- Vince A. Tolve

- SVP, Global Trading, FIS

Introducing the FIS Corporate Cash Investment Report 2015

by Vince Tolve, SVP, Global Trading, FIS

Now in its fifth year, FIS (formerly SunGard)’s Corporate Cash Investment report is an in-depth study among corporate treasury professionals that explores corporate attitudes to cash investment, investment policies and transaction execution, particularly in the context of major regulatory change in the months ahead. Having now built up five years of data, this report uniquely presents not only the 2015 findings but also identifies trends and developments over time.

Once again, the study involved corporations globally across all major regions and industries. Forty-six percent of respondents were located in North America, with a further 37% from Europe. Ninety-four percent of respondent organisations had centralised their treasury either globally or regionally, similar to previous studies.

Summary of key findings

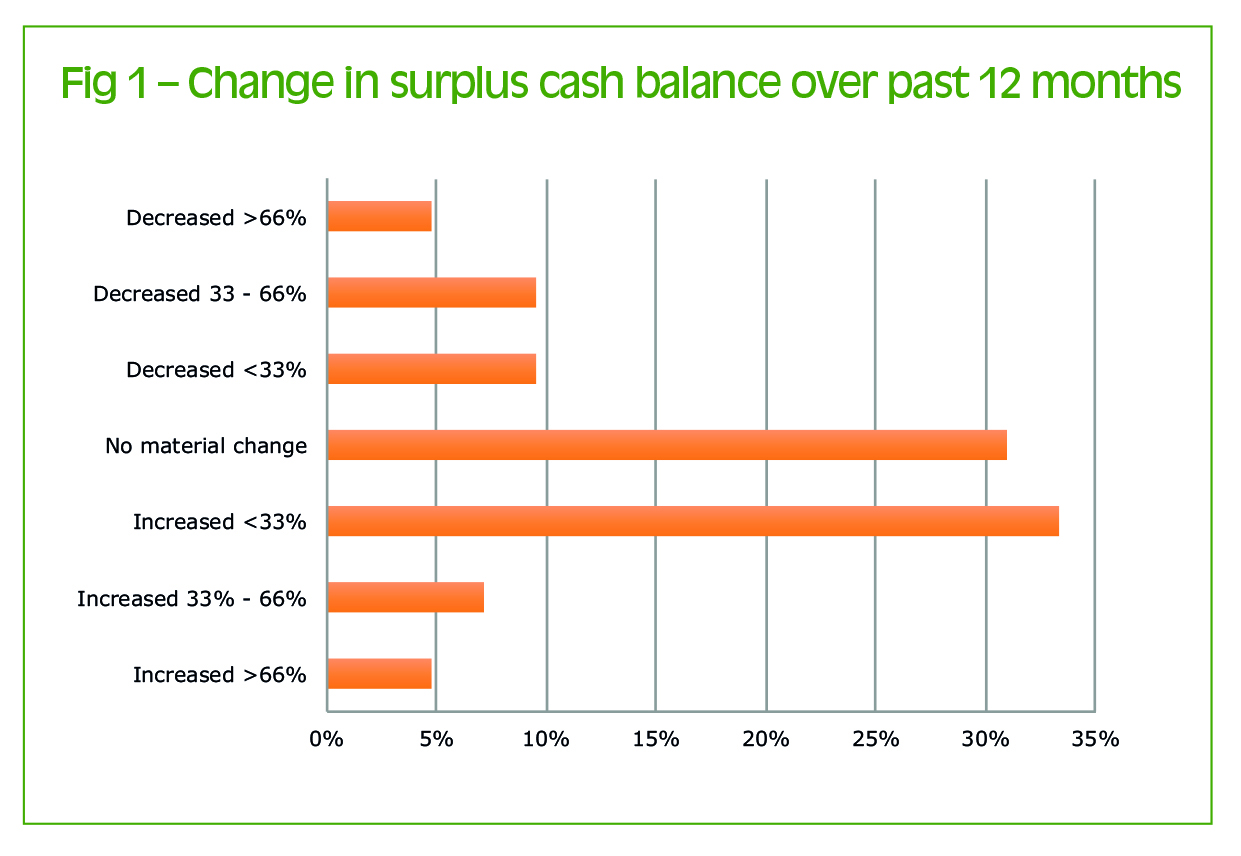

- Cash levels. Corporate cash balances continue to rise strongly in 2015, with 45% of respondents noting an increase. A third of companies hold cash for capital investment and M&A, and a quarter for working capital financing.

