Ports are a vital part of the global economy – so when one of the biggest in the world is striving to counter climate change, its actions should be watched closely. TMI spoke to Tim de Knegt, Port of Rotterdam Manager Strategic Finance & Treasury, to find out how the financing of his epic sustainable projects is progressing.

With UN figures suggesting that more than 90% of all trade is carried by sea, the importance of maritime transport is beyond dispute. Of course, ships need ports, and Port of Rotterdam is the largest in Europe, and one of the busiest in the world. Spread across 127 sq km, it is used by bulk carriers, container ships, ferry services and cruise liners. It’s also home to a broad range of manufacturing and (petro-) chemical businesses and storage facilities.

Given the necessary dominance in this environment of ‘grey’ assets – those that are constructed as opposed to natural – it’s understandable that Port of Rotterdam, as a forward-looking organisation, is seeking to balance the port’s activities with the ‘green’ goals countering climate change.

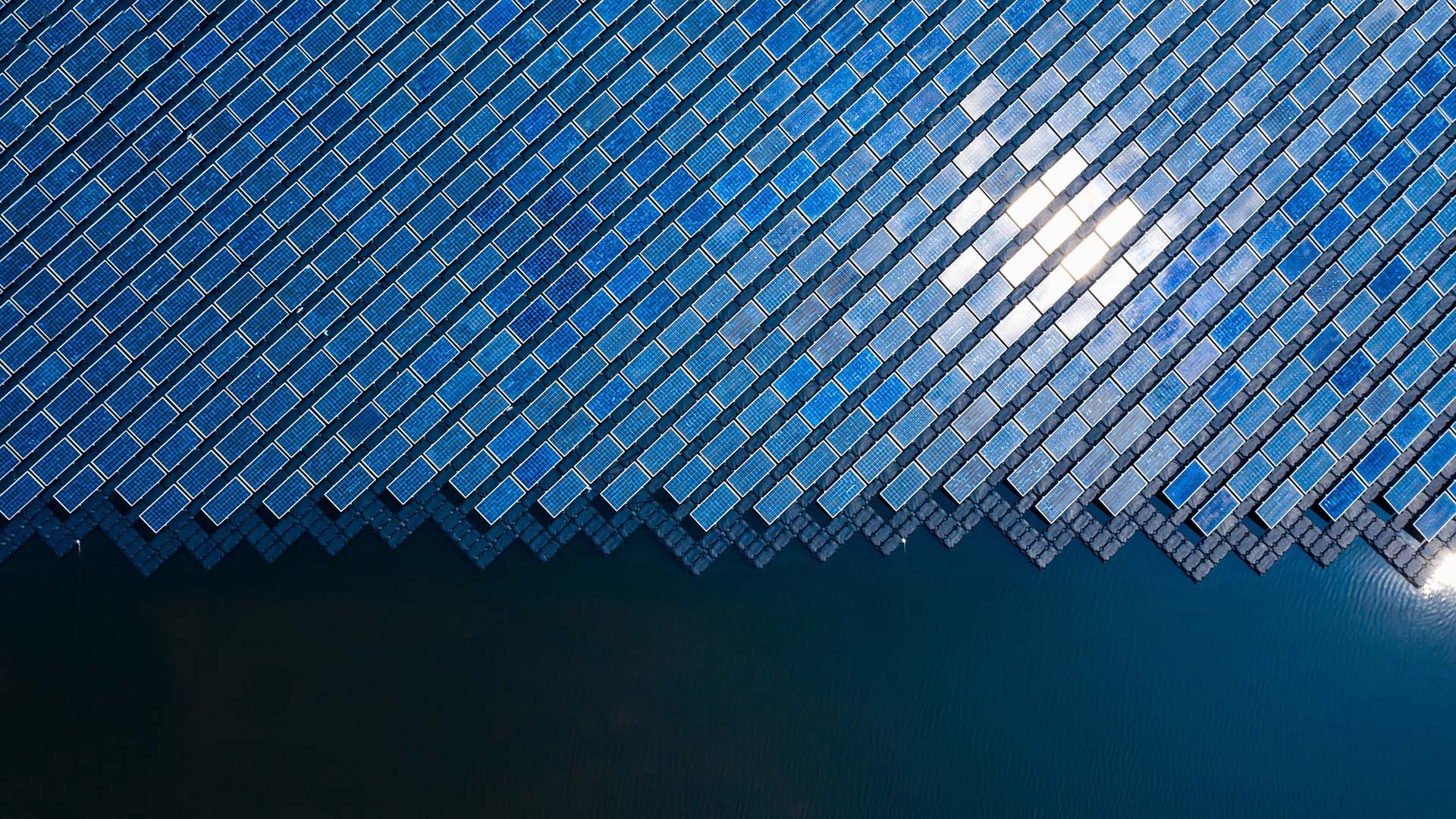

A large part of this plan centres on energy transition (see fig.1) This will see the Port increasingly using natural resources such as sunlight and wind power, replacing old lighting with LEDs, using hybrid patrol vehicles, reusing residual heat in dockland machinery, and perhaps most intriguing of all, plans to locally capture and store CO₂ in empty North Sea gas fields. This is good for the environment, but it costs money.

With sustainable finance making bigger waves these days, one of the driving forces behind these green objectives is Port of Rotterdam Treasurer Tim de Knegt. Having engaged with financiers on green funding for some time, he notes distinct financial pathways opening up, but issues arise for all.

The corporate strand covers traditional finance products such as bonds and linked loans. Port of Rotterdam finalised a green revolving credit facility (RCF) in early 2019, arranged a Schuldschein transaction (the German private placement market) at the end of 2018, with plans for the next capital market transaction to be fully green, and it is looking at other green capital market issuances.

This has been easy enough to come by, given the Port’s credit rating, but to de Knegt, these types of instruments just scratch the surface of what is, or should be, possible with sustainable finance solutions. So far, funding has been aimed at specific and very visible but relatively small-scale activities or the refinancing of historical investments.

But, he says, where it really gets “interesting” is financing the vast ambition of the Port’s energy transition goal on a project-by-project basis. And by ‘interesting’ he means complex and, at times, quite frustrating. The question is how financing can move beyond the simple corporate strand, and start stimulating and bringing focus to new investments through a linked project finance strand.

