If you’ve not yet heard about financed emissions, get ready to do your homework. They are about to become a key part of banks’ lending decisions and could potentially put pressure on corporate access to capital. Michelle Horsfield, Executive Director, SMBC Group, explains the basics.

Financed emissions is a metric that apportions emissions to a financial actor based on the amount of lending. It is set to become a key metric used by FIs to track their own progress towards climate-safe lending and will be part of future lending decisions.

The idea blossomed at COP26 in November 2021 with the creation of the Glasgow Financial Alliance for Net Zero (GFANZ) commitment to accelerate the decarbonisation of the economy. Like other sectors of the economy, FIs want to fulfil their strategic climate commitments and reduce their climate risk, and are looking again at the way in which they lend money to businesses. The ultimate aim is to produce a measure of progress for the financial industry as it seeks to align with the 2015 Paris Agreement goal to keep global warming below 1.5°C by delivering net-zero emissions by 2050.

Financed emissions will soon become more than just a reference in the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations once the EU’s Corporate Sustainability Reporting Directive (CSRD) becomes applicable in 2024. It’s the only way that exists at the moment for FIs to demonstrate how they help to decrease greenhouse gas (GHG) emissions.

Even for jurisdictions without a regulatory driver, like many sustainability elements this, too, could be executed on a voluntary basis by FIs keen to demonstrate their progress.

The industry is only just working out how to apply the recommendations and so there is still plenty of scope for change as the industry seeks to remove any unintended consequences. As Horsfield comments, “it’s not perfect, but it’s all we’ve got as a way for FIs to see where they are”. There will be much discussion before the regulators take action, but it’s vital now that corporate treasurers begin understanding how these metrics may work because at some point the way they secure funding could shift.

A straw poll at the recent Association of Corporate Treasurers (ACT) Annual Conference in Newport, Wales, revealed the level of awareness of financed emissions as almost non-existent among corporate treasury professionals. This needs to be addressed before it becomes an access-to-capital issue for companies.

Adding up

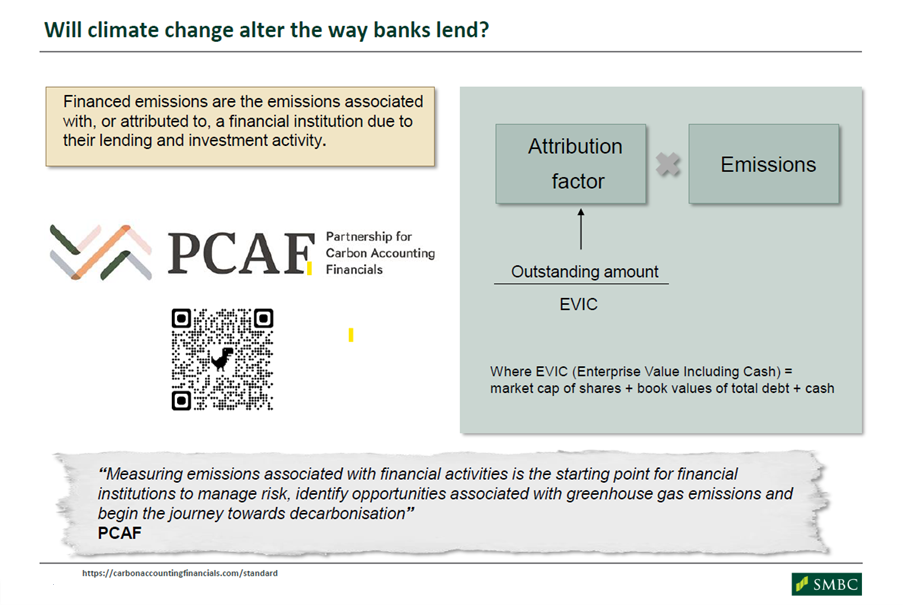

There are a number of ways to calculate financed emissions metrics, the most prominent of which is offered by the Partnership for Carbon Accounting Financials (PCAF). This methodology is referenced in TCFD recommendations, which makes it the de facto standard in the UK at least. It is already being used by a number of banks, with SMBC having produced its first baseline results in 2022.

In essence, PCAF calculations (as shown in Chart 1) are the sum of emissions multiplied by how much the lender contributed to the capital structure of the emitting company or asset. The figures are thus arrived at by multiplying a company’s GHG emissions by an attribution factor. While banks can have some methodological variations, generally this factor comprises the drawn amount of a facility, divided by equity value including cash (EVIC) which is the sum of market cap of shares, plus book values of total debt, plus cash.

Chart 1:

While EVIC may eschew how the rest of the financial markets work because cash is included, the PCAF rationale is that it avoids the possibility of some companies being ascribed negative emissions, which would be impossible.

It’s worth pointing out here that the process is carried out by the FI, not the corporate. The treasurer is not being asked to find the data and run these calculations. The FIs are using this information to steer their future lending.

By producing metrics across their portfolio of corporate clients, each FI will be able to see where its greatest exposures and opportunities are, and how it will make its contribution to addressing climate change. And to put that into context, SMBC Group, like most majors, has committed, via the Net-Zero Banking Alliance (NZBA), to a reduction in its financed emissions in the power and energy sectors by 2030, states Horsfield.