- Investment priorities. Finding suitable repositories for corporate cash remains the top priority for treasurers. However, while Basel III barely registered a year ago, it is now a key priority for 43% of respondents.

- Impact of MMF reform. 60% of treasurers in the United States expect to invest in prime MMFs at a similar level post-2016 SEC reforms. 37% expect to decrease their holdings, identifying accounting, intraday liquidity and investment policy constraints as the biggest obstacles.

- Expanding portfolios. Treasurers expect to expand their holdings of cash in term deposits, commercial paper, certificates of deposit and government debt either in in addition to, or as an alternative to prime MMFs.

- Dealing in practice. For the first time since the study was launched in 2011, use of independent portals has overtaken other dealing methods for short-term cash instruments, both telephone (38%) and portals provided by investment managers (21%).

How are cash balances changing?

Corporate cash balances rose once again in 2015, continuing the trend that we have seen since 2012 despite greater market confidence and strong M&A activities in some markets (figure 1). As the survey reveals, companies are holding (and growing) large cash balances for a variety of reasons, with only subtle changes in their relative importance over recent years. Treasurers had already been building up cash balances in the years leading up to the crisis to fund mergers and acquisitions (M&A) and capital investment, and for working capital reasons. Once the crisis struck, surplus cash became an important ‘buffer’ against revenue shocks and to mitigate liquidity risk, but this has become less of a priority.

What are treasurers’ key investment challenges?

Over the past five years, treasurers’ investment challenges have evolved significantly. Operational concerns, such as cash flow forecasting, predominated in 2011, while market and regulatory issues took over in 2012 as the Eurozone crisis struck and the Federal Deposit Insurance Corporation (FDIC) guaranteed non-interest bearing account scheme expired. In 2013 and 2014, with cash balances continuing to grow, treasurers were most concerned about finding suitable instruments in which to invest. Unlocking trapped cash held in regulated markets was also a major consideration.[[[PAGE]]]

Click image to enlarge

In 2015, regulatory change is firmly back on the agenda. While finding suitable investment instruments remains the most significant concern, noted by 46% as one of their top three challenges (figure 2), this figure is significantly lower than in 2014. In contrast, managing the impact of Basel III (43%) and MMF reform in the US (39%) is now a priority, a sharp increase from the 2014 survey when these issues barely touched treasurers’ list of priorities. Related to these issues, 31% noted that a lack of credit limits with highly rated banks was a challenge.

The challenges of finding suitable repositories of cash, and credit limit availability with authorised banks are likely to be exacerbated as banks complete their Basel III implementation and MMF reforms take effect. In the past, if a bank had discouraged an investor from depositing cash, treasurers would have typically turned to an alternative bank: however, this is clearly becoming increasingly difficult. The problem has been compounded by credit rating downgrades, so many treasurers now have a smaller panel of approved counterparty banks in which to invest. Furthermore, MMF reform will force investors to consider the implications of constant net asset value (NAV) instruments on their investment policy, reporting and accounting processes.

As companies review, and potentially revise their investment policy, they also need to consider how they execute transactions.

‘Trapped’ cash (i.e., cash that cannot be repatriated, typically in emerging markets with capital and/or currency controls) also continues to be a major issue. Although trapped cash affects fewer respondent organisations than regulatory change, depending on their industry and geographic reach, it was identified as the single biggest challenge, up from 17% in 2014 to 19% in 2015. China has historically been the market most frequently cited, but although recent reforms now make it easier to leverage surplus liquidity, not all companies have yet been able to take advantage of these new opportunities. Although trapped cash is becoming far less of a challenge in China, companies are increasingly expanding into more challenging emerging countries in Asia, Latin America and Africa so trapped cash is likely to continue to be a challenge in the years ahead.

What choices are investors making?

Given the regulatory pressures on treasurers’ investment options, companies have become more confident in segmenting their cash into balances that are required to fund short-term liquidity requirements, and amounts that can be invested in the longer term, potentially generating a higher return. While cash security remains a critical requirement, some companies have become willing to use liquidity as a lever to access a wider range of instruments, and potentially increase the return on cash.