New thinking needed

Port of Rotterdam is in the process of several final investment decisions (FIDs), as per the CCS (Carbon Capture and Storage) project, referred to above. Dubbed ‘Porthos’ (Port of Rotterdam CO₂ transport hub and offshore storage), this is a collaboration between the Port, Gasunie and EBN. It is the partners’ €500m response to the Netherlands’ climate objective to reduce the emission of greenhouse gases by 49% in 2030 and by 95% in 2050, compared with 1990.

Porthos is an elaborate programme that will see the port-based locations of participating companies – Air Liquide, Air Products, ExxonMobil and Shell – capture CO₂ that is released during their production processes. This will be sent to a collective pipeline that will run through the Rotterdam port area before heading out for storage in the North Sea seabed. Over a 15-year term, some 2.5 megatonnes of CO₂ will be stored per year.

“The way that we need to structure support projects to get the most environmental benefit is not necessarily the structure needed to get it non-recourse financed,” explains de Knegt. What is required to attract debt funding of the size needed for projects such as Porthos is for all risks to be mitigated at financial close. This is a problem. “We’ve found it very difficult to maintain the agility and project speed needed to make the most environmental impact, while at the same time getting it financed through traditional routes.”

Energy transition projects inherently contain three core risk elements: technology risk, market risk, and regulatory risk. “These three don’t sit well with non-recourse finance,” notes de Knegt. “That’s where the challenge is for me. I can do everything on a balance sheet basis, but if I do that, at some point the transition process will slow down due to capital restrictions.” And without maintaining momentum, projects and thus the transition process will stall.

Knowing more or less when or what triggers mitigation of risks, de Knegt is trying to find ways of recycling Port of Rotterdam’s capital. He is currently looking to start out on a balance sheet basis, financing all-equity up front, but then as soon the risks have been mitigated, refinancing to allow some of the equity to be released to be able to kick-start the next projects.

“If we’re not able to unlock external funding upfront, we’ll have to unlock it during the process,” he states. There is hope of getting to a point soon where treasury can have the financing agreement, or at least have agreements that trigger availability of funding, so that once the risk mitigation triggers are hit, the capital is released. “It’s not the case yet.”

Other than that, he has seen no current financing arrangements that benefit energy transition, “for instance where payments are determined by the price for Emissions Trading System [ETS] certificates, like inflation-linked instruments”.

