Exclusive insight for TMI subscribers! Northern Trust Asset Management share a monthly market commentary for treasurers.

Eurozone Market Update

The ECB unanimously voted to raise its three key interest rates by 25 bps in July, taking the deposit rate to 3.75%, the highest since 2001. Following the announcement, President Christine Lagarde firmly ruled out the prospects of a cut at the September meeting and stressed multiple times that the ECB could hike or pause at that time. This gives the central bank optionality and underscores the importance of incoming financial data. The euro area composite Purchasing Managers Index (PMI) was 48.9 in July, below expectations of 49.6, as both manufacturing and services components softened for the third consecutive month. The most significant composite PMI declines were in Germany (48.3, down 2.3) and France (46.6, down 0.6).

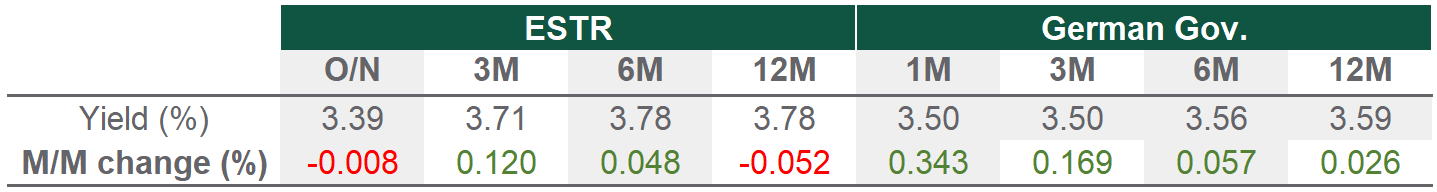

Euro Short Term Rates

Source: Bloomberg, data as at 31 July 2023

UK Market Update

July’s UK inflation came in softer than expected, with annual headline CPI at 7.9% and annual core inflation at 6.9% (see Chart of the Month). This divided market views for August’s BoE meeting, with some now leaning towards a 25 bps hike instead of 50 bps. UK labour market data showed mixed signals, with employment rising by 102,000 in the three months from May, as wage growth continued accelerating. The BoE’s Decision Maker Panel survey for June indicated a rise in three-year ahead inflation expectations from 3.4% to 3.7%. PMI data slowed for the third consecutive month, indicating softening demand in the service sector due to the impact of higher interest rates.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version