Effectively Managing a Necessary Evil!

Tarek Elyafi, Director, Corporate Products, Transaction Banking, Standard Chartered Bank

Executive Summary

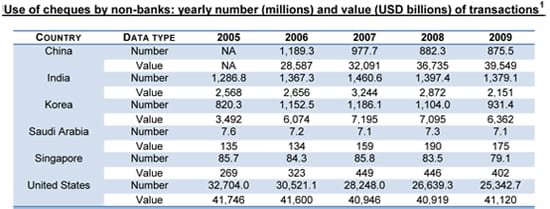

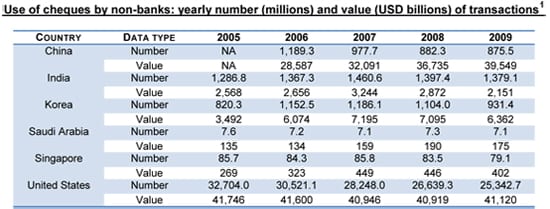

Over the last 5 years, extensive efforts have been made to encourage electronic payment methods over cheques. Improvements in channels coverage; such as Mobile Money or Near-field communication, and cost; such as Automated clearing house for bulk clearing, had seen the cost of electronic transacting reduce significantly. Though reductions in Consumer-to-Consumer (C2C) and Consumer-to-Business cheque usage have been encouraging, the Business-to-Business and Business-to-Consumer space is still heavily dependent on the issuance of cheques for a variety of reasons.

This article suggests ways that businesses can manage the cost of cheque processing and mitigate fraud risk.

Exaggerated demise of cheques

Over the last 5 years, the payment industry has increasingly embraced paperless and automated solutions. As a result, the relative importance of cheques has decreased in many countries, prompting experts and authorities in some countries to predict and act to accelerate the demise of cheque payments. However, cheques continue to be extensively used.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version