by Lex Greensill, Managing Director, Head of Supply Chain Finance for Europe, Middle East & Africa, Citi

Multinational firms have developed highly complex, sophisticated supply chains in recent years, but the recent tragic events in Japan have illustrated that while many factors can be controlled, every supply chain remains inherently fragile. While treasurers and finance managers cannot protect their supplier base physically, they are in a position to support them financially and therefore ensure that the financial elements of the supply chain are as efficient as possible. In doing so, they both preserve the company’s working capital position and are in a position to leverage the company’s financial assets as a source of financing.

Financing in good times and bad

Supply chain finance (SCF) has developed significantly since the credit crisis. Previously seen as a source of financing for small and medium-sized enterprises or companies in distress, an increasing number of firms, particularly large multinationals with strong credit ratings, have recognised the potential of SCF to help unlock liquidity and increase the robustness of the financial supply chain. In many cases, SCF was considered a stop-gap financing technique during a period of market turbulence, but it has rapidly become apparent that it is not simply a technique for troubled times. As markets start to ease globally, the value of SCF remains undiminished, and could be even greater in the coming years. With more conservative credit models and more stringent banking regulations, credit will not be as cheap or accessible as in pre-crisis days, while optimising liquidity will remain key to funding future investments.

Creating a ‘win win’

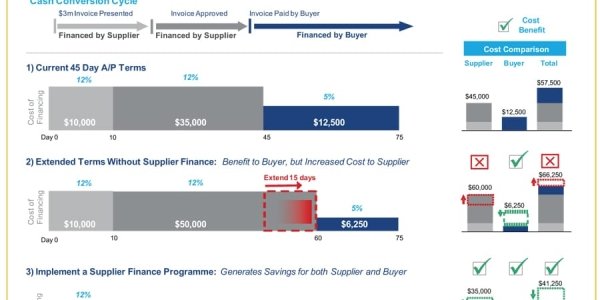

There are few financial structures which can truly be said to create a ‘win win’ for both parties, but SCF is undoubtedly advantageous for both buyers and sellers (figure 1). For example, buyers find that:

- Their financial supply chain becomes more resilient as key suppliers have greater financial certainty and are therefore in a better position to fulfil orders on time, reducing risk in the buyer’s financial supply chain.

- The cost of processing is reduced as the numbers of supplier queries, in-house payments processing and payment fees are reduced.

- Relationships with suppliers are improved, with the potential for achieving better commercial terms without negatively impacting on suppliers.

- An SCF programme does not compromise a company’s ability to source other forms of financing, and does not impact on its credit rating.

For the supplier, the benefits are comparable:

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version