Exclusive insight for TMI subscribers! Northern Trust Asset Management share a monthly market commentary for treasurers.

Eurozone Market Update

As widely expected, the ECB kept its key interest rates unchanged in December, maintaining the deposit facility rate at 4%. The accompanying press release acknowledged the recent fall in inflation, replacing previous commentary on inflation being “too high for too long”. The statement also noted “domestic price pressures remain elevated, primarily owing to strong growth in unit labour costs,” reflecting that wage inflation has the ECB’s attention. One hawkish surprise was a change to the ECB’s pandemic emergency purchase program (PEPP), with reductions to the PEPP portfolio of €7.5 billion per month on average, starting in the second half of 2024. There were no changes to the plan to discontinue reinvestments at the end of 2024. New ECB staff economic forecasts indicated a slower path for growth in 2023 and 2024 and suggested that the risk to growth remains on the downside.

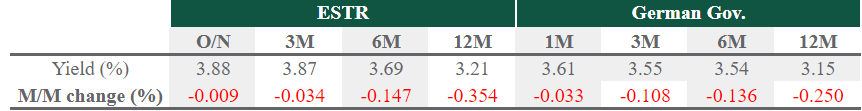

Source: Bloomberg, data as of 29 December 2023

UK Market Update

In December, the BoE kept the bank rate at 5.25%, but the split in Monetary Policy Committee (MPC) voting highlighted the Committee’s more hawkish skew relative to other central banks. While six of the nine members supported a continued pause, three voted for an increase of 25 basis points (bps). The MPC reiterated that while consumer price inflation has fallen as expected and private sector wage growth surprised on the downside, critical indicators of persistent UK inflation remained elevated. The Committee also reminded market participants that “relative to developments in the United States and the euro area, measures of wage inflation were considerably higher in the United Kingdom and services price inflation had fallen back by less so far.” They noted that monetary policy is likely to remain restrictive for an extended period and may even have to become more restrictive if there is evidence of more persistent inflationary pressures.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version