Further Reading

The ABC of CBDCs

TMI examines the emerging CBDC area and its impact on treasury.

Treasury and E-invoicing

As experts from BNP Paribas and Pagero reveal, the e-invoicing landscape is changing rapidly, presenting challenges and opportunities for corporates.

Feel the Force, Find Success

In his role heading up the Middle Office of Baker Hughes, Levente Lázár helped build an entire treasury function from scratch.

Cautious Central Banks Emphasise Data Dependence in June Meetings

Exclusive insight for TMI subscribers! Northern Trust Asset Management share a monthly market commentary for treasurers.

C’est Magnifique!

URSSAF Caisse Nationale has implemented a new TMS to remove complexities from its cash management and drive greater efficiencies in its payment processes.

Connecting the Globe

Visa aims to shake up cross-border payment inconsistencies through the growth of its Visa B2B Connect network.

Another Side of the Same Coin

In TMI’s new ‘Treasury Angles’ miniseries, we explore treasury in banking and FIs, uncovering key differences and similarities with corporate settings.

Uncertainty Principle

This year’s ACT Annual Conference opted to boost treasury’s role in saving the day, going for the theme of Tomorrow’s Treasurer: Thriving in Uncertainty.

Received Wisdom

Infosys’ Executive Vice President of Finance and BNP Paribas reprisantatives explore the value of a global receivables purchasing facility.

Castrol Collaborates on Industry-First Insurance for Asian Bikers

A four-way partnership involving Standard Chartered aims to promote customer loyalty and social responsibility while defining a blueprint for scalable growth through co-creation.

Perfecting the Art of tailor-made Client Service in Company-Bank Relationships

The client servicing offered by banks to their corporate clients plays a pivotal role in the success of both parties.

Fed and BoE Wrestle with Fragile Confidence as ECB Cuts First

Exclusive insight for TMI subscribers! Northern Trust Asset Management share a monthly market commentary for treasurers.

Embracing Diversification with MMFs

We consider the headline trends in the MMF space and explain why it is imperative for treasurers to maintain a diversified portfolio.

Pooling Power for Treasury Transformation

Equinix and Bank Mendes Gans discuss how pooling solutions can streamline liquidity management and bolster operational efficiency.

Power Pairing

Discover how the embedded revolution is now gaining traction in the corporate space.

Related Videos

Embedded Finance Meets Card Innovation

The embedded finance revolution is driving innovation in the cards space. Find out what this means for corporate treasurers.

ETDA - What Next? Transitioning to Electronic Trade Documents

Join us for this insightful trade finance discussion and hear our expert panel outline the key considerations for treasurers when it comes to digital trade

AI: Reshaping the Role of the Treasurer

What does AI and the advance of large language models such as ChatGPT mean for corporate treasurers? Our panel explore the possibilities.

Liquidity Management in Uncertain Times

Discover fresh ways to effectively manage liquidity amidst oncoming macro headwinds.

Enhancing Treasury Operations: A Compelling Business Case for Cards

In this webinar playback, experts examine the true potential of cards, including integrated solutions, to bring visibility, control and working capital benefits to treasury.

Through the Liquidity Lens: Corporate Treasury Trends in Short-term Investments

Hear from industry experts on achieving your short-term investment goals whilst maintaining a core focus on liquidity and capital preservation.

Automating FX Risk and Optimising Hedging: A Fresh Look

Experts from Dräger and Nomentia provide an overview of a project undertaken by Dräger to automate the calculations of its FX exposures.

Balance of Trade: Supplier-led Solutions for Unlocking Cash Now

Our expert panel reveal how to unlock sources of capital, optimise cashflow and ultimately reduce risk within trade relationships.

Cash Forecasting 2.0: The Emergence of Liquidity Planning

Treasurers need to evolve beyond visibility into cash by making forecasting actionable. Find out how in this webinar replay.

Are Treasury APIs Always the Right Answer?

APIs are often touted as a silver bullet for real-time treasury needs, and the integration of disparate systems. But are APIs all they’re cracked up to be?

Getting Real: The Truth about Instant Payments and Collections

Javier Orejas (IATA) and Rishi Munjal (Kyriba) provide a lens over recent developments in real-time payments and what they mean for corporate companies.

Transitioning a Corporate from LIBOR to CME Term SOFR

Watch this webinar replay to learn about how to efficiently transition from USD LIBOR, the opportunities this robust and transparent rate creates for corporate treasurers, and the pitfalls to avoid on your transition journey.

