Understanding the challenges

by Raveen Ramlakan, Head of Africa and Corridors Structuring and Matthew van der Horn, Derivative Structurer, in conjunction with RMB Global Markets’ Africa analysts, Nema Ramkhelawan-Bhana and Celeste Fauconnier, Rand Merchant Bank

Interest in investing in Africa continues to grow, and although the story has been told many times over, it is always worth mentioning why Africa is an attractive investment environment for companies across the world. In RMB’s 2012/2013 edition of “Where to Invest in Africa”, it is noted that:

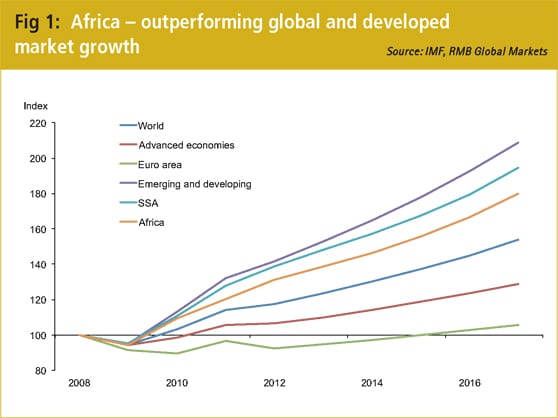

- If growth is taken as a measure of return, then Africa’s rapid expansion over the last five years is sound justification for investment. The region grew at around 5% in 2012, which is remarkable against a backdrop of slowing global growth. The continent, along with other countries in emerging markets has also led the growth recovery since the global financial crisis in 2008

- Africa’s high growth potential stems mainly from its abundance of resources. The continent offers huge potential for companies associated with minerals, oil and gas. In addition, the need for food security and other sources of energy paves the way for a booming agricultural sector with 60% of the available cropland globally situated in Africa

- The continent has extremely favourable demographics, with a population that is now over one billion people. The forecast population growth rate is 2.1% annually over the next few years compared to 0.2% in the developed world. Africa is also expected to have an average 40% urbanisation growth rate between 2010 and 2020

- Africa as a whole has US$3tr in purchasing power and high levels of forecasted income growth, with an average expected GDP/capita growth rate of 5% between 2012 and 2016 (2.8% in developed nations)

- A continued increase in FDI, especially into infrastructure. The region now receives about 5.5% of global FDI projects, and although the continent saw a brief decline in FDI following the financial crisis, the annual figures remain at elevated levels

Africa’s operating environment

The operating environment in most African countries remains well below par, with access to financing topping the list in terms of the most problematic factors for doing business on the continent. The other factors making up the top five are: corruption, inadequate infrastructure, government bureaucracy and political instability. On the whole, Africa has struggled to improve its overall operating environment despite consistent growth in GDP and economic market size between 1995 and 2012.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version