by Helen Sanders, Editor

FX losses amongst corporations in 2013 amounted to $17.8bn amongst fewer than 850 international companies. In an environment where sophisticated treasury and risk management systems are more readily available and cost effective than ever, online portals streamline the dealing process and a variety of hedging techniques are well-established, it seems hard to understand why. After all, with all these tools at their disposal, surely FX risk management should no longer prove an issue for treasurers of multinational corporations? FiREapps’ recently released 2013 Corporate Earnings Currency Impact Report provides a stark reminder, however, that managing FX risk remains a very real and tangible issue. With 846 multinational corporations included in the study (representing a subset of the Fortune 2000 companies that have at least 15% or more international revenues in at least two currencies) the impact of FX risk within this sample and the broader implications for the international corporate community are material and serious.

Scale and impact of FX losses

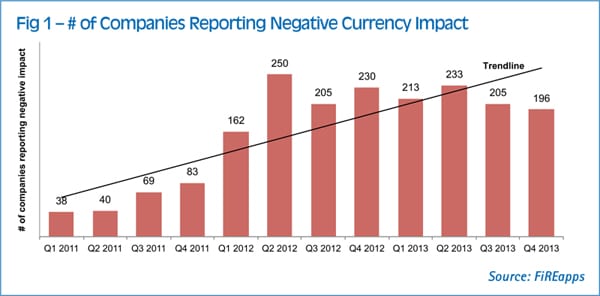

Twenty-five percent of the companies included in the FiREapps study reported negative impact resulting from FX volatility over the course of 2013 (figure 1).

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version