As part of their calculations, many FIs are using public data sources such as CDP or Bloomberg, along with company reports. The results are increasingly used as another lens through which to evaluate a company’s credit application, says Horsfield. While FIs are applying this only to loans at the moment, capital markets instruments such as bonds will be covered (under the guise of facilitated emissions) once final guidelines are published. This is currently set for Q3 2023. Other funding sources such as trade finance are yet to be considered.

Not perfect

For Horsfield, the major concern with the process as it currently exists, is that the figures represent only a snapshot in time of a company’s activities. It takes one particular date for the value of a business, its emissions over a 12-month period prior to that date, and how much it has drawn down from a facility during that time. Clearly, these attributes can change over time.

For those banks that are signatories to the NZBA, part of the commitment is that they are required to set targets by sector, with at least nine being tackled in the first three years.

SMBC is already working on power, oil and gas, automotive, and steel as its initial objectives for financed emissions reductions by 2030.

However, there may be a temptation for some banks making lending decisions to see the results as a ‘once-and-for-all’ metric, and not take into account a host of plausible variables within the constituents of the calculation.

If a client that happens to be a relatively low emitter of GHG but, against the grain, draws down a large proportion of its facility during the measured period, the results will be skewed, and it appears on paper to be a major problem for the lender. The bank could shift its views on how to finance that company. For this reason, Horsfield is adamant that financed emissions metrics “must be used in conjunction with an assessment of a client’s transition plan”.

The impact of financed emissions also generates a serious point of consideration for treasurers concerning their banking groups. On the back of its financed emissions metrics, Horsfield cites one multinational commodity trading and mining company seeking re-financing as having already been compelled by a raft of its existing funding partners to look elsewhere.

The issue for the corporate was not that it would have necessarily seen any additional cost on its capital, but that its banking group was forcibly changed. Normally, where there is good rapport between a treasury and its banking group, when problems arise (such as the financial consequences of the pandemic) those relationships can prove a valuable lifeline. If treasury has been involuntarily shifted away from its banking group towards new relationships, that goodwill will need to be re-established. It may even be the case that some prospective new banking partners may not wish to be associated with a business that will impact its publicly reported emissions metrics, further reducing treasury’s options (and perhaps then increasing costs).

Fair judgment

A wider potential problem is that without a single standard to control financed emissions calculation and application, each bank could choose to use different methodologies. “Treasury teams will therefore need to ask each of their banks which methodology is being used – for example, PCAF – and which data sources are being used in their overall evaluation of the client as a borrower,” advises Horsfield. “They need to be comfortable with that model because some emissions figures are determined by estimation, or are based on a proxy such as sales volumes, which might not accurately or fairly reflect their own situation.”

To bring sense to proceedings, Horsfield suggests treasurers should be making a point of understanding one methodology, say PCAF, and then using that as their benchmark. They can then go to their banks, pose questions, raise concerns, and provide responses from a position of knowledge.

It’s possible that from a panel of 20 banks, 10 could be using PCAF and the other 10 using a range of different methodologies. Once the methodology used by each bank in your group is known, it will be necessary to discover how its outcomes will change the lending relationship.

At the discovery stage, a company could present its bank with what it foresees as its likely future emissions, and how much it might draw down from its facilities over a certain period, but in the real world Horsfield suspects most treasurers will not know the answers. “But by having an understanding of the process, a ballpark view, or an idea of the direction of travel, of company figures, a treasurer will be able to give banks a heads-up and, in doing so, make a meaningful contribution to their own company’s decarbonisation plans. In having this knowledge, it may also make the company a more attractive prospect to lend to.”

With the onus on banks to show progress, some may simply elect to cease lending to the highest-emitting clients, but Horsfield believes it is more likely that the financed emissions metrics will be read alongside client transition plans when making a judgment. This suggests that companies without a credible, science-based plan could be adversely viewed. Their banks may decide to keep them based on the strength of the banking relationship, taking the hit on their financed emissions metrics in the short term, but for others it could indeed signal the end of the relationship as banks pull the sole lever for change that is fully under their control – their committed exposure to the client.

Time for action

It’s clear that for the FI community and its stakeholders, financed emissions remains a matter of deep discussion. As Horsfield says, “at face value it all seems very straightforward, but my concern is that, as this is a nascent concept, we haven’t yet thought through all the unintended consequences”.

For treasurers, it should now be a matter of thinking what a bank could do with financed emissions metrics, and what information could be offered to help the banks make the most appropriate decisions. The only way this will happen is if treasurers engage now. For Horsfield, this starts by “gaining a good handle on the emissions that they currently measure and disclose, and forming an idea of their trajectory”.

The two key functions of the organisation that treasury will need to collaborate with to build the most effective understanding are, she suggests, the team responsible for sustainability, and those with a strategic input, such Business Development, to give direction on corporate strategy. It may also be beneficial to connect with the Communications team, as the process concerns disclosure and reporting to stakeholders, regardless of where the business is on its journey.

“For their own benefit though, the next big step for treasurers is to become familiar with the PCAF methodology, read it, work out where its limitations are, and then get into early dialogue with your banks, because they, too, are still trying to get their arms around it.”

Heading up ESG Advisory in EMEA, Michelle Horsfield supports SMBC corporate clients on all aspects of sustainability, building on her earlier career in industry as a Chartered Environmentalist.