Request to Pay – a new standard for requesting a payment – is being built on top of the existing payment infrastructure throughout Europe. With a patchwork of account-to-account solutions already covering a wealth of different use cases, how will Request to Pay change the payments ecosystem?

In a recent Banking Circle webinar, Sarah Lauridsen, Head of Products and Solutions, Banking Circle, and Claus Richter, Chief Operating Officer, P27 Nordic Payments, shared their insights on the future of Request to Pay, which is owned and managed by Pay.UK, and its potential impact.

The session was moderated by Esther Groen, an adviser to Holland FinTech and an executive board member of the European Women Payments Network.

Why the buzz around Request to Pay?

“Every once in a while, there is a regulation or methodology that really has the potential to change the way we make and receive payments,” Lauridsen said.

Currently, there are various iterations of account-to-account payment solutions available – most of which have their own shortcomings. Request to Pay has been designed to fill in the missing pieces of the puzzle, and as a result is likely to spark innovation in the payments area, Lauridsen went on to explain.

So how does it work? Request to Pay is a messaging framework that offers the ability to easily request and complete real-time direct account-to-account payments. There are already a number of similar schemes across the global markets, including initiatives and the European Payments Council.

Lauridsen explained: “What all of these initiatives have in common is that they have been very thorough with the design – spending years on it in some cases – and in implementing a lot of best practices from modern product development The end result is that Request to Pay is a versatile messaging scheme that will pave the way for more innovation.”

Who will drive success – and what are the obstacles?

While Request to Pay is tipped to have the potential to transform the payments landscape, it’s important to note that it is still early days in terms of its development and reach, said Richter.

The success and adoption levels of Request to Pay schemes will be largely dependent on whether the industry, particularly banks, and regulators support the initiatives and drive the take-up, according to Richter.

Lauridsen agreed:

“I would expect to see the vast majority of consumers following the lead of their bank, When the banks make this available to their customers as a built-in part of their digital services, that’s when we will see the traction and coverage.”

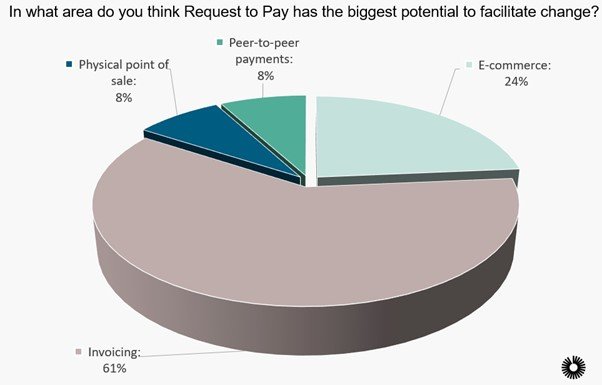

On top of the backing of the industry, both Lauridsen and Richter pointed to the number of positive use cases as a key driver in the success of Request to Pay – highlighting speed, operational cost savings and the customer experience as key benefits.

“When you look at this from the merchant or corporate perspective, harmonisation across markets will be a highly efficient driver for them in their internal processing,” Richter added. “We will see in a number of areas that the use case is very efficient.”

Watch the webinar on demand here.