Treasury in 2023: What’s on the Horizon for Short-term Investments?

Watch this webinar replay to hear our expert panellists reflect on the short-term investment landscape – and how corporate investors might take advantage.

Collaborative Trade Finance: How to Unlock Liquidity at Speed

Watch this webinar replay to learn how collaborative trade finance can streamline the guarantee process, centralise visibility and unlock liquidity.

TMI's Guide to Short-term Investing for Treasurers

Discover TMI’s Treasurer’s Guide to the latest short-term investment trends and insights

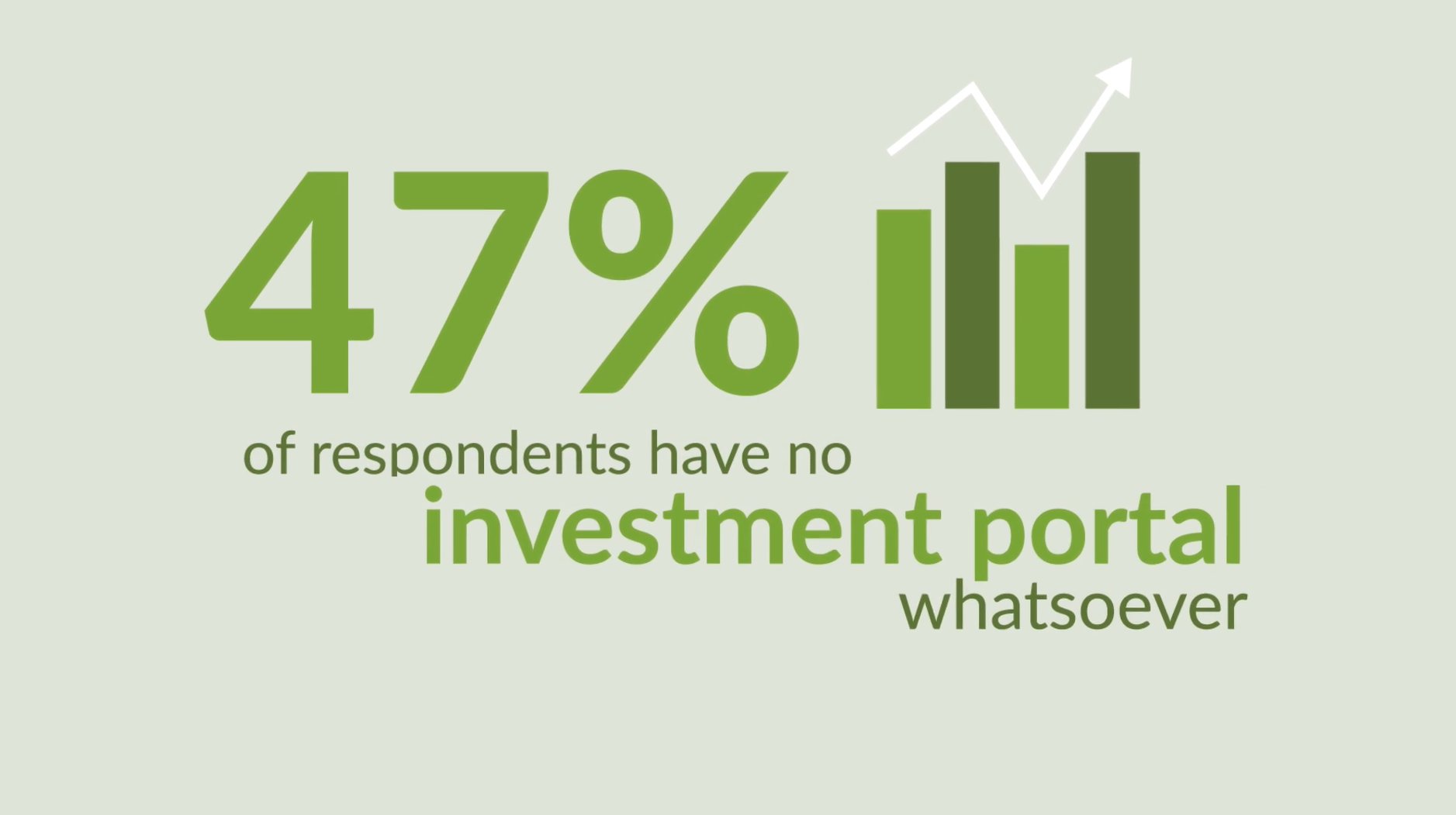

Global Liquidity Barometer 2022

Drawing on data collected from the treasury community, this survey report offers a means to understand the present future of short-term investing.

