Economic recovery depends on how well we recover from the pandemic. A year ago, companies ploughed cash into money market funds (MMFs) to keep it safe and liquid as the crisis wreaked havoc on families, work and businesses. By the end of 2020, companies were heading into the new year in a cautiously optimistic frame of mind.

At the start of 2021, ICD took the pulse of institutional investors to gain insight on plans for cash and investments and for technology used in their treasury organisations. Our 2021 ICD Client Survey revealed that companies are looking for yield, impact, and efficiency this year.

Cash and investments

With the roll-out of vaccines, a new administration in the US, a post-Brexit UK, low interest rates and inflation concerns, there is still much uncertainty about the remainder of 2021. Even so, some companies are becoming more comfortable with expanding the breadth of their cash investments. This reflects much about the state of treasury.

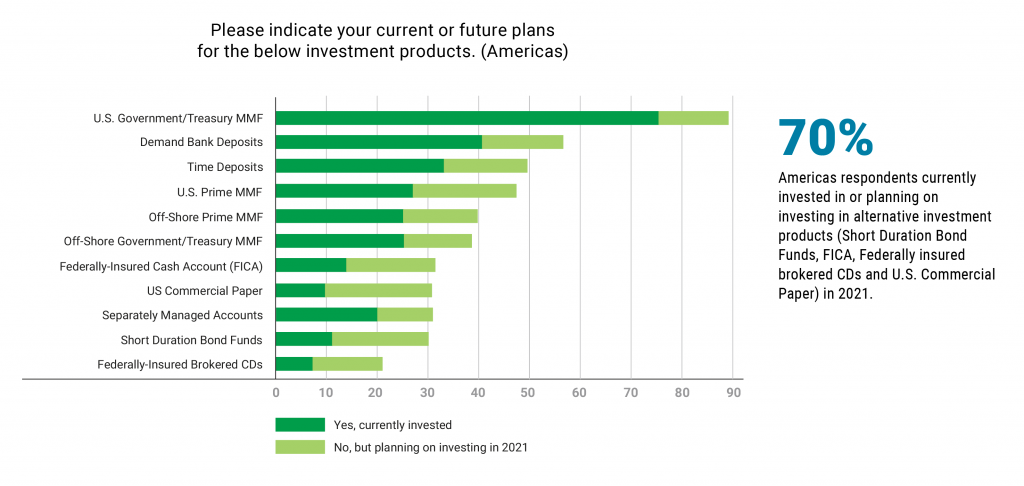

First, companies still need their cash to be relatively liquid. An impressive 61% of the 150 treasury professionals who responded to the survey said they are either maintaining or increasing cash balances in the first half of 2021, and almost all (86%) are invested in or increasing their investments in MMFs. Still, 70% of respondents from the Americas indicated that they are expanding their portfolios to include new products beyond traditional cash investments.

Source: 2021 ICD Client Survey

This makes sense as some short-term products are yielding significantly more than traditional cash investments while still maintaining a degree of liquidity. Short duration bond funds, for example, were yielding 32 times that of government MMFs, on average, as of 31 March 2021, according to Crane Data.

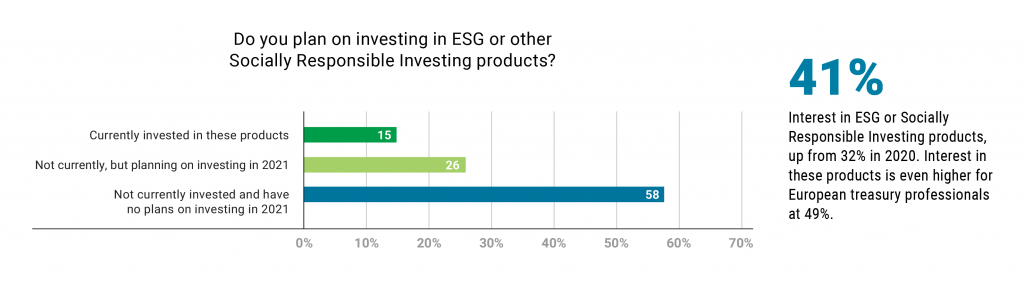

On the back of an incredibly difficult and eventful 2020, corporate mandates for environmental, social and governance (ESG) initiatives are coming down from the board. While many treasury teams are taking up segmentation strategies to put portions of their cash balances to work with alternative investments, a notable 41% in the Americas are also showing growing interest in socially responsible investing (SRI). In Europe, interest is even higher at 49%.

Source: 2021 ICD Client Survey

Technology the enabler

The pandemic also impacted the workplace, highlighting the critical role of technology. As public and private entities transitioned their staff to working from home, remote access and seamless data flow became essential.

It’s no surprise, then, that an impressive 66% of respondents said they were implementing a treasury transformation project in 2021. Interestingly, only 15% said they were implementing or changing a treasury management system, suggesting that transformative treasury lies in the integration of treasury’s technology stack, powering an end-to-end workflow.

Technology fills the gap between what is expected of treasury, and the staff available to fulfil those expectations. A significant 86% of respondents said they saw their treasury teams shrink or stay the same in 2020, while 99% said they expect their roles and responsibilities to increase or stay the same. This is a familiar story that has been unfolding since the global financial crisis of 2008.

Throughout the remainder of 2021, treasury professionals will move forward cautiously but optimistically, and with eyes fixed on opportunity. To read the full 2021 ICD Client Survey, visit ICD Resources at icdportal.com