by Francis De Roeck, Head of SEPA offering, BNP Paribas

The potential to transfer value between counterparties on a near- or real-time basis is now being discussed actively in a number of countries globally, with some faster or instant payment schemes already in place. Looking at instant payments in euro, there are proactive initiatives under way to process payments in seconds on a 24/7 basis, 365 days a year. This is based on the existing SEPA Credit Transfer (SCT) instrument but through a separate scheme, SCTinst.

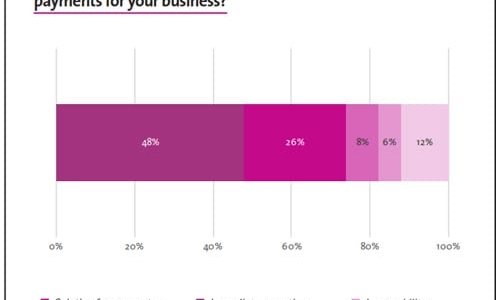

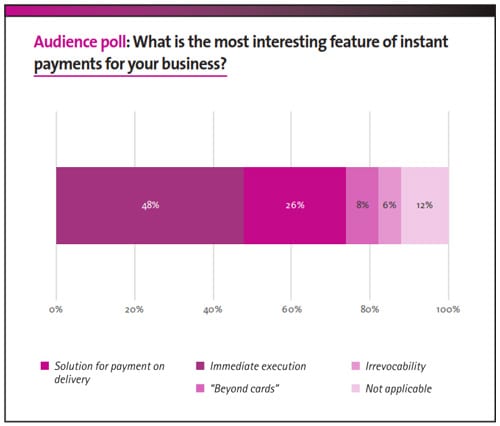

There are a variety of use cases where instant payments offer specific value. For example, while cards are very convenient, they cannot satisfy every requirement: the payment amount may exceed the card limit; the beneficiary may not accept cards, and they are typically not suited to person to person payments. Therefore, in the future, it is likely that cards and instant payments will co-exist, as happens today in countries that have already introduced instant or faster payment schemes. Instant payments also fulfil the need for time critical payments, particularly in industries where cash needs to be available for use very quickly. Instant payments will also offer comparable benefits to SCT such as irrevocability (except in the case of fraud), which is essential for payment on delivery transactions.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version