- Yuri Avramenko

- Director, Head of Sales in Russia, CIS, Central & Eastern Europe, Treasury and Trade Solutions, Citi

by Yuri Avramenko, Director, Head of Sales in Russia, CIS, Central and Eastern Europe, Treasury and Trade Solutions, Citi

Central and Eastern Europe (CEE) has experienced huge change over the last two decades, with many countries making a successful transition from state-run, closed economic systems to fast-developing, competitive market economies. As the economic, regulatory, cultural and infrastructural environment continues to improve, an increasing number of multinational corporations are investing in CEE. While corporations in manufacturing-intensive industries, such as the automotive, technology, electronics, pharmaceutical and chemical sectors were amongst the first to do so, companies from sectors such as FMCG are now looking to CEE as a key sales and sourcing location, and as a base for manufacturing and centralised business services. As they do so, they need a reliable banking partner to support them across their target countries and integrate their flows, balances and information within a wider regional or global cash, liquidity and risk management framework.

Resilience and growth

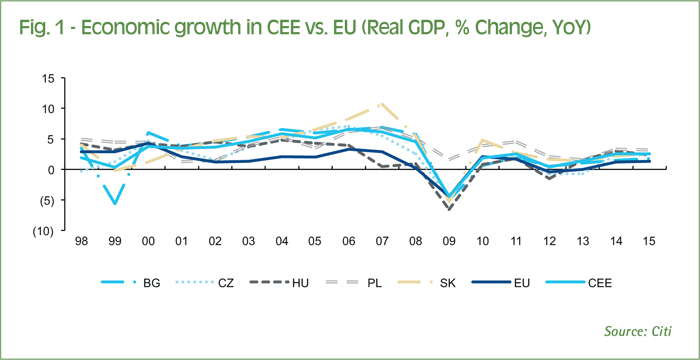

Unlike many economies in Western Europe, CEE recovered quickly from the global financial crisis. Governments in countries such as Poland, Czech Republic, Slovakia, Hungary, Bulgaria and Romania continue to focus on closing the development gap with Western Europe and enhance their competitiveness globally. As a result, a number of key CEE countries have reported strong, steady growth figures over the past five years, particularly the past 12 months (figure 1). This is particularly noteworthy given that this period coincided with a global economic slowdown, geopolitical uncertainty in Russia and Ukraine, and increasing risks in Turkey. This reflects the strong macro-economic fundamentals in the CEE region, and the increasingly favourable business conditions.

Setting firm foundations for growth

In this environment, CEE is becoming an attractive centre for manufacturing, centralised business support functions (such as finance and accounting) and business process outsourcing (BPO) not least due to its favourable time zone and location as a crossroads between Europe, the Middle East, Russia, Turkey and the former Soviet Republics, providing access to around 250 million consumers within 1,000 km. The region is also characterised by a well-educated but relatively low-cost workforce and a business culture that is becoming more closely aligned with international standards. Infrastructure is also improving, with better communications and an increase in well-appointed, low-cost office space.

In Hungary, for example, the shared service centre (SSC) industry is one of the fastest growing and best-performing sectors. The first regional SSC was established in the late 1990s, and around 80 SSCs are now in operation, including those of industry leaders such as Exxon Mobile, British Petrol, Vodafone, IBM, Morgan Stanley, British Telecom, Diageo and Citi, employing more than 30,000 professionals. Czech Republic and Slovakia are also attractive, and many technology companies, such as Dell, HP, IBM, Lenovo, NESS or Siemens have already located their administrative and business support centres for EMEA in Slovakia.[[[PAGE]]]

Amongst emerging destinations, Romania offers considerable potential for future SSC and BPO development. Various studies place Romania among the top destinations in Europe for a wide range of global services. Romania recently ranked 6th in the top 10 emerging outsourcing destinations (source: Outsourcing Business supplement, The Times in association with the National Outsourcing Association (NOA), June 2012). Romania has over 20 million inhabitants and a highly skilled, low-cost workforce. In 2013, the average gross salary was EUR 494, and net EUR 361 with a strong reputation for IT and engineering expertise. Supported by language proficiency and an attractive business environment, a growing number of multinational corporations are investing in Romania, setting up and expanding SSCs, and outsourcing specific activities to local entities.

The regional imperative

Although different countries in CEE offer specific benefits to incoming investors, corporations seeking to establish an SSC in a particular country are leveraging this hub to support their business across CEE and often more widely. These corporations are keen to leverage Citi’s unique expertise and reputation for supporting SSCs globally, with its integrated platforms, harmonised processes and consistent approach to solution and service delivery. Citi has a long-established presence in CEE (figure 2) with clear differentiation in its approach. For example, while most banks take a multi-domestic approach to supporting customers in CEE i.e., on a country by country basis, Citi takes a regional approach to delivering cash, treasury and trade services in CEE. This is apparent in the consistency of the bank’s solutions and services and its service delivery model, with dedicated contacts for customers in CEE across their regional footprint. This is an essential requirement for both emerging and established SSCs to leverage the bank’s regional capabilities as effectively as possible, standardise and optimise processes and information flows and achieve economies of scale.

Reducing complexity, accelerating flows

For example, many corporations have expanded their activities across the region incrementally, either through organic growth or acquisition, resulting in a variety of banking partners and multiple electronic banking channels. This makes it difficult to establish visibility and control over cash, and standardise processes such as payments, collections and cash management. In contrast, Citi provides SSCs in CEE with centralised, tailor-made cash liquidity solutions through a single electronic banking channel, eliminating complexity and supporting efficient, harmonised processes, as illustrated in the CEZ Group and Mondelēz case studies.

Similarly, credit risk and working capital optimisation are often cited as challenges. As corporations globalise, their counterparties may be more diverse and less familiar, leading to difficulties in managing credit risk. In other organisations, the use of different payment and collection methods across countries poses obstacles both to harmonised, centralised processes, and to efficient working capital management. Citi offers a range of custom solutions such as cost-effective short-term financing to cover liquidity gaps, together with trade and working capital solutions that both optimise working capital and reduce risk to commercial counterparties.

As SSCs and treasury centres in CEE have typically been established more recently than those in Western Europe and North America, they are able to leverage digital technology more readily, with fewer legacy technology and integration issues. Consequently, Citi continues to partner these centres to achieve world-class operational and financial efficiency through its investment in tools such as CitiDirect BESM Mobile and Tablet to maximise accessibility of information. In addition, the Treasury Diagnostics capabilities helps SSCs and treasury centres to benchmark their activities, identify and deliver on potential improvements.[[[PAGE]]]

A blueprint for innovative banking in CEE

Citi’s regional approach to supporting customers in CEE has been received enthusiastically by customers. In addition, the bank has received independent accolades in CEE such as Euromoney’s Award for Excellence, 2014 for Best Transaction Services House in CEE. Global Finance also awarded Citi Best Corporate/ Institutional Internet Bank in 2014 for CEE in its regional category awards and internet bank awards. As corporations continue to invest and expand in CEE, with increasingly sophisticated cash and treasury management requirements, Citi is positioned as the bank of choice for these corporations to optimise operational efficiency and control, and manage liquidity and risk through world-class solutions and platforms, both across CEE and beyond.