As this study has demonstrated over the past five years, bank deposits and MMFs are treasurers’ most popular choices for investing surplus cash. MMFs remain more common in the United States and Europe than in other regions, but their use in Asia is also growing. However, with major changes to both deposits and MMFs under way, treasurers are reviewing their investment policies and processes, and in some cases, changing the way they invest surplus cash. Furthermore, there are significant valuation, accounting and operational implications for prime MMFs that companies that choose to invest in these funds will need to consider. According to this survey, the majority (60%) anticipate that they will continue to invest in these funds at a similar level to today, while just over one third expect to decrease their level of investment. However, as treasurers become more familiar with new instruments and make the necessary revisions to their policies and processes, this decline may not materialise in practice, particularly given the difficulties in finding alternatives.

Many respondents plan to diversify their cash investment portfolio (figure 3) across a wider range of instruments. Treasurers are currently most attracted to term deposits (19%), commercial paper (CP, 15%) certificates of deposit (CD, 13%) and government debt (13%). However, the future interest rate environment, availability of assets and treasurers’ ability to segment cash will impact on these plans. Furthermore, treasurers will need to consider the resource implications of managing their cash assets directly, such as when investing in CP, CDs and repos, as opposed to outsourcing this to a fund manager. Treasurers choosing some of these direct investments will also lose the inherent diversification associated with the use of funds, whether MMFs, bond funds or separately managed accounts.

How do you deal short-term investments most efficiently?

As companies review, and potentially revise their investment policy, they also need to consider how they execute transactions. This year’s data reveals that the gradual shift towards electronic dealing for more ‘vanilla’ instruments (e.g., deposits, MMFs, FX spot and forward transactions) that we have observed over recent years has continued. In some cases, this involves using dealing tools offered by banks, while in others, companies choose to use independent portals that allow them to deal with multiple counterparties and funds through a single channel.[[[PAGE]]]

In 2014, the use of bank portals compared with independent portals was roughly equivalent. In 2015, however, there has been a substantial increase in the use of independent portals, now at 41% (in some cases used on a standalone basis or integrated it with the enterprise resource planning (ERP) or treasury management system (TMS)). Consequently, the use of independent, multi-bank portals has now become the most popular means of dealing short-term cash instruments for the first time. However, although the benefits of electronic dealing are well-established, figure 4 shows that telephone dealing remains popular at 38%, a similar proportion to the 2014 study.

Given that such a large proportion of companies are now using electronic dealing, treasurers who expand their cash investment portfolio into instruments that are less often dealt electronically than those they use today need to consider how their treasury processes may be affected, and how they will achieve their security and efficiency objectives.

Conclusions

With an unprecedented period of low interest rates, which are now in negative territory in Europe, the value of surplus cash has been negligible over recent years. Even as the Fed has begun to increase USD rates, yields are likely to remain at very low levels, and negative in Europe, for the foreseeable future. Added to this, with the most common investment choices, namely bank deposits and MMFs in question as a result of MMF reform and Basel III, treasurers are now being forced to question why they are holding such large, growing cash balances.

As treasurers become more adept at forecasting cash flow, and are therefore in a better position to segment their cash balances into short-term, core and strategic cash, some will be in a position to sacrifice same-day liquidity on a portion of their cash in order to access a wider range of instruments, and potentially increase the return on their cash. The study demonstrates that treasurers are considering a wide range of instruments to achieve this, both direct investments and investment funds. While some treasury functions have the resources to invest in the market directly, this is not universally the case.

However, treasurers do not need to compromise on the convenience, diversification and credit quality associated with MMFs; rather, they can gain access to a wider range of fund types, including separately managed accounts where their cash balances are of a sufficient size. There are operational benefits too. For example, a growing number and diversity of funds (as well as other short-term cash investments) are supported through independent portals such as FIS’ SGN Short-Term Cash Management Portal, allowing treasurers to standardise and optimise processes, integration, reporting and analytics without limiting their investment choices.

To access a full copy of the FIS 2015 Cash Investment Report, please go to http://www.sungard.com/cashinvestment