by Mikael Kepp, Chief Expert, CM partner bank and Vendor management relationship, Nordea

Digital business

The adoption of financial technology and faster, more agile e-systems in banking has had profound implications in corporate finance. It is becoming increasingly rare to find a corporate financial process that has not been digitised.

At Nordea, we are committed to offering digital banking solutions that make life easier for our customers, whether that is an e-banking platform or cash-forecasting tools. We know that the quality of our online and integrated host-to-host (H2H) solutions is important — after all, 86% of finance professionals say the capabilities of a bank’s technology platform is an important factor when choosing a banking partner[1] — but we know that this alone is not enough.

End-to-end automation is the goal

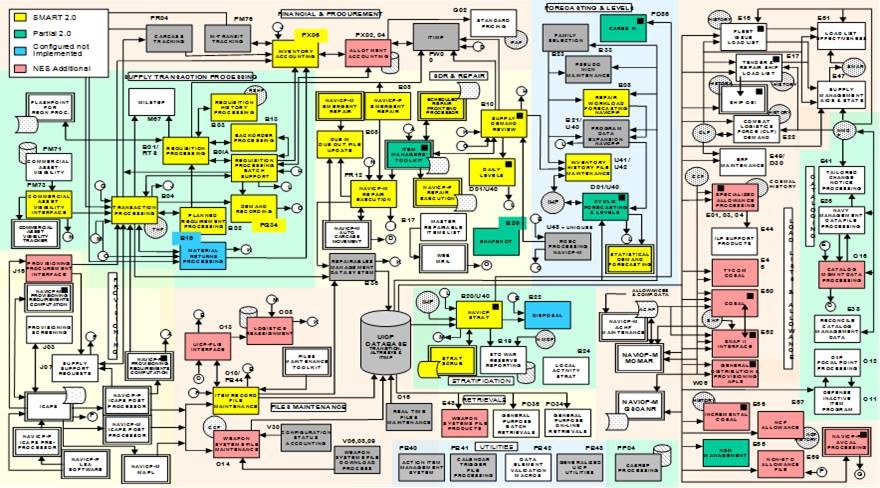

No business has just one system, and business processes often succeed or fail depending on how well multiple systems are integrated. You expect your transactions and file transfers to be processed seamlessly, in real time and without error, from your treasury management system (TMS) or enterprise resource planning (ERP) system to your banking partners, customers and suppliers, via messaging standards. Below, you will find an example of an IT-system portfolio and how a long range of systems and processes are integrated and interlinked.

Click image to enlarge (opens in new window)

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version