by Anssi Yli-Hietanen, Treasurer, UNESCO

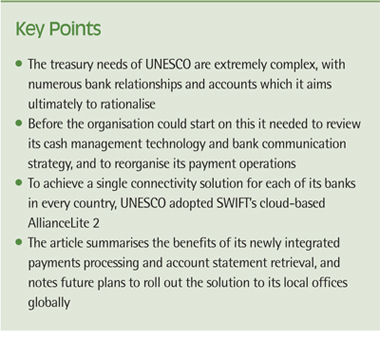

Although UNESCO has a relatively small treasury management function, its needs are complex with operations across every continent and 69 local offices. Consequently, the ability to process payments efficiently and achieve visibility over cash and risk across the organisation is essential, but without the need for substantial investment or resourcing. Having evaluated a range of options, UNESCO identified Alliance Lite2, SWIFT’s convenient cloud-based solution for bank communication globally, as the most appropriate solution for their needs.

UNESCO treasury organisation

We have a centralised treasury function based at our Paris headquarters, responsible for managing UNESCO’s banking relationships and global cash management. While our treasury function selects banking relationships on behalf of UNESCO, we increasingly do so in co-operation with other United Nations organisations to leverage economies of scale and access a wider range of solutions and services. We currently have one primary bank for payments processing in our major currencies, and relationships with a further 80 banks from 30 different banking groups, with which we hold around 200 bank accounts. Ultimately, our aim is to rationalise these relationships with a selected group of United Nations partner banks that together give us the global coverage we require.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version