Low-code technology enables non-IT professionals to develop the automation software they want, when they want it. Following on from TMI’s 2022 look at low-code no-code platforms, we consider the drivers and opportunities in 2023 for low-code.

Low-code is an application development tool that uses visual, rather than textual, coding. Its simple drag-and-drop interface enables users of all levels – even those without technical expertise – to begin collaborating on, co-developing and building the applications that they want, when they want them.

By using a low-code application development platform (LCAP), process automation can become easier, quicker, and cheaper than if relying on traditional IT or vendor resources. In fact, the entire application life cycle can be managed within one of these platforms, from ideation, development and documentation, to testing, deployment, revision, and eventual retirement.

In the current volatile environment, treasurers with the flexibility to quickly create automation tools for short-term or even one-off deployment have a clear advantage over those who rely on their (often over-stretched) IT departments or vendors for developments or modifications.

But there are a number of other potential advantages to the low-code self-build approach. Key among these is the fact that it leverages the technical skill and knowledge of the treasury team to build and deliver treasury-specific apps: there is no need to translate requirements for the IT team, or incur additional costs with vendors.

When other functions are brought into the development process, low-code projects can leverage their technical skills and knowledge too. And while IT may still retain final control and oversight of any live system, inter- and intra-departmental development of simple process automation tools frees up their specialised developers and coders to work on more complex tasks.

Another advantage is that low-code development uses pre-configured and pre-tested elements such as modules, logic, templates, and connectors, which can be reused many times over, in different tools and by different functions. Additionally, LCAPs should support all phases of the app development life cycle, with tools, for example, able to streamline project management, requirements management, version control, testing, and deployment.

Collaborative development within LCAPs is usually supported by tools for revision tracking and team messaging. This should enable different users to work iteratively and autonomously. Further, the relatively simple visual nature of low-code means all participants in a cross-functional project will be able to converse in the same development language – even with IT – so there is less room for misunderstanding. Of course, by breaking down functional silos, it fosters stronger internal understanding and partnerships.

The typical cloud-native architecture of LCAPs ensures developers always have secure, rapid, and easy accessibility to projects. Indeed, most LCAPs enable app features to be extended or amended quickly, and many are scalable for enterprise-level use.

Secure data integration is always an important element. LCAPs can use pre-configured APIs and connectors to safely capture data from multiple sources and systems, including TMSs and ERPs. This can drive new data discovery and sharing regimes across projects and teams, with the reusable components potentially being applied to the development and building of new microservices from enterprise data.

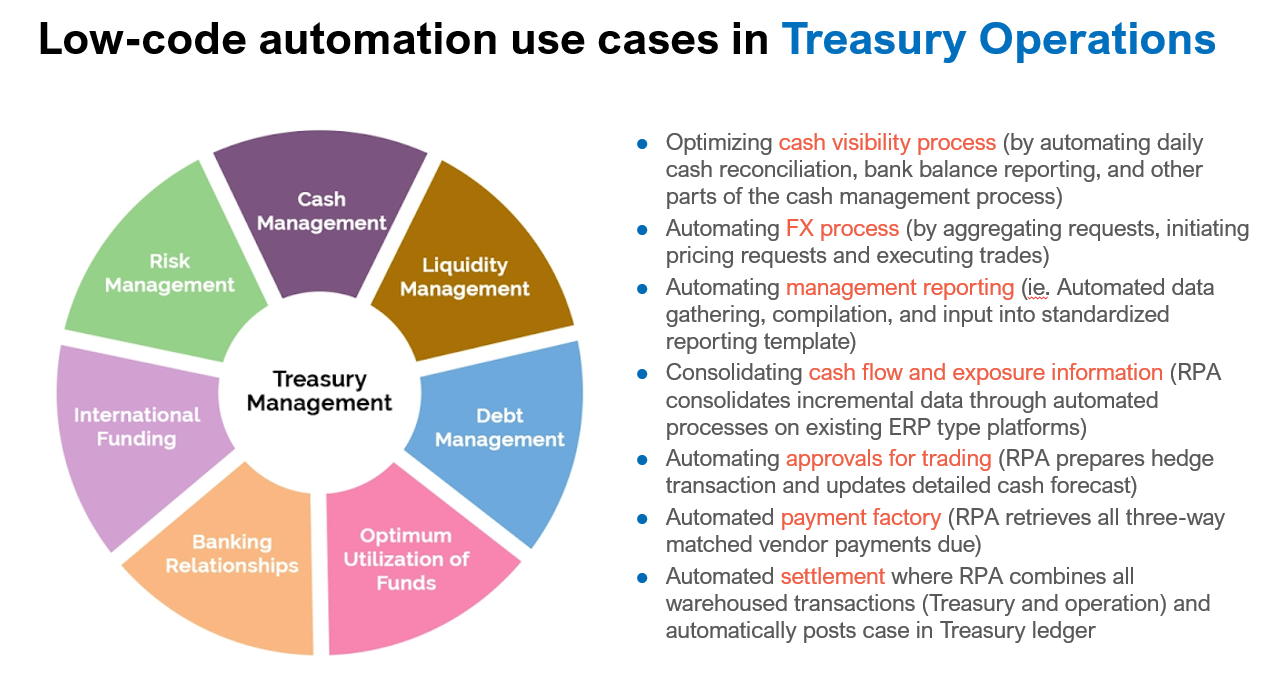

Treasury-specific use cases

Introducing automation initiatives into a treasury function can be challenging because of the aforementioned resource-strapped IT teams, shrinking budgets, and an ever-growing technology skills gap. With the evolving global economic situation creating specific organisational cash flow challenges, low-code could have a significant role to play in helping treasuries meet their key challenges in 2023.

Increase cash visibility

An EACT survey published in 2022 found that 68% of treasurers have highlighted cash flow forecasting as one of their top three issues. The reasons for prioritising cash flow remain acute due to fallout from Russia’s invasion of Ukraine, rising global inflation, and interest rate increases.

Low-code applications can enable treasurers to automate daily cash reconciliation, bank balance reporting, and other parts of the cash management process. Not only can treasurers remove repetitive time-consuming work but they can also access real-time dashboard information to help make timely decisions.

Reimagine risk strategy

Treasuries are currently highly sensitive to the exposure of their balance sheets to rapid changes in interest rates, currency fluctuations, and commodity and supply chain risks as global financial conditions continue to decline.

There is a low-code opportunity here, with treasuries able to leverage more strategic and systematic options for currency hedging, and take advantage of favourable hedging opportunities. Areas where low-code tools can yield the most benefit here include:

- Automating FX processes such as aggregating requests

- Initiating pricing requests

- Executing trade strategies based on favourable pre-designed parameters

Manage reporting

Treasurers often rely on time-consuming manual processes for business-critical tasks. For example, the collection and analysis of data for critical tasks, such as FX management, risk planning, and increasingly, merging ESG reporting data. Low-code-developed process management tools can be used to optimise these workflows, with treasurers able to choose from where data is automatically integrated in real-time.

As an example, automating management reporting – including automated data gathering, compilation, and input into standardised reporting templates – can be implemented incrementally across organisations to yield substantial efficiency gains.

Source: Nintex

The key to successful adoption of LCNC applications is to start small, understand what’s needed and how it can be delivered, and make iterative additions, adjustments and fixes, and develop these over time, as required.

If sufficient people in a treasury department have knowledge of the low code approach, and can secure management support, ideal solutions can be created much faster. What’s more, with low code experience, treasurers and other corporate professionals can begin actively supporting their organisations’ digital transformation with the exact tools they need, not the tools someone else thinks they need. It’s a positive challenge for 2023!