With the ongoing urgency of the climate crisis and increasing focus on greenwashing, it’s critical that businesses understand the full breadth of their emissions and how they can effectively eliminate and reduce them.

Scope 3 emissions (also commonly referred to as value chain emissions) account for the majority of total emissions in many sectors (and more than 90% in a multitude of global companies, according to Carbon Disclosure Project [CDP] reporting), and are viewed as fundamental to tackle climate change. However, as noted in a recent NatWest ESG webinar, not all Scope 3 emissions are created equal. They can be complex to measure and difficult to compare across sectors.

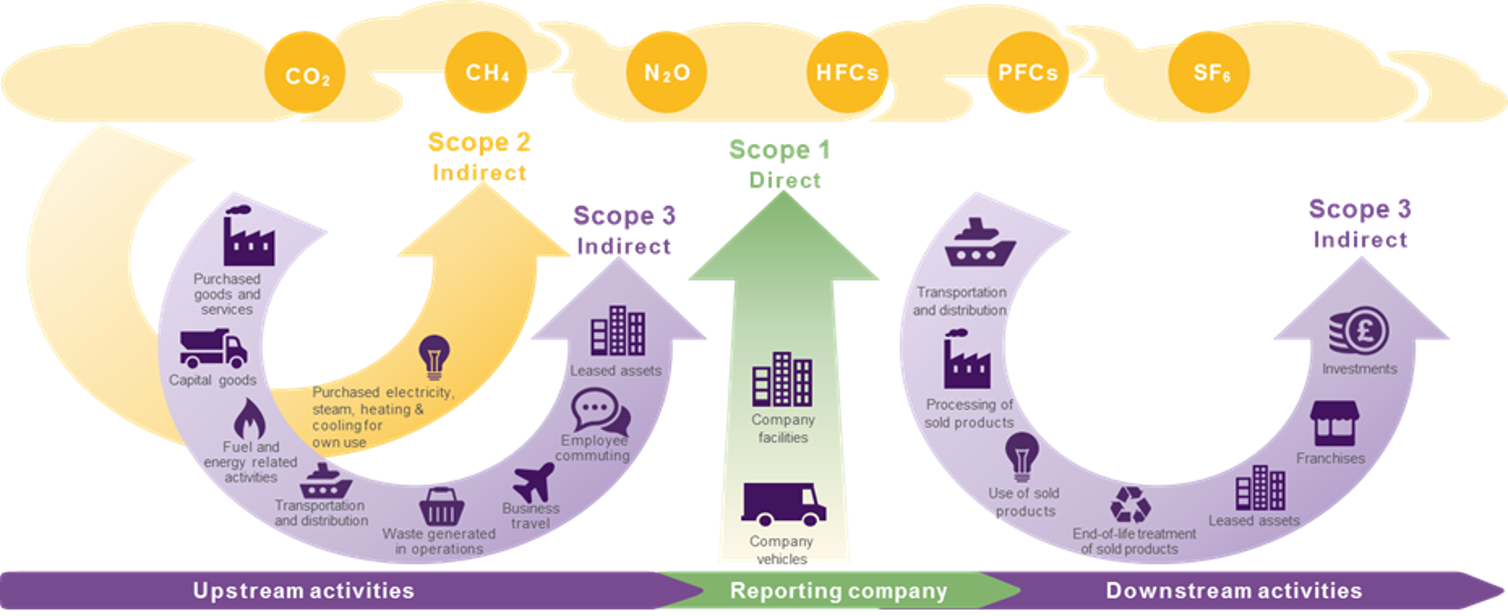

Scope 3 emissions span 15 mutually exclusive indirect greenhouse gas (GHG) emission sub-categories: eight upstream sub-categories related to purchased or acquired goods and services, and seven downstream sub-categories related to sold goods and services [1].

The challenge

Tracking, measuring, and accounting for GHG emissions is still in its infancy compared with financial accounting, and the multifaceted components of Scope 3 make it materially harder to quantify and influence than Scope 1 and 2 emissions.