Stay Safe! How to Protect Treasury Processes from Fraud and Ensure Compliance

This video is a recording of a live event that took place on Thursday 14 July

Treasury Spotlight: How Ocado Integrated its Treasury and Payments

This video is a recording of a live event that took place on Thursday, 7 July 2022

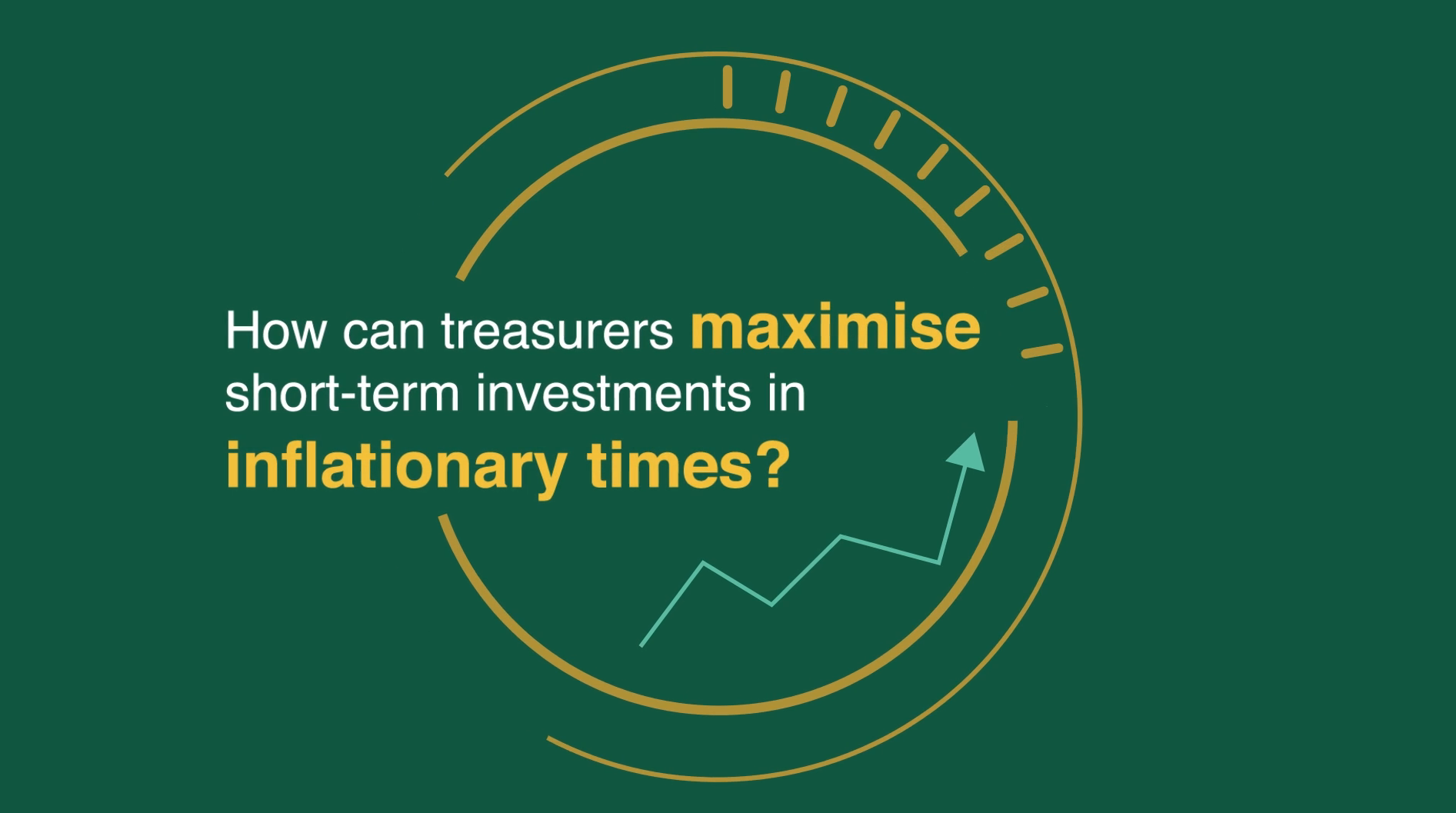

Under Pressure! Inflation, Rates and Regulations Hit Treasury Short-Term Investment Plans

With the immediate challenges of inflation and rate hikes combined with longer-term regulatory concerns, corporate treasurers have much to consider for their short-term investment policies.

