Credit and collections, or customer to cash management, is an integral part of every company’s drive to improve cash flow. It has only been relatively recently that corporations have truly invested time and resources into improving this main component of a flourishing organisation, however. The most successful companies are leading the way in modernising their practices utilising the latest technology and cloud deployment methods. Those that are simply maintaining old practices are needlessly allowing cash to flow out of their business and putting their corporations at risk.

In a recent study, FIS surveyed 131 credit and collection professionals from corporations around the globe to understand how they are modernising their processes and procedures within the broader credit-to-cash landscape and the role technology plays therein.

Doing more with less

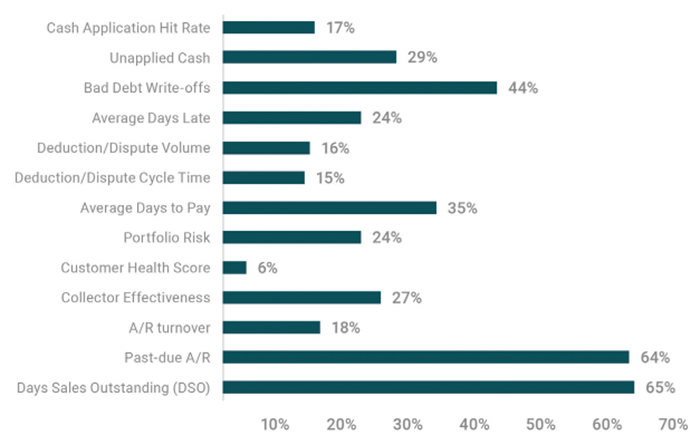

Based on the survey results, many corporations are still struggling with having to do more with fewer resources. When asked about the most challenging aspect of managing a credit and collections team over the last 24 months, a significant 78% pointed to collections’ volume increasing while staffing levels remained flat or even reduced. These conditions are leading organisations to seek automated solutions for relief. Resource restrictions hit across all areas of the credit-to-cash cycle, including credit, collections, disputes and deductions, as well as cash application. Solutions that provide process automation decrease resource requirements while increasing cash flow and reducing days sales outstanding (DSO). These are key metrics used by executives to measure the health of their organisation and benchmark themselves against best-in-class companies (fig. 1).

Fig 1 – Key Performance Indicators

|

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version