by Kee Joo Wong, Head of Global Payments and Cash Management, Asia Pacific, The Hongkong and Shanghai Banking Corporation Limited

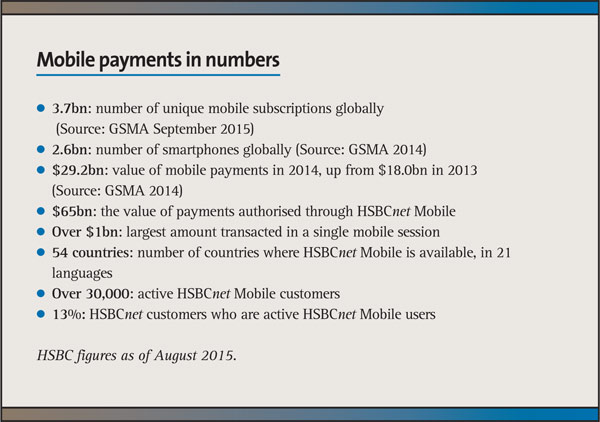

Despite mobile devices becoming ubiquitous in almost every country around the world, it has taken longer to realise the potential for mobile banking solutions to transform the payments landscape. This is now changing as individuals become more accustomed to using mobile devices for personal banking, and are therefore seeking to achieve comparable advantage at an organisational level. Similarly, a growing number of corporations are leveraging the value from the mobile money solutions that are expanding across developing markets to improve collections security and efficiency.

The mobile catalyst

The use of mobile phones for banking and transaction purposes has evolved in a variety of ways over recent years. In the developed world in particular, mobile banking initiatives were initially targeted at retail banking customers, firstly for balance checking and transfers, then for C2C and increasingly C2B payments using only a mobile phone number.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version