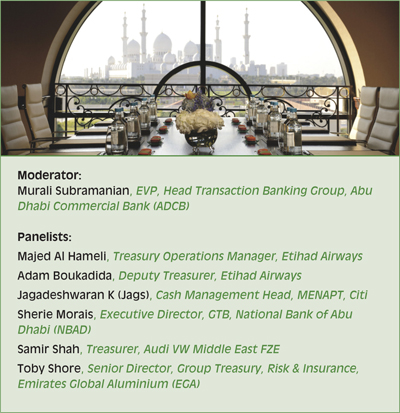

A TMI roundtable in association with D+H

In May 2015, a panel of leading corporate treasurers and both international and local banks gathered to discuss some of the most important priorities for corporate treasurers in UAE, and how the banks are responding to these evolving needs. The following is an edited transcript of this conversation. With thanks to panellists, participants and D+H for sponsoring this event.

Murali Subramanian, ADCB

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version