by Suzanne Hosmans, Group Treasurer, Celio International

Since its incorporation in 1985, Celio has become a major international menswear brand. Celio has over 1,000 stores across 70 countries, with particular strength in France, which sell 35 million items across four collections of 800 designs per collection each year.

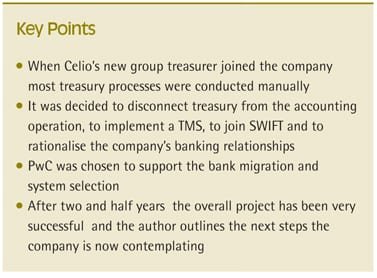

Celio has experienced impressive growth in recent years both through organic expansion and acquisition, leading to an increase in the complexity of its financial activities. In this article, Suzanne Hosmans, Group Treasurer explains how she established a new cash and treasury management function to support the company’s current and future international strategy.

Until I joined the company, most treasury processes at Celio were conducted manually, with little definition or separation between treasury and accounting. Payment processing was the major treasury task and we communicated with our banks via fax. This meant that tasks were labour-intensive and lacked security and control, while value-added activities such as managing cash and risk were not being undertaken.

Initiating the change

We were able to demonstrate convincingly to senior management that there were some immediate areas in which a treasury function could add value. For example, each store maintained its own bank account at a local bank, resulting in a large number of banking partners and major difficulties both in constructing a group-wide cash position and negotiating terms with banks. We identified a series of initial objectives:

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version