Exclusive insight for TMI subscribers! Northern Trust Asset Management share a monthly market commentary for treasurers.

Eurozone Market Update

With no ECB monetary policy meeting in August, investors’ focus turned to the euro area’s key economic data releases. Second quarter GDP grew 0.3%, beating expectations of 0.2%. August’s unemployment rate of 6.4% came in 0.1% lower than expected. Crucially, the euro area composite Purchasing Managers Index (PMI) of 47.0 fell well below expectations of 48.5 (see Chart of the Month). The services PMI fell particularly sharply to 48.3 versus expectations of 50.5. German PMI came in 3.6 below market expectations. Expectations for euro inflation over the next 12 months soften to 3.4% for June, according to the monthly ECB survey, compared to May’s 3.9% forecast. Markets are split over a 10th successive interest rate hike at September’s ECB meeting.

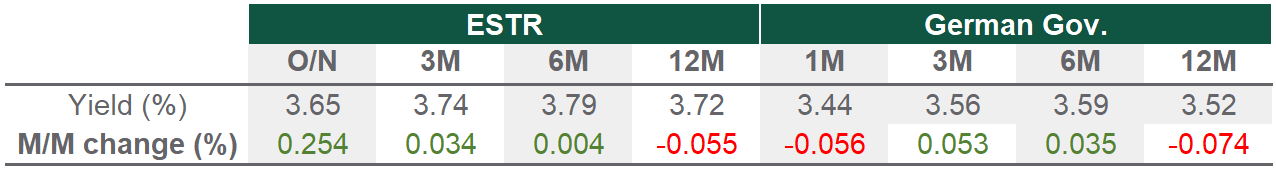

Euro Short Term Rates

Source: Bloomberg, data as of 31 August 2023

UK Market Update

The BoE increased the bank rate by 25 bps to 5.25%. The bank included new guidance that it “will ensure that the bank rate is sufficiently restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium-term.” Governor Andrew Bailey stated there are different paths available to reach the inflation target, which suggests to us that options include a higher peak rate and faster cuts or a lower peak rate for a prolonged period. Updated BoE projections estimate inflation will return to 2% by mid-2025. Higher rates appear to be slowing the economy, as the PMI composite of 47.9 missed expectations of 50.4. However, we think the continued wage surge of 8.2% has kept inflation elevated. Inflation of 6.8% was down but still higher than anticipated, while core inflation, which excludes more volatile food and energy prices, was higher at 6.9%.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version