by Stanley Wachs, Global Head of Bank Engagement, SWIFTgpi and Damien Godderis, Senior Product Manager, International Payments and Correspondent Network, BNP Paribas

Corporate treasurers face a range of challenges when dealing with cross-border payments, not least tracking progress, calculating fees, pinpointing when funds can be used by the beneficiary, and identifying the invoice to which payments relate.

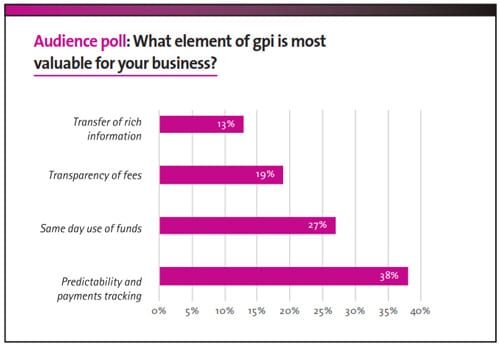

These prompted SWIFT to launch its global payments initiative (gpi) in late 2015. BNP Paribas was quick to recognise the value of gpi and was an early signatory, and 74 banks (as of July 2016) have now signed up. The key principles of gpi are to enable same day use of funds, transparency and predictability of fees, end to end payments tracking, by sending back a confirmation and the transfer of rich payment information. The new service will help corporates grow their international business, improve supplier relationships, and achieve greater treasury efficiencies. In addition, banks will have the ability to track payments end to end using a payments tracking database, hosted at SWIFT, using a unique identifier across the messages. Underpinning gpi is a new set of business rules between banks, which is currently in a pilot phase, with the results due to be launched at Sibos 2016 in Geneva. In parallel, SWIFT is launching a five year vision for correspondent banking to define a strategic roadmap that will bring significant new value and cost reductions for payment users beyond 2017.