Independent treasury consultant Bas Rebel picks his way through the ‘minefield’ of fiscal and regulatory reforms surrounding cash pooling and examines the advantages and challenges to prove the overall benefit case of this method of liquidity management is still strong.

Cash pooling is in the crosshairs of regulators and tax authorities. This scrutiny increases the cost and complexity of compliance and maintenance – and may even make cash pooling unattainable for some organisations. But in the current economic climate, when many organisations are looking for liquidity and exploring areas where costs can be cut, let us not forget cash pooling’s raison d’être: efficient liquidity management. With that in mind, the business case remains worthwhile pursuing.

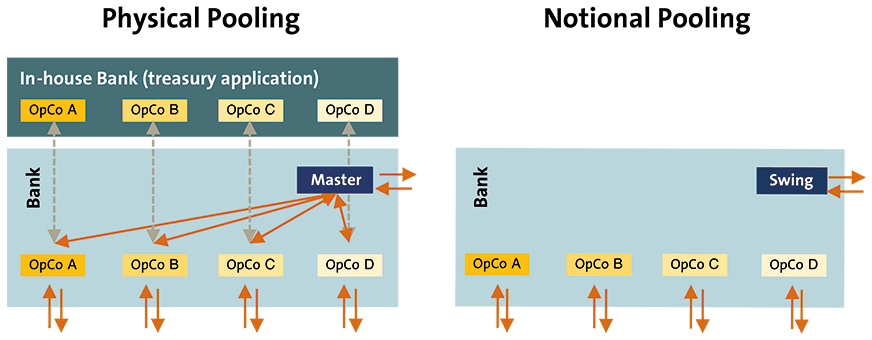

Physical versus notional pooling

There are two types of cash pooling solutions physical and notional (see fig. 1). All pooling products offered by banks, including target balancing, Nordic, cross-border, cross-currency and cross-bank pooling, are variations of either or a combination of both. Virtual bank accounts – the latest pooling innovation – can be regarded as a hybrid of physical and notional pooling.

Fig 1: Two main types of cash pooling

Source: Bas Rebel

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version