For many companies, for example in the retail sector, the largest Scope 3 emissions are often in Purchased Goods and Services (category 1) and Use of Sold Products (category 11), which require extensive supplier engagement to tackle collaboratively and innovate existing products (including the increase of respective life cycles). As noted in a previous article in this Carbonomics series [2], institutions such as the CDP are working with large purchasing organisations including Microsoft, Diageo, and Sainsbury’s [3] as part of their supply chain programme to encourage more than 11,000 companies in their respective supply chains to disclose their GHG emissions and improve Scope 3 reporting capabilities [4]. Moreover, companies have begun to work with ESG data providers, ESG assurance providers, and other specialist firms to help companies and investors capture, assess, and verify data through smart technologies such as blockchain or tagging. For example, SAP has developed a programme called Catena-X for the automotive sector to track the carbon footprint of products by enabling companies to share their carbon footprint with partners securely using blockchain [5].

While suppliers work to measure their own Scope 1 and 2 emissions, companies looking to measure their Scope 3 releases are required to make several assumptions about supplier and customer behaviour, often using emission factors where available (i.e., at an industry level).

These companies are approaching the improvement of Scope 3 emission reporting in different ways. We have seen several include Scope 1 and 2 GHG measurement and reduction targets (including encouraging supplier targets verified by the Science-Based Target initiative [SBTi]) and/or a requirement to use renewable energy within their supply chain charters. For example, Cisco requires tier 1 and 2 suppliers to disclose their GHG emissions through CDP and, by way of webinars and other collaborative activities, Moody’s is targeting 60% of their suppliers (by spend purchased goods and services and capital goods) to have their own science-based targets by the end of 2025 [6].

Other companies are tackling targeted and material areas of respective Scope 3 emissions e.g., waste reduction, increase in recovered and recycled products, increase in electric vehicles used (if third party), and increase in sustainable materials purchased (i.e., FSC certified wood). Further examples include supermarkets that are working with WRAP [7] to reduce the level of plastic within their packaging while installing recycling facilities in their stores to increase recycling accessibility for customers.

Industry initiatives

The Greenhouse Gas Protocol provides support for companies seeking to tackle Scope 3 and to develop their reporting [8]. Under the GHG Protocol, companies may set a variety of Scope 3 reduction goals that encompass all Scope 3 categories, individual categories, or a combination of the two in line with approved methods by the SBTi.

As the largest companies lead the way in working with their suppliers to tackle Scope 3, we will continue to see top-down pressure for SBTi-aligned GHG reduction targets and improved ESG reporting capabilities. So far in 2022, 1,198 companies have either set or committed to set a SBTi-aligned target, exceeding the 1,183 companies that did so between 2017 – 2020 and bringing the yearly average to date to 200 pledges per month. This will be further reinforced by investors, with 24% of respondents to our RBS International survey (125 key influencers on decisions relating to investment strategy in alternative investment funds) noting that investor pressure is the most significant driver of their own science-based target adoption.

There are also several initiatives from non-governmental organisations aiming to develop a global baseline of sustainability disclosure. The International Sustainability Standards Board (ISSB), for example, requires Scope 3 reporting in its latest Climate Standard draft. The Task Force on Climate-related Financial Disclosures (TCFD) recommends Scope 3 reporting where appropriate [9]. To aid strategic alignment, the SBTi approached its newly published cross-sector pathway Corporate Framework holistically, outlining: i) the requirement for both near- and long-term science-based targets to reduce value chain emissions; ii) view to mitigate emissions beyond their value chain during the transition phase; and iii) neutralise residual emissions.

Disclosure

Despite Scope 3 reporting being further advanced in Europe compared with the US and APAC, there are still many companies in Europe disclosing minimal information about their Scope 3 emissions, requiring international policy objectives to push the level of transparency within GHG reporting.

