Exercising Control Through Innovation

While globalisation has given businesses easy access to more markets and facilitated supply chain diversification, it has also resulted in complicated and longer cash conversion cycles. In a high interest rate environment, companies need to extract as much value as they can from their working capital. Citi’s Elizebeth John, Managing Director – Deposits & Investments, Treasury & Trade Solutions (TTS) EMEA, and Ritesh Jain, B2B Product Head – EMEA, TTS Commercial Cards, explain how businesses can build a leaner, healthier relationship with their cash by leveraging innovative solutions, some of which are currently under the radar.

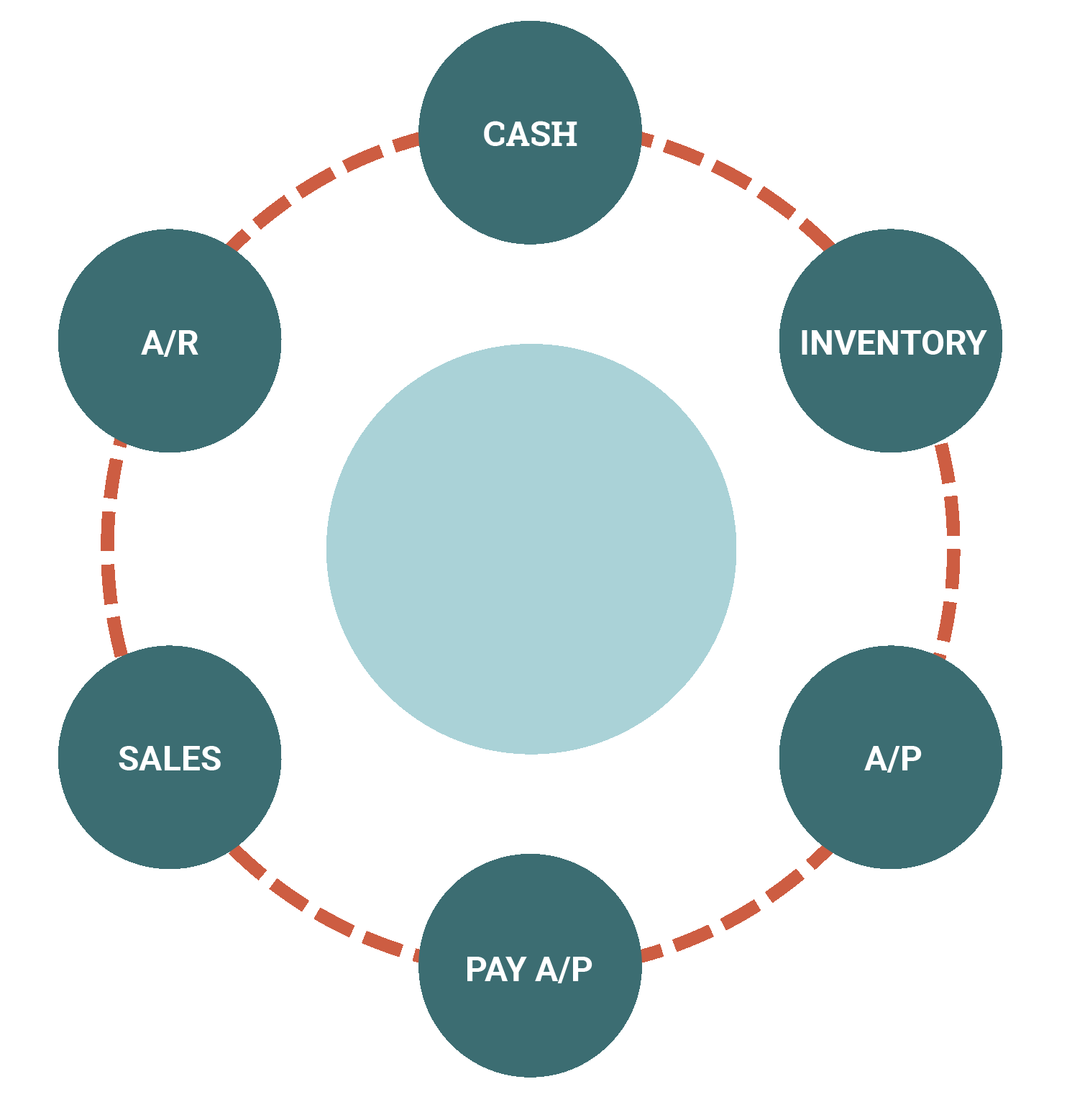

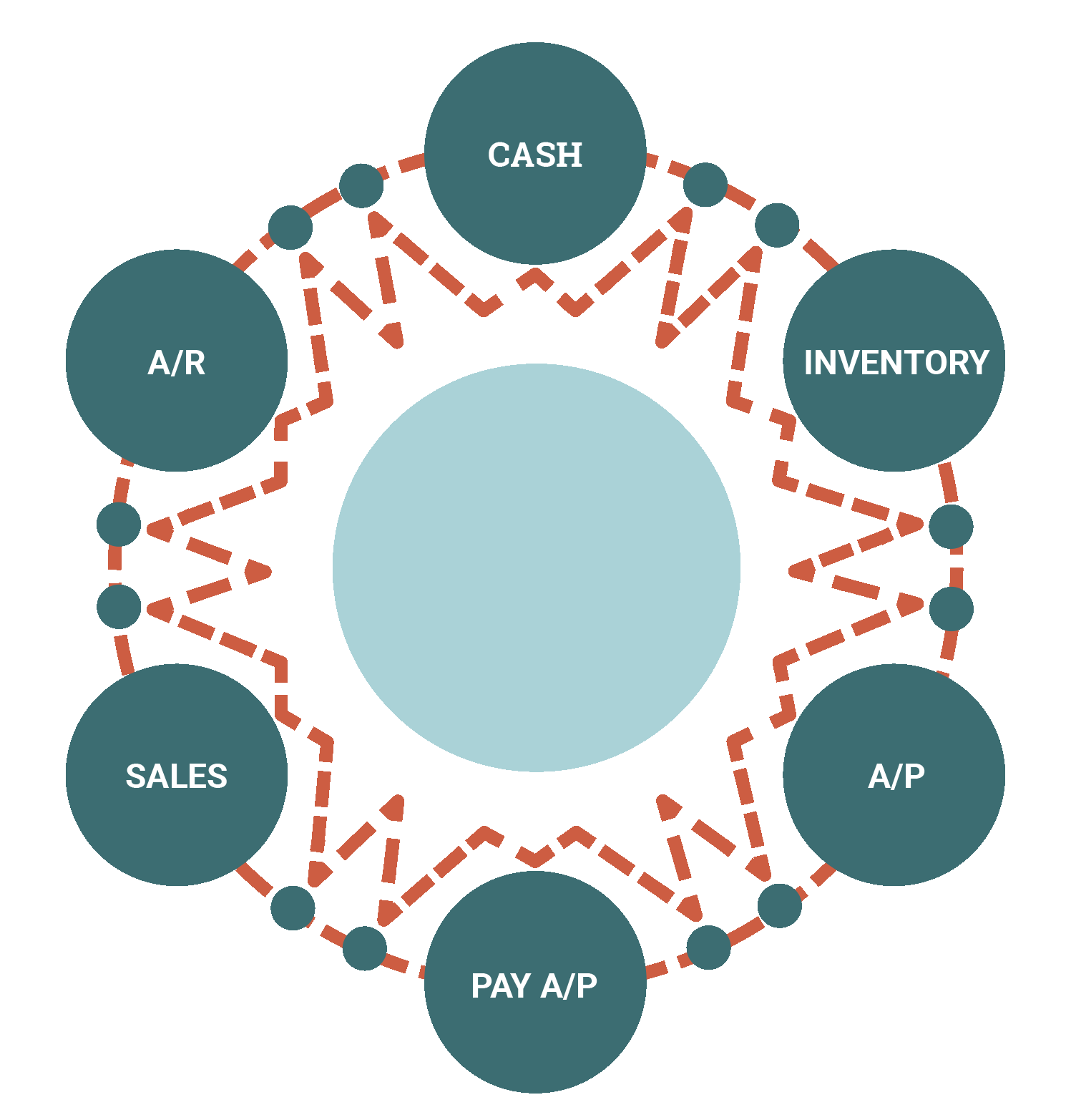

The processes of the cash conversion cycle (CCC) were defined many years ago, typically to support simple single-country and single-currency buyer and supplier set-ups (see fig. 1). Yet the modern multinational has supply chains and customer bases far and wide (see fig. 2).

FIG 1: The traditional CCC

Single-currency, single-country manufacturing, local buyers and limited suppliers

FIG 2: The typical modern MNC CCC

Friction is introduced by multiple locations, different business lines, multiple currencies, global suppliers, and customers

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version