governor Andrew Bailey had made to a Parliamentary Committee earlier in the month. Data showed that the UK slipped into a technical recession in the second half of last year, driven by weak consumption and net trade. This news saw the expected 2024 BoE rate pricing fall intraday.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version