The policy shift towards greater Scope 3 transparency is illustrated by the European Commission’s recent adoption of the Corporate Sustainability Reporting Directive (CSRD) [10], which aims to expand the existing Non-Financial Reporting Directive (NFRD) to include Scope 3 where relevant and apply to all large and listed European Union (EU) companies [11] to support the EU’s ambition to be the first climate-neutral continent.

On the other side of the pond, the US Securities and Exchange Commission (SEC) recently announced the requirement for US public companies to disclose Scope 3 emissions and intensity if material to their business and/or have Scope 3 in their existing GHG emission reduction targets. Investors and lenders will continue to include greater ESG considerations in their financing processes with the Sustainable Finance Disclosure Regulation (SFDR) outlining the obligations for EU manufacturers of financial products and financial advisers towards end-investors [12]. The Financial Conduct Authority (FCA) has also voiced its support of the UK government’s consideration to bringing ESG data within their regulatory perimeter [13] to increase standardisation and prevent greenwashing.

Scope 3 target setting

The different types of Scope 3 targets seen in sustainable finance are:

- Absolute targets

- Intensity targets (e.g., percentage of revenue or profit)

- Supplier engagement targets (e.g., number of suppliers that have Scopes 1 and 2 SBTi-aligned targets)

- Other KPIs that address emissions through targeting areas of material impact for the relevant industry or company (e.g., waste reduction)

Absolute targets provide the greatest transparency and commitment to directly reduce emissions and therefore are often the most challenging to set. Where companies are unable to target all Scope 3 emissions, there is growing trend to implement targets for accurately reportable Scope 3 categories with the view to incorporate all relevant categories when possible. This is also driven by the SBTi’s recommendation for a Scope 3 target if it accounts for 40% or more of total GHG emissions (with the target covering at least two-thirds of total Scope 3 emissions) [14], and the International Capital Market Association (ICMA) and Loan Market Association’s (LMA) requirements for KPIs to be material and targets ambitious. It is therefore important that the parameters of a Scope 3 KPI included in sustainability-linked financing are clearly reported to prevent inadvertently misleading stakeholders.

Value chain data availability and accuracy of Scope 3 reporting present significant challenges for corporate issuers and borrowers looking to include Scope 3 in their sustainability-linked financing. The multifaceted components of Scope 3, many of which require extensive collaboration with third parties to address, often mean that companies are more cautious of including a Scope 3 KPI in their financing. Subject to data availability, Scope 3 can be based on several assumptions and approximations. And, both ICMA and LMA require third-party verification of annual KPI performance.

This was reflected by a short survey of NatWest’s ESG stakeholder panel webinar participants, where 30% said that they have already defined and publicly disclosed their Scope 3 targets, 40% said that they are currently developing their Scope 3 target, and another 27% admitted that they haven’t yet started to define a target. For companies that are still developing their Scope 3 capabilities and targets, it is important to explain why those targets haven’t been set to date and what plans are in place to report and reduce Scope 3 emissions in the future; pressure on those that are slow to act will only rise.

Future value chain developments

The increased focus on Scope 3 emissions has highlighted how other ESG topics within sustainability strategies are interlinked and cannot be tackled individually, requiring extensive sector and supply chain partnerships.

With companies seeking to demonstrate a holistic approach to ESG, there is a growing interest in social KPIs in sustainable finance, and we expect that there will be further focus on companies to take ownership of the social impact of their value chain.

Simultaneously, with COP26’s focus on a Just Transition and continued development of social reporting initiatives (e.g., the EU’s Social Taxonomy), companies are looking into what role they play within this space. Companies will need to consider the interrelated nature of social and environmental issues, working with suppliers to improve their overall ESG credentials while collaborating on solutions to reduce their respective GHG emissions. This will ensure companies remain ahead of the curve in the ever-evolving ESG market.

Follow NatWest’s Carbonomics 101 series to stay informed on the development of the carbon markets and learn about the role they could play in your sustainability strategy. To access the full Carbonomics 101 series you can visit the bank’s Carbon Hub, where they also include essential tools and insights to help you on your climate transition journey.