Environmental, social and governance (ESG) initiatives are now a boardroom priority – and an increasingly important part of the treasurer’s strategic remit. Nevertheless, only a quarter of treasury departments currently have key performance indicators relating to ESG. Helen Kelly, Head of Europe, Barclays Corporate Banking, examines the types of ESG initiatives and targets leading treasury teams are implementing and highlights the critical role of diversity and inclusion within a modern, sustainable treasury function.

“The goal of measurement is to not only do things right; but do the right things – and continuously improve by doing that.” This quote from Pearl Zhu, a digital visionary, corporate innovator and author, encapsulates the essence of key performance indicators (KPIs). These measures are designed to drive an organisation to consistently achieve goals, and strive to ‘do better’, which in many ways is also the aim of ESG initiatives.

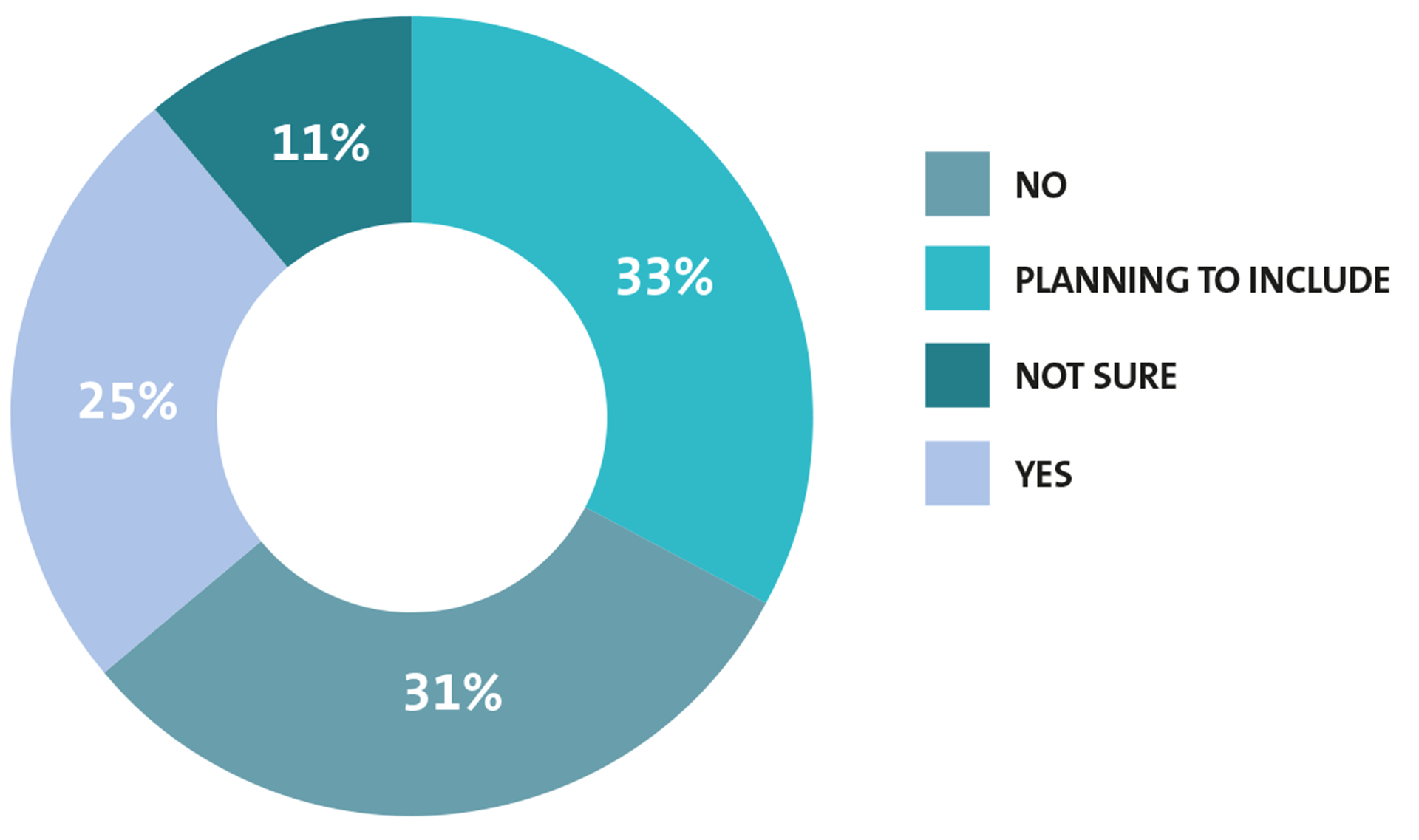

While treasurers are used to setting and achieving KPIs, ranging from forecast accuracy to retrospective hedge effectiveness, ESG-specific KPIs (often called Sustainability Performance Targets or SPTs) are a new concept for many treasury professionals. In fact, according to the recently released TMI and Barclays’ European Corporate Treasury Survey 2021, only 25% of European treasury functions currently have SPTs in place (see fig.1). Of the 225 respondents to the survey, 33% are planning to include ESG measures in their treasury objectives in the near future.

Fig 1: Are sustainability/ESG measures reflected in your organisation’s treasury/finance objectives?

Driving ESG KPIs

To understand how best to implement SPTs within treasury, it is first important to examine the drivers behind the rise of ESG within the department, and the wider organisation. Kelly explains: “Over the past 12 months, ESG has become a true boardroom imperative. Looking back to 2020, ESG was a theme that was lingering on the fringes of the board’s attention – but the Covid-19 pandemic catalysed an intense focus on communities and social challenges, as well as global supply chains, and supplier relationships and values. As such ESG is now front and centre for boards [see fig. 2] and this trend will only accelerate as we head into 2022.”

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version