A Research Review of Progress in the International Supply Chain Finance Market

by Phillip Kerle, Chief Executive Officer, Demica

As relationship business lending by banks continues to contract in many parts of the world, companies are looking for alternative financing tools. Particularly hard hit have been SMEs, even in rapid growth BRIC economies, who find it difficult to raise affordable credit. Larger corporations, sitting at the head of supply chains, while largely untouched by the credit squeeze, are concerned about volatility in their supply chains. They wish to avoid disruption resulting from financial difficulties amongst essential suppliers. As a result, recent years have witnessed a rise in the take-up of Supply Chain Finance (SCF) schemes, where larger corporations with access to more liquidity than they need seek to pass that benefit through to their smaller suppliers.

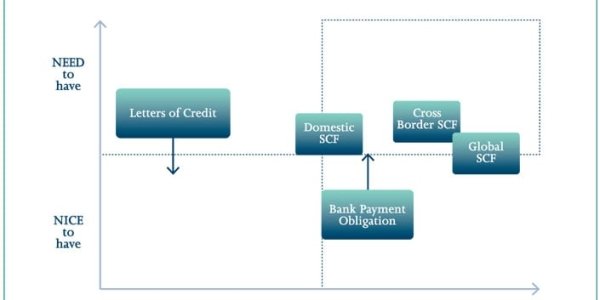

Demica has been tracking this market since 2010, researching emerging trends with the banking and corporate communities. This latest research report seeks broadly to scale current and predicted SCF market growth rates, the status of SCF alongside other trade finance products, along with opinion on obstacles and potential accelerant factors for this market to 2020.

Current growth rates

Surveyed respondents have all experienced growth in their SCF business in recent years, with international banks in particular reporting significant growth rates. On a conservative estimate, annual growth rate of SCF averages between 30% and 40% in the last two years for global banks. One respondent from a multinational bank reported an increase in the number of their SCF programmes, along with an annual growth rate of 50% in the last three years.

A similarly positive growth trend has been confirmed by another commentator whose financial institution has registered a 35% annual increase in SCF assets in the last two and a half years. Another banking professional from a global bank even reported a 100% annual growth rate in the previous three years. Banks in continental Europe are also seeing a heightened level of supplier finance activities with one Dutch banker describing the growth of SCF at his bank in recent years as exponential. In comparison to 2012, his institution has already witnessed a 60% to 70% increase in the number of programmes in the first four months of 2013. His German peer from another major bank also confirmed a positive double digit growth rate.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version