Dealing with the disconnects

Having had numerous discussions with various banks, Invest-NL (a Dutch public-private institution for providing energy transition finance), and ministerial-level consultations with the Dutch Government, the thinking is that while there are no debt instruments available for the energy transition risk profile, the importance of knowledgeable and financially strong consortia becomes ever clearer.

On the regulatory side, there remains a disconnect between policy and instruments, notes de Knegt. As an example, the EU Renewable Energy Directive provides incentive for increased value to renewable products, ensuring a minimum market volume and supporting investment. Countering this is a proposal to ensure renewable and non-renewable products cannot be sold separately, removing the product’s value and the ‘investability’ of its renewable production process.

“The policy arm seems to destroy the value of the investment proposals where capital is being made available. The misalignment is quite frustrating,” he comments, adding that the ability to finance sustainable projects, and the right policies to promote it, need to coincide on a local, provincial, national and even EU level.

Until there is joined-up thinking, financing on a project level remains “quite difficult”. What de Knegt is trying to do in the interim is move towards a balance between simple corporate lending, portfolio lending, and project lending. “We want to see how these interact, so that we can progress without being held back by either the risk appetite of the financier, or the policies that are being made by government.”

There is a further issue with which Port of Rotterdam must contend. It is trying to build infrastructure (pipelines, roads, railways et al) that will support it for the next 50 years, with the expectation that these constructions will not reach peak usage for at least the next 25 years. De Knegt says investors often balk at such long-term views. Indeed, a similar effect is seen in sustainable finance where the real benefit will be seen in the long term. For this reason, he feels that green finance today is “mainly marketing-driven”. Greenwash, it seems is still alive and well.

Alignment and balance

Indeed, some companies are sending out the wrong signal about what sustainable finance is, believes de Knegt. Reports of large corporate buyers being granted sustainable loans based on improving their supply chains’ environmental impact are welcome. But when a business does little more than impose tighter ESG-based restrictions on its small suppliers, while enjoying all the benefits of the loan (not least its huge marketing value), it is at best unhelpful.

It happens on the investor side too, with de Knegt citing numerous conversations revealing little or no practical in-house sustainability effort or interest on the part of the investor. “They’re only interested in our credit rating,” he says, adding that a business such as Port of Rotterdam can find the money anywhere. “What I’m trying to do now is find partners that are aligned with us from a holistic perspective.” The trouble here, he feels, is that too many investors and potential corporate partners are still aligned “in words, not deeds”.

Of course, it is easy, when considering the energy transition plans of an industrial location such as Port of Rotterdam, to question what ‘green’ really means at all. Certainly, in some cases it might mean ‘emission-free’. But being green in a grey, heavily industrialised world could also be defined by using the best available technology to begin reducing emissions.

De Knegt knows he must balance available funding between projects of varying shades of green – not just pick the obvious ‘shop-window’ candidates – if he is to speed up the transition process. This is where his ‘holistic’ approach comes into play (see fig.2).

Rather than seeking funding across several different and sometimes competing areas, it is necessary to see the full range of activities as an integrated whole, he explains. In his view, being green means having a comprehensive strategy, covering all activities. “It enables us to show investors what our end goal is, and the path that we’re taking. Yes, it can be the basis of issuing a green bond or whatever, but what it really allows us to do is take full responsibility for what we are trying to achieve.”

Although financiers can see and understand the holistic energy-transition model de Knegt has constructed, he says many still focus on the three core risks of certain projects – technology risk, market risk, and regulatory risk – offering finance only once these risks have been mitigated.

But the money is needed now to get specific projects to a stage where they are stable from a risk perspective. It’s a Catch-22 that takes time to overcome. “Wind turbine finance for at least a decade was all-equity financing. We’re slowly getting to the stage where traditional project finance can be used, now that financiers perceive the markets to have stabilised, and now it can speed up,” he explains. Do we have that kind of time for all the other projects to catch up?

From his position within Port of Rotterdam, and the broad view across the supply chain that this offers, de Knegt clearly has a different perspective on green finance. And his big plans remain undiminished by the current frustrations. In general, he is positive about the use of green instruments and will be using them more often, initially as a marketing instrument, “but I’m hoping we can begin moving from these corporate instruments, to portfolio instruments, and finally to project instruments”. It’s an example of realism that we can all follow.