Exclusive insight for TMI subscribers! Northern Trust Asset Management share a monthly market commentary for treasurers.

Eurozone Market Update

In September, the ECB delivered its tenth consecutive rate hike since 2022, raising its key interest rates by 25 bps and taking the deposit facility rate to 4%. Markets interpreted this as the bank having reached the summit of its rate hikes cycle, at least for now, as supplementary ECB commentary stated that policy rates are now set at a sufficiently restrictive level. Updated ECB projections for average headline inflation showed an upward revision in 2023 (5.6%) and 2024 (3.2%), mainly to reflect higher energy prices, but revised down the 2025 number to 2.1%. We think this leaves the door open for further rate hikes if inflation reaccelerates. Last month, headline eurozone inflation dropped from 5.2% to 4.3% (see Chart of the Month), while core inflation also fell (from 5.3% to 4.5%). Quarterly GDP (0.1%) missed expectations, reflecting Europe’s stagnating economic activity. This led the ECB to revise down their growth projections to 0.7% in 2023, 1.0% in 2024 and 1.5% in 2025.

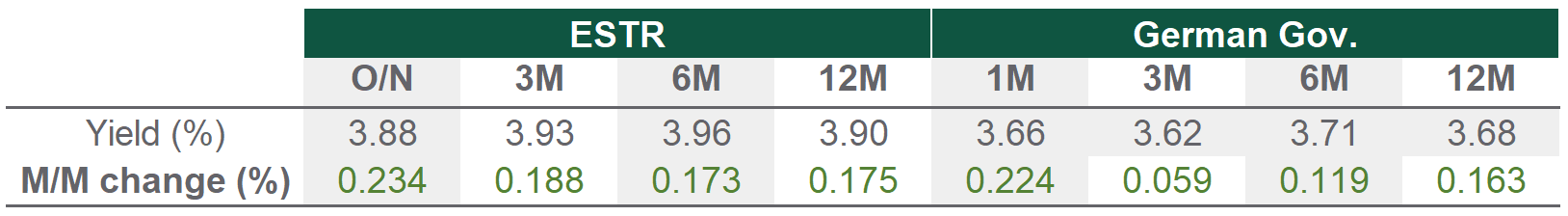

Euro Short Term Rates

Source: Bloomberg, data as of 29 September 2023

UK Market Update

Following fourteen successive rate hikes, September saw the BoE’s Monetary Policy Committee (MPC) vote 5-4 to pause its hiking cycle, with Governor Andrew Bailey casting the deciding vote. Therefore, the bank rate remained unchanged at 5.25%. The day before the vote, UK annual inflation data came in well below market expectations, with headline inflation printing at 6.7% versus 7.0% expected, and core inflation printing at 6.2% versus 6.8% expected. This provided a clear signal to the BoE that they should indeed follow the alternative path of having a lower peak rate for a prolonged period, as opposed to a sharp move up in rates followed by a similarly swift cut. The BoE kept its forward guidance unchanged, repeating that “further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures.” The MPC’s updated projections highlighted further signs of loosening in the labour market. At the same time, inflation should return to the 2% target by Q2 2025, though this is far from a given.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version