Exclusive insight for TMI subscribers! Northern Trust Asset Management share a monthly market commentary for treasurers.

Eurozone Market Update

The European Central Bank’s (ECB) Governing Council maintained their three key interest rates for the third successive month, as widely anticipated by the markets. The tone of the discussion became slightly dovish and more favourable to medium-term cuts (in the summer at the earliest), as suggested by President Christine Lagarde’s statements during the month. The council outlined that “the declining trend in underlying inflation has continued”, while the reference to “domestic price pressures remain strong” was removed. The statement also highlighted “tight financing conditions are dampening demand, and this is helping to push down inflation”. The future course of policy remains data-dependent, and the statement continued to stress that policy rates will be maintained at current levels for a sufficiently long time to substantially contribute to the ECB’s inflation goal. These comments moved market expectations of a first cut to April, from March, with a 90% chance of an April cut priced in. We think this is still too early and that June is more likely.

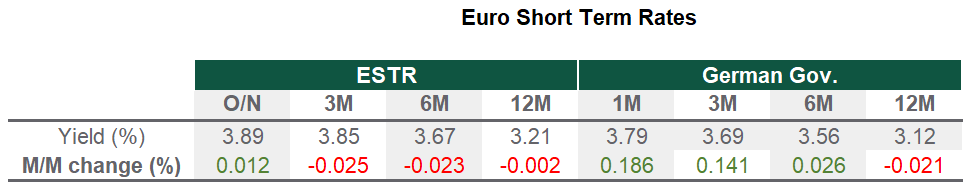

Source: Bloomberg, data as of 31 January 2024

UK Market Update

As expected, the Bank of England’s (BoE) Monetary Policy Committee left the bank rate unchanged at 5.25%, but the voting split surprised markets. Two committee members preferred a 25 basis point rate increase while one member favoured a 25 basis point rate cut, with six voting to keep the rate unchanged. The updated economic forecasts indicated that risks to the committee’s inflation forecast are now more balanced, although key indicators of inflation persistence remain elevated. Governor Andrew Bailey reiterated that the committee needs to become more confident in the persistent fall of inflation. Indeed, December’s annual inflation data surprised to the upside for both headline (4% from 3.9%) and core inflation (unchanged at 5.1%), reminding markets that the road to 2% remains bumpy. Bailey stated the BoE has moved from asking “How restrictive do we need to be?” to “How long do we need to be restrictive for?”.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version