Ernie Caballero – UPS欧亚财务与并购部副总裁

UPS(联合包裹服务公司)于1907年在美国成立时是一家信使公司,如今是世界最大的包裹速递公司,也是全球专业运输和物流服务领先提供商。每天,在1,800多个经营点95,000多辆车辆、216架UPS喷气式飞机和296架包机组成的网络支持下,超过425,000名UPS员工管理着面向全球超过215个国家和地区近800万客户的货物、资金及信息流。UPS总部位于乔治亚州亚特兰大市,2009年集团营业收入达453亿美元,自由现金流37亿美元。穆迪给UPS的评级为Aa3,标准普尔评级为AA-。

全球财务架构

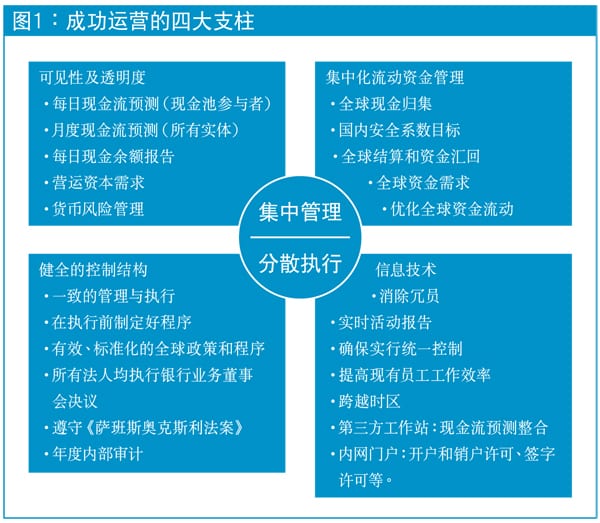

2002年之前,UPS的财务架构从本质上来说反映的是一家开展国际业务的美国公司的组织状况。我们意识到,要想让UPS在全球范围建立起世界级的财务基础架构,我们的观念和策略都需要作出重大转变。尽管建立新的集中化基础架构意味着重大的机构变革,其商业理由却非常充分,而且高管层也全力支持我们的计划。当时,我们有很多合作银行和银行账户,但是现金的可见性却不高,可支配性也较差。大家都清楚地认识到,现金是企业的宝贵资产,财务部通过全球和区域财资管理中心对现金管理进行集中控制,就能更好地保护这种资产,也能更好地利用这种资产来提升股东价值 。

企业财务部现在负责制定整个集团的战略和政策,而执行则分别由位于伦敦、新加坡和迈阿密的区域财资中心负责。通过这种方式实现现金管理集中化,各经营单位不再需要处理流动资金、投资及借款等问题,只需进行日常账户管理、收款以及向供应商付款。

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version