The Key to Smarter Liquidity Management: Breaking Down Silos

Discover how the convergence of spend and liquidity can help finance, procurement, and treasury be smarter together.

Unlocking Real-time Treasury: How to Benefit from APIs and Instant Data on Demand

Watch this dynamic panel discussion to discover how the treasury departments at Nokia and Freeway Entertainment are utilising APIs.

What to Do with Corporate Cash in Challenging Times

Experts from Calastone and Aviva outline how to successfully navigate these roadblocks, debunk incoming regulations, and assess ‘step out’ strategies

Treasury in 2022 and Beyond

Bob Stark (Kyriba) and Sebastian di Paola (PwC) explore how smart treasurers are using the latest treasury trends to shape strategy.

The 3 T’s of The Future: Tech, Treasury, and Transformation

Royston Da Cost (Ferguson plc) and Ulrika Haug (Coupa) explain how recent trends have impacted finance and what that means for the future of treasury.

How BearingPoint Harnessed Data-Driven Forecasting with CashAnalytics and SAP

Watch this Forecasting Masterclass to discover what “data driven” really means – and how combining specialist solutions is key to forecasting nirvana.

Journeys to Treasury: Managing Changing Perspectives

Join us for a special webinar showcasing the results of the Journeys to Treasury 2021-22 report.

Cybersecurity for Treasurers

Watch this webinar to discover the latest tools and best practices treasurers should be employing to combat cybercriminals.

How Treasurers Can Navigate Cash Markets in 2022

Daniel Farrell (Northern Trust Management) and James Douglas, CFA (Rabobank) discuss Treasurers the outlook for money markets, trends to watch, and strategies for cash management through the coming year and beyond.

Scale for Growth: Using Data as the Corner for Finance Transformation

Watch this webinar replay to see Kim Estes, Vice President, Accounting, The Knot Worldwide discuss company’s finance transformation journey.

Realising Treasury’s True Value – A Strategy for Change

Join the Head of Treasury at global ice cream company Froneri to hear how a focus on people, processes & technology unlocked the true value of the treasury team

Strength in Numbers: Lessons from Innospec on Building a Strong Cash Culture

This webinar reveals how Andrew Hawes, Group Treasurer, Innospec set about building a strong cash culture across the business.

How to Make Your TMS the Ultimate Investment Tool

The right TMS can be a huge asset to treasury. But these one-stop shops often fall short when it comes to short term investment workflows.

Innovations in Retail Payments

Key trends shaping the future of commerce, and how companies can set themselves up for success by achieving the following goals:

3 Reasons to Automate Transactional FX

More treasury teams are discovering the benefits of automating their transactional foreign exchange (FX) workflows.

Lost in Transaction: Overcoming Payments Pitfalls

A panel of experts examine common pain points and outline ways to improve payment workflows through better connectivity, control and optimisation.

The Path to Transformational Global Cash Visibility

Davina Bradley (CEVA Logistics) and Conor Deegan (CashAnalytics) join TMI to explore how treasurers can transform their cash visibility and forecasting.

Are Cybercriminals Targeting Your Treasury?

Corporate systems and data are increasingly being held to random by cybercriminals. This video highlights the latest cyber traps and offer advice to treasurers.

Keeping Pace with Real-Time Payments

Treasurers in business-to-business (B2B) sectors can no longer write off real-time payments as ‘only fit for consumer industries’.

Treasury in 2030: 5 Practical Steps for Preparing Ahead

2030 is nine years away. But the time for transformation is now.

Are You Serious About ESG?

The majority of company boards now consider ESG to be a key agenda item but just 25% of treasury functions have ESG-related KPIs. Read our latest article, in partnership with Barclays, and find out how leading treasury teams...

Building a Data Driven Cash Forecast (with Minimum Effort)

A TMI Webinar in partnership with CashAnalytics This video is a recording of a live event that took place on Thursday 8 July 2021. Make use of internal and external cash flow data...

Why the 'One Size Fits All' Approach is Outdated - A Cash Segmentation Treasury Masterclass

A TMI Webinar in partnership with Northern Trust Asset Management This video is a...

Tackling the Complexities of IBOR Transition

A TMI Webinar with Salmon Software, Deloitte and Associated British Ports. This video is a recording of a live event that took place on Tuesday 29 June 2021. Speakers Shaun...

To Step Out or Not to Step Out? That is the Question

A TMI Webinar with Spotify and J.P. Morgan Asset Management This video is a recording of a live event that took place on Wednesday 19 May 2021 Speakers Niklas Muhrbeck, Senior...

