- Steve Lethaby

- Senior Sales Manager, GSF Sales/Relationship Management, - UK, Ireland, South Africa and the Americas, Clearstream

by Steve Lethaby, Senior Sales Manager, GSF Sales/Relationship Management– UK, Ireland, South Africa and the Americas, Clearstream

While investing surplus cash has always been a challenging process for corporate treasurers in order to manage counterparty risk, maintain access to liquidity and generate above-inflation returns, decisions over the choice of investment product have typically been more straightforward. Treasurers’ cash investment mandate is generally conservative, with deposits and to some extent money market funds (MMFs) predominating, together with instruments such as certificates of deposit (CDs) and commercial paper (CP) amongst those with larger cash balances. Today, however, a range of market, regulatory and internal factors are forcing treasurers to rethink the choice of investment solutions in which they invest. The difficulty for treasurers, therefore, is to find instruments that continue to meet the corporation’s liquidity, risk and yield objectives within this new environment. Increasingly, tri-party repos are proving an attractive choice.

Pressure on investment choices

While regulatory change is a fact of corporate life, there are two key developments that are prompting treasurers to rethink their investment practices now, and will do so more strongly in the months ahead. Firstly, Basel III and in particular the liquidity coverage ratio (LCR), is making short-term deposits of non-operating cash (effectively any deposit that is not linked to other activities such as payments and collections management) far less attractive to banks than in the past. While deposits of a minimum tenor, e.g., 90 days, will be more attractive to banks, and therefore they are likely to incentivise their corporate clients accordingly, this lack of flexibility in maturity dates is likely to compromise many corporations’ liquidity requirements.

Money market fund reform will also have an impact both in United States and Europe. While MMFs will continue to be an attractive investment choice for some corporations, particularly as MMFs are likely to be more robust as a result of the forthcoming changes, others are likely to be deterred by the move from constant net asset value (NAV) to variable NAV.

It is not only regulatory change that is encouraging treasurers to revise their investment strategies. Corporate treasurers are holding unprecedented levels of cash; at the same time, however, the pool of assets that meet corporate investment policy is declining, and treasurers are increasingly challenged to generate yield as the lengthy period of historically low interest rates continues. Treasurers are therefore taking a fresh look both at their investment policies and market opportunities, and considering the alternatives to their traditional investment choices.[[[PAGE]]]

The potential of tri-party repos

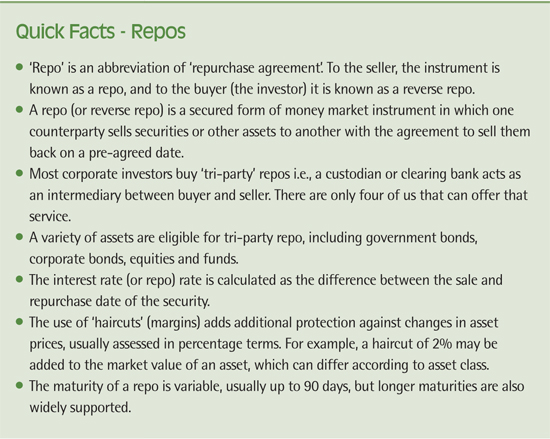

One of the most important instruments that treasurers are lighting upon is tri-party repos (see box) (or reverse repos from the perspective of the corporate investor). Tri-party repos offer considerable opportunities as part of a corporate cash investment portfolio, enabling treasurers to access a wider range of assets without compromising security, liquidity or yield objectives. Indeed, they are often more flexible than other investments as treasurers can select a maturity date and asset profile that meets their needs, whilst taking advantage of higher returns that may be available on longer-term securities. Similarly, the secured nature of tri-party repos may also be attractive, and the ability to re-use collateral, such as an alternative to cash for project financing, such as on export credit agency financing projects, can be very valuable for corporate treasurers.

Despite the advantages, however, investing in tri-party repos introduces a variety of considerations that may not have been relevant in the past. Tri-party repos (as opposed to bilateral repos) are typically preferred by corporate treasurers as they avoid the need to contract separate legal agreements with each asset owner, but treasurers still need to appoint a third party collateral agent. Treasurers complete a tri-party collateral management service agreement which mandates the collateral agent to perform back-office administration on its behalf, including the collection, valuation and management of securities. In addition, the corporate investor signs a master repurchase agreement with each trading counterparty, which sets out the rules and duties of the various parties under a repo transaction. This can be onerous, and has traditionally dissuaded some treasurers from conducting tri-party repos. However, Clearstream has streamlined this process with a new legal master agreement for tri-party repo transactions called the Clearstream Repurchase Conditions (CRC). This new agreement allows market participants to sign just one contract for multiple counterparties. In other words, the CRCs only need to be signed once to give corporate investors access to a wide range of counterparties that have also signed the same agreement.

The collateral agent also fulfils a vital role in the transaction by selecting and screening collateral for the tri-party repo (effectively matching buyers and sellers and reducing the risk for both parties) and managing key processes such as margin calls (i.e., to ensure that sufficient collateral is segregated to reflect positive or negative changes in asset prices). The agent holds collateral in segregated accounts, so neither party have an exposure to the agent. The agent is also instrumental in streamlining transaction execution and operational management of the tri-party repo.

The importance of a collateral management agent

As a result of the pivotal role played by the collateral management agent in the tri-party repo process, it is essential to select the right organisation that can fulfil the various functions it performs with a high degree of efficiency, integrity and transparency. Key to this is the technology in place to support granular eligibility screening, a substitution process in the event that an asset becomes ineligible, regular valuations and automatic triggering of market calls. The ability to leverage sophisticated technology and expertise to support these essential functions is one of the key factors in a corporate treasurer’s decision to work with Clearstream.

Achieving visibility, security and automation

In addition to managing ‘behind the scenes’ transaction processing and monitoring, corporate treasurers have direct access to Clearstream’s Global Liquidity Hub. Transactions can be performed using treasurers’ standard online dealing platform, e.g., Bloomberg, 360T etc. with the ability to achieve full end-to-end integration through standard SWIFT-based messaging. Through the Global Liquidity Hub, treasurers have access to a full range of transaction management and monitoring tools, with the ability to take control of collateral in the event of counterparty default, and liquidate or refinance assets through their own bank or broker. Furthermore, these capabilities are available without cost to the corporate investor.

Tri-party repos are already proving very popular with a growing number of corporate treasurers within Europe, such as in Germany, where treasurers are using the opportunity to invest in assets such as asset-backed or mortgage-backed securities with a higher yield than unsecured investments. Currently, these are typically larger corporations, but smaller corporates with surplus cash balances are also likely to invest in tri-party repos as the benefits become more widely understood, particularly given the ease of transaction, maintenance and contractual process when working with an expert collateral management agent such as Clearstream.