Exclusive insight for TMI subscribers! Northern Trust Asset Management share a monthly market commentary for treasurers.

Eurozone Market Update

Following 10 straight rate hikes, the ECB did not change its monetary policy in October, leaving deposit facility rates at 4%. The ECB’s accompanying statement reiterated its data-dependent approach and the expectation that it must maintain the current rate for a sufficiently long time so that inflation returns to its 2% target over the medium-term. The ECB has consistently pushed back on any talk of rate cuts, characterising this as extremely premature. Annual eurozone inflation fell to 2.9% in October, while core inflation remains high at 4.2%. Third quarter GDP of -0.1% missed market expectations of 0%, reflecting stagnating economic activity. October’s flash composite Purchasing Managers’ Index (PMI) of 46.5 was down from 47.2 September and below the consensus of 47.4, primarily due to softening demand conditions.

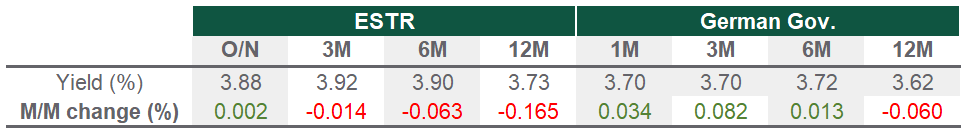

Euro Short Term Rates

Source: Bloomberg, data as of 31 October 2023

UK Market Update

Inflation in the UK remains sticky, with annual Consumer Price Index inflation in September at 6.7%, unchanged from August and above the consensus of 6.6%. Core inflation was 6.1%, down from August’s 6.2% but also above consensus of 6%. The data looked sufficiently well-behaved to allow the BoE to vote 6-3 to remain on hold at 5.25%. Following a new trial method of calculations, UK employment fell by 82,000 from July to August, with the rate falling to 60.9% from 61.2%, helping to reduce the upward pressure on wages. While recovered modestly in August with a 0.2% monthly gain, in line with expectations, composite PMI hit 48.6, up 0.1 from September.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version