6 Steps to Smart Treasury Success

As corporates continue to digitise, find o...

Smart Treasury: Steps to a Successful Digital Journey

A decade ago, the possibility of real-time, digital treasury was just a dream. Today, it is very much a reality. We are delighted to share expert insight as to how treasurers can...

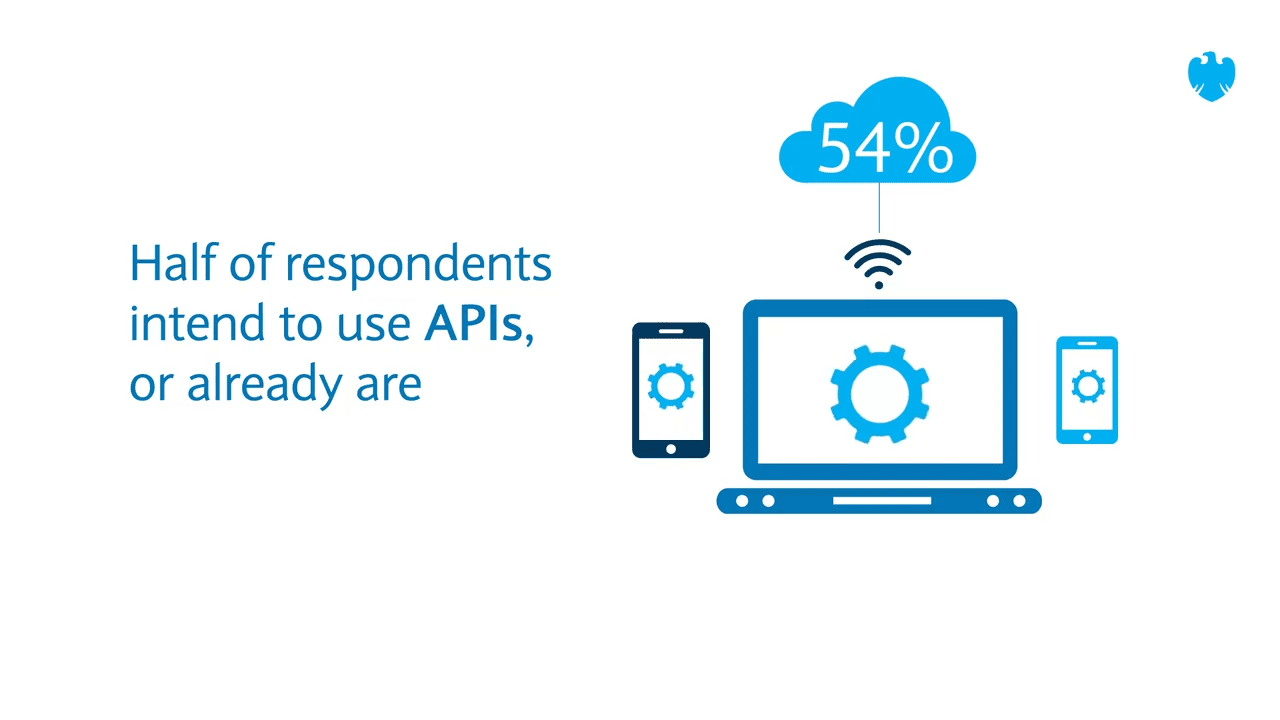

New Technologies for a 'New Europe'

TMI, in partnership with Barclays, are delighted to share the results of a recent survey answered by over 300 of Europe’s leading corporate treasurers and CFOs. We discovered that Data Analytics will be a key technology for treasurers in 2021, and over half of respndents use – or to plan to use – APIs. Discover more insights from the survey >

Future Treasury Recruits: What Skills Do They Need in the 'New Europe'?

TMI, in partnership with Barclays, are delighted to share the results of a recent survey answered by over 300 of Europe’s leading corporate treasurers and CFOs. Data analytics was the most highly sought after, followed by soft skills. Discover more insights from the survey >

New Europe Awakens: A Fresh Look at Post-Brexit Treasury

TMI, in partnership with Barclays, are delighted to share the results of a recent survey answered by over 300 of Europe’s leading corporate treasurers and CFOs. We discovered that 35% of respondents are looking to change bank account locations and 21% are reviewing their cash pooling arrangements. Discover more insights from the survey >

Benetracker

BNP Paribas has launched Benetracker, a co-creative solution that leverages SWIFT gpi, with the help of its clients in Europe and Asia-Pacific in order to